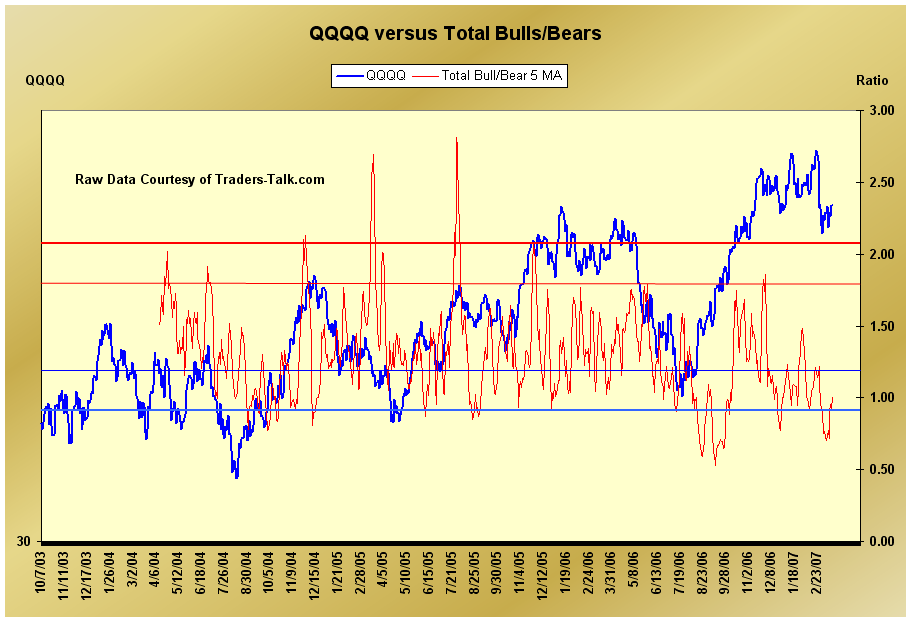

Sentiment is shaping up nicely, and people are turning bullish again. It is still in a zone where it can bounce higher, or in a downtrend, an area where it can turn lower with a dead cat.

I would like to look at the P/C ratio today and see what the OEX vs ECPC is at the end of the day. Too much optimism may mean the dead cat is over. Too much pessimism may mean scorch tomorrow.