i thought the exact same thing as your title

seems like everybody has forgotten what happened at the jan top

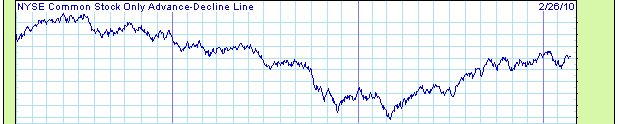

nyad was confirming further upside and gave us no warning of a move down

I suppose we could conclude that the A/D doesn't necessarily diverge on every top, but when it does it's a distinct warning. We'll see how it plays out, but wouldn't it be interesting if that top in January turned out not to be much of a top? Either way, they change the key to the lock at every top and bottom, otherwise it would be too easy.

IT

I remember Louise Yamada saying the A/D doesn't always deverge prior to a tanking like in the 1930s meltdown and rally. She looked way back. So the A/D melting down first is not a golden rule.

December 19, 2009: As part of Financial Sense Newshour's review of 2009, Louise is interviewed by Jim Puplava and John Loeffler. Topics include current technical conditions in the equity markets, energy, gold and a glance at the beginning of next year. MP3 of the interview is available at:

netcastdaily.com/broadcast/fsn2009-1219-3a.mp3