Posted 09 September 2007 - 11:13 PM

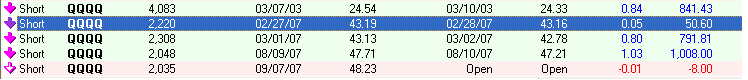

As I've stated, the results show a tendancy to gap up on the following day where a fairly large gap down was experienced.

This doesn't mean absolute, this doesn't mean the day won't be down. As someone has pointed out, futures are down.

And I've stated it before that such a large gap down with inability to fill it is a fairly good sign of weakness and a few days later there was always further weakness (ie it didn't shoot straight up from here).

But a few things that I just don't like here...

1) Since 9/11/01, the few days before 9/11 and 9/11 itself have not been bearish days, granted that there's only a few data points.

2) The fully short % here is above 30%, and if you have the historical TT poll results, one would know that out of some 50x that the fully short % was above 30%, the next few days being down were not very high. Again granted its all just odds.

3) Theres a few fed heads talking on monday/tuesday, and Ben is one of them. One could say that it could drive the markets lower, but they tend to be bull's best friends

4) MCO/TRIN went truly hog wild early last week.. tho this isn't necessarily bearish.. with 9:1 up days etc.

On the flip side,

1) The # of small options traders going long got pretty frothy last week

2) The rydex traders were buying all last week, and especially friday they dumped in big on the long side

3) The SP small traders loaded up the @ss last week (tuesday report), and I've said many times we ain't going up til these guys capitulate and go short

4) EW wise, it looks like a 3-3-5 formation with wave 5 down ready to start.

So since I can't make heads or tails of it, I'm going to sit out til the picture gets clear.

Qui custodiet ipsos custodes?