A very bullish count for QQQQ

#1

Posted 03 May 2007 - 12:56 PM

QQQQ Starting 3 wave up

#2

Posted 03 May 2007 - 01:20 PM

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#3

Posted 03 May 2007 - 01:29 PM

#4

Posted 03 May 2007 - 01:35 PM

Nice job, though I would move your 1 and 2 to the July bottoming period before the acceleration to the upside.

And by the way, nowhere have I seen anyone suggest that the NASDAQ or NDX were in Primary 3...this reference has always been maintained as it relates to the primary market of stocks that trade on the NYSE.

Fib

Nowhere? How about this guy?

http://stockcharts.c...t...87&cmd=show[s67200334]&disp=P

Should show up as COMPQ weekly. Apologies if it doesn't show up as link.

pdl

PS - thanks for raising the idea.

#5

Posted 03 May 2007 - 01:51 PM

Well, I don't know about anyone else, but I've been quite clear on this subject for 4 years now. Originally, my idea was that we were in Primary 5 after the 2002 lows (with the NASDAQ in a bear market rally), but that all changed back in January of this year when the New York ratio adjusted advance/decline line took out its all time highs of 1959. Only a third of wave of Primary degree - or higher - could have done this under the original guidelines of the methodology. At this juncture, there still isn't enough evidence to suggest that any general count changes would be applied to the secondary group of stocks.I said I was asking those who were talking about wave 3 to post it and no one did so I never knew what they were talking about.

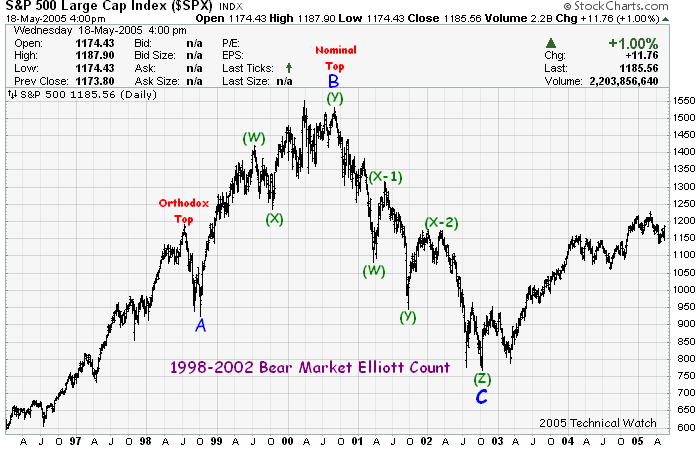

For reference, this has been my preferred bear market count of the 1998-2002 bear market in which I'm considering Primary wave 2 of either Cycle wave 3 or 5...too soon to tell.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#6

Posted 03 May 2007 - 01:51 PM

http://stockcharts.com/c-sc/sc?s=$OEX&p=W&yr=7&mn=6&dy=0&i=p62210233287&a=81658925&r=3391.png

#7

Posted 03 May 2007 - 01:52 PM

#8

Posted 03 May 2007 - 02:05 PM

And your effort is appreciated.So I did it myself and now I see at least the possibility of it.

As far is Don is concerned, he's always in wave 3 of one degree of the other.

And yes, many thanks to Pedro for the link provided in this thread....nice Elliott work being done over there. I have bookmarked it for future follow up.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#9

Posted 03 May 2007 - 02:12 PM

http://stockcharts.c...3054&r=9362.png

#10

Posted 03 May 2007 - 02:21 PM