Is it 1998?

#1

Posted 03 November 2007 - 02:08 PM

#2

Posted 03 November 2007 - 02:18 PM

#3

Posted 03 November 2007 - 02:30 PM

#4

Posted 03 November 2007 - 02:42 PM

#5

Posted 03 November 2007 - 02:53 PM

This is all my writing. Do I normally sound like an idiot that can't put something like this together or vice versa?

Seriously, I've put a lot of hours thinking about whether its 1998 or not. My end conclusion is that its not, although there are many technical similarities. The one that counts the most, however, is price. And price pattern right now is saying NDX up, SPX down. Very close pattern wise to 1998.

1937 has much more correlation on many levels than 1998. Unfortunately, there was no NDX back then, so its hard to imagine how the techs would have fared.

I can post some more charts of 1998 (futures positions, breadth data, sentiment, etc) if people are interested. At the moment, however, I'm doing a study on parabolics and how to predict their termination. I'll likely open a thread on that later this weekend after a few runs.

that's the 64k question and i've thought alot about it too. public sentiment is completely different. people are pessimistic in general.

i just talked to a friend for over an hour and he's usually very bullish on business but he says for once in his lifetime he's pessimistic and it's causing him to question everything including his age

me, well i turned bearish in 98....which in hindsight was a mistake tho it probably spared me somewhat later. and i am bearish now tho heavily invested.

i tend to think we're closer to 2000 than 98.

ed rader

#6

Posted 03 November 2007 - 04:29 PM

Mr. Prechter, who keeps in touch with Mr. Jones through e-mail and the occasional phone call, says that Mr. Jones, his recent rough stretch notwithstanding, is best placed to survive a crash."He does not go cold and clammy," Mr. Prechter said.

He does not know if Mr. Jones shares his dark view of the market, though he allows that "Paul is certainly aware of the risk of an extensive bear market" and "is well aware that stocks are vulnerable."

But don't expect Mr. Jones to relive his 1987 glory. One investor who has spoken with him in the last week, who asked not to be identified because he is not authorized to speak publicly about Mr. Jones's investment strategies, said that the recent rate cut had made Mr. Jones increasingly bullish. Indeed, as opposed to 1987, Mr. Jones is said to be reminded of 1998, when cuts by the Federal Reserve led to the stock market boom of the late 1990s. "I have not heard him mention Prechter in a long time," this investor said.

Edited by SemiBizz, 03 November 2007 - 04:29 PM.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#7

Posted 03 November 2007 - 05:17 PM

In '98 the risk to money center banks was counter party solvency. Today the risk is stuff those same banks actually own.

#8

Posted 03 November 2007 - 08:24 PM

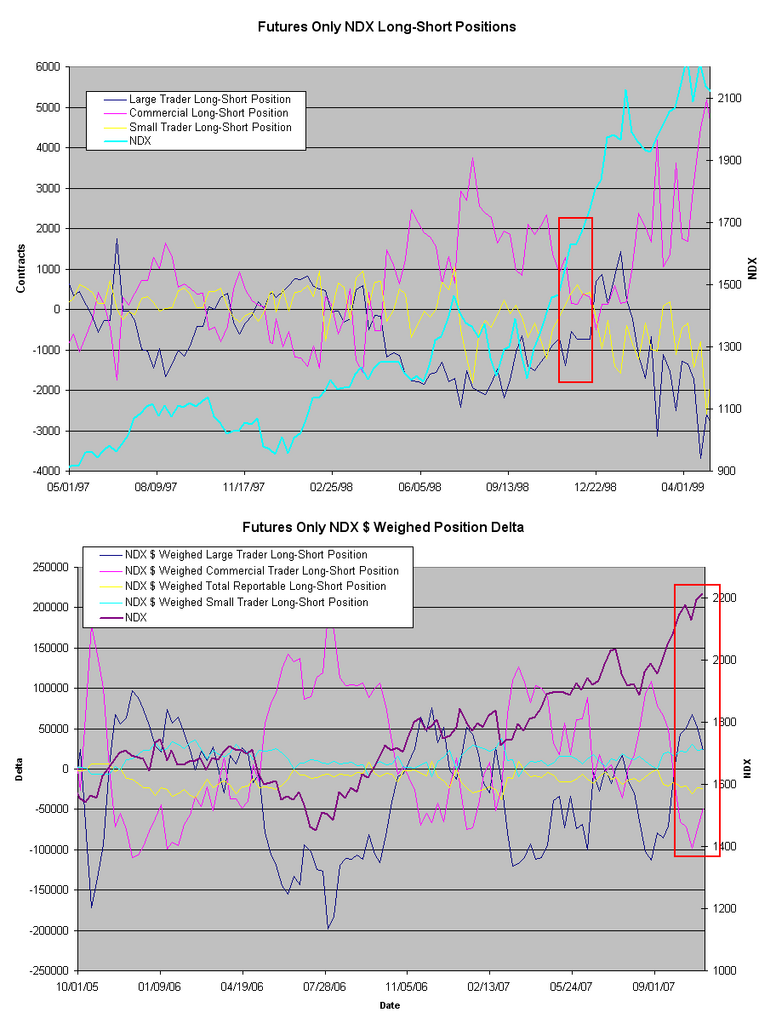

I've boxed the similar area in 1998 where we should be, according to price pattern (and time from bottom).

But as you can see, commercials were very long back then, and large traders were short and ramping up. Small fries were very long and just turning short.

In 2007, commercials are short, large traders long, and small fries are still long...

#9

Posted 03 November 2007 - 09:38 PM

This is what the futures looked like in 1998 vs 2007.

I've boxed the similar area in 1998 where we should be, according to price pattern (and time from bottom).

But as you can see, commercials were very long back then, and large traders were short and ramping up. Small fries were very long and just turning short.

In 2007, commercials are short, large traders long, and small fries are still long...

Don't be overly reliant on COT data for index (or any other financial) futures. COT is best used for physical commodities. Very few index "commercials" are "net" anything. If a firm is "short" NQ/ND you best believe they're long a basket of stocks or delta long in options or long RUT ect.

#10

Posted 03 November 2007 - 11:30 PM

This is what the futures looked like in 1998 vs 2007.

I've boxed the similar area in 1998 where we should be, according to price pattern (and time from bottom).

But as you can see, commercials were very long back then, and large traders were short and ramping up. Small fries were very long and just turning short.

In 2007, commercials are short, large traders long, and small fries are still long...

Don't be overly reliant on COT data for index (or any other financial) futures. COT is best used for physical commodities. Very few index "commercials" are "net" anything. If a firm is "short" NQ/ND you best believe they're long a basket of stocks or delta long in options or long RUT ect.

Yup, I'm a believer that only small traders are mostly directional (ie non-hedgers). Large and commercials are mostly hedgers.

I still haven't conclusively determined if the COT matters for anything stockwise.. the correlation seems tenuous at best.