Armstrong Business Cycle + general thoughts from Euro-man

#1

Posted 04 April 2007 - 06:24 AM

#2

Posted 04 April 2007 - 07:18 AM

............

Category: General Interest

From: deuxsous (Tom Drake)

To: ALL

Date Posted: January 05, 2007 at 21:47:42

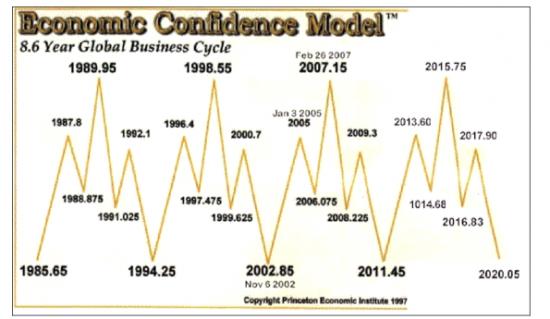

Subject: Benner and Armstrong

--------------------------------------------------------------------------------

down der they were talking up marty armstrong as some kind of martyr...lol... he made his first bucks as a coin dealer (read: wide b/a spread in illiquid stuff bought by people who don't know the field). then he started an "institute" near enough to princeton NJ so he could use the name of princeton in his bidness name. he wrote expensive but beautiful nonsense market analyses and gave high priced seminarz attended by the starz and dummeez. then he decided to sell special bondz in japan where he had a big office for the nonsenz bidness...

some big japoneez lost some big bucks with marty, as was predictable, and decided to call his bluff. marty refused to produce evidence requested in court in the gawdin state and went to jail on a contempt charge where he has been for yearz. he had many opportunities to comply with court requests and turned them all down.

one of his claims to fame was the famous 8.6 year CONfidenz cycle which actually came from an ohio farmer by the name of benner, in the 19th century. marty originally had copies of a chart on his website (now defunct) identical to benner's which he cited as the origin of his own CONfidenz cycle. the chart was found in a desk drawer in philly in the 1930's. (i kid you not!) but then it miraculously disappeared and only marty's cycle remained. (there are people who have the complete original site in replication.) actually benner's chart was produced also in early (maybe later too?) editions of frost's and prechter's elliott book classic.

several years ago a poster at another site compared the benner and marty charts, and a german lady reproduced an updated benner chart and posted it.

rumor is that marty is finally going to come clean or whatever it takes to get out from under contempt of court. if he is relatively clean after that (hu noze), he is going to come on like gangbusters to make up for all the money he lost while in stir. hey! wouldn't you? just thought i'd warn yas.

http://members.cox.n...cs/bennerts.gif

#3

Posted 04 April 2007 - 08:43 AM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#4

Posted 04 April 2007 - 09:09 AM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#5

Posted 04 April 2007 - 09:13 AM

#6

Posted 04 April 2007 - 10:41 AM

#7

Posted 04 April 2007 - 11:07 AM

Good posts, Russ. I might add that Marty predicted the 1987 crash the prior weekend in one of his seminars, as I've been told by another source.

and within hours of the low i mite add.......so did prechter predict the 87 crash.....within hours of the low.......

calling for the crash from the day of the august top ...months before the crash .....now that takes someone with mo smartz dontchu think??????

#8

Posted 04 April 2007 - 11:58 AM

Good posts, Russ. I might add that Marty predicted the 1987 crash the prior weekend in one of his seminars, as I've been told by another source.

and within hours of the low i mite add.......so did prechter predict the 87 crash.....within hours of the low.......

calling for the crash from the day of the august top ...months before the crash .....now that takes someone with mo smartz dontchu think??????

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#9

Posted 04 April 2007 - 12:13 PM

Edited by da_cheif, 04 April 2007 - 12:15 PM.

#10

Posted 04 April 2007 - 12:38 PM

Interpreting the pi cycle can be tricky as to what to expect, even Armstrong did not always see it exactly right, but there is no denying that this cycle is highly significant. This is just the 8.6 cycle, his computer model had other things in it that just the 8.6. It is an international capital model that shows where capital is moving to internationally.

It is his model, Benner's cycle is totally different.

check the model........it called all kinds of crashes.....like a stopped clock......sometimes there was a hiccup.....sometimes there wasnt.....if you hadnt noticed.....there have been thousands of "crashes".......:>).......of course...it wasnt his model to begin with......armstrong wasa teif......blaming the judge for his incarceration is typical of those who have no independent thought........

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/