decengr: I've asked before and never got an email....can you show your count please.

Check your TT PM.. if it didn't get through, PM me your email and I'll add you to my blog.

Posted 29 August 2007 - 09:34 PM

decengr: I've asked before and never got an email....can you show your count please.

Posted 29 August 2007 - 09:40 PM

Tea,

My count is that we are starting 'c' up to complete wave 2. We should see higher highs, perhaps Dow 13,500 going into tuesday of next week.

We are still in wave 2, where many think the correction is over, so I expect a 3 down sometime after wave 2 ends.

IF we are in wave 2, we should not exceed Dow 13, 700..

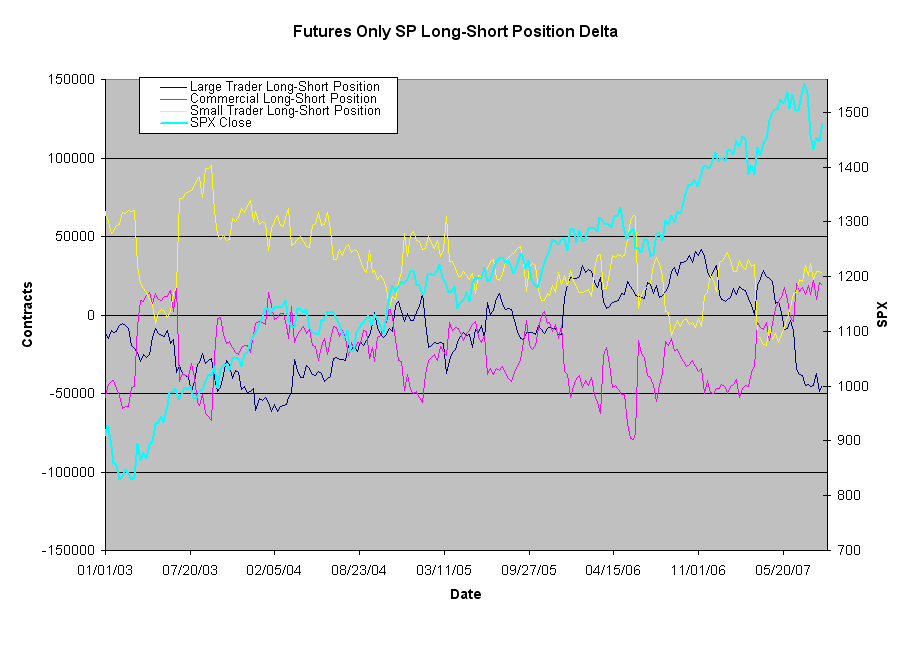

The main reason why I think there's still more downside is that small SP traders are STILL LONG. They'll capitulate when others do, which will cause the Fed to cut rates next meeting. Fed ain't gonna cut rates until they piss in their pants, not with the dollar this low.

But in order for wave 3 down to start, its gonna have to get mighty bullish in sentiment.

Posted 29 August 2007 - 09:47 PM

Tea,

My count is that we are starting 'c' up to complete wave 2. We should see higher highs, perhaps Dow 13,500 going into tuesday of next week.

We are still in wave 2, where many think the correction is over, so I expect a 3 down sometime after wave 2 ends.

IF we are in wave 2, we should not exceed Dow 13, 700..

The main reason why I think there's still more downside is that small SP traders are STILL LONG. They'll capitulate when others do, which will cause the Fed to cut rates next meeting. Fed ain't gonna cut rates until they piss in their pants, not with the dollar this low.

But in order for wave 3 down to start, its gonna have to get mighty bullish in sentiment.

Wouldn't it be surprizing if the market just takes off here and completely ignores anything, including the Fed, credit issues and everything that has been talked over and over for the past few weeks ?

How many people are actually on board of the bull train, and how many sold out and will have to urgently buy the stuff back ?

Just a random thought.

Posted 29 August 2007 - 10:12 PM

Anything's possible... I just look at this chart tho and I shake my head in disbelief..

Edited by ogm, 29 August 2007 - 10:20 PM.