Closest Analogy to the Current Bear Market

#21

Posted 17 April 2009 - 07:21 AM

#23

Posted 17 April 2009 - 07:24 AM

comparing current charts with historic charts is something ive been watching perma bears do for decades.. obviously...a waste of time.....i can only guess how many thousands of points up will occur before this stealth bull market loses the unwashed publics bear market label.......it took 7 years for that to occur after the hiccup of 1987.......back then it felt like the end of the world........and any thots of a huge bull market out of that was met with absolute distain......

im with da chief. comparing old to new is the most bogus thing ive ever seen. sure anyone can find a match. AFTER The fact.

this bull has legs. market action tells me noone is expecting this to keep going up. too many nervous nellies. i like dat.

#24

Posted 17 April 2009 - 07:31 AM

#25

Posted 17 April 2009 - 08:51 AM

#26

Posted 17 April 2009 - 09:52 AM

Also, one needs to keep in mind the context of whether a rally or decline is within a larger bear/bull period - those rallies/declines act/feel a lot different depending on period.

What is fascinating is that just two years ago, comparisons to the last 4th Turning ('29'- '44) would have seemed so ridiculous. And talk about states succeeding from the Union -

http://www.businessi...he-union-2009-4

or the gathering of arms and ammo -

http://www.ky3.com/n...l/42932397.html

sure has a tinge of that previous 4T (1860-1865)

and certainly recent Tea Parties have harken back to even an earlier 4T (1773-1794) -

http://news.bostonhe...position=recent

Now if we start hearing about privateering (e.g., private warship authorized by a country's government by letters of marque to attack or defend shipping) to counter some pirate activities, well that would look like the 4T crisis of 1569-1594. And that would be just too much to...

Opps, wait a minute...

http://www.nytimes.c...-edlet.html?hpw

Nay, history can't repeat itself and certainly has nothing to teach us.

If the world didn't suck, wouldn't we all just fly off?

#28

Posted 17 April 2009 - 10:20 AM

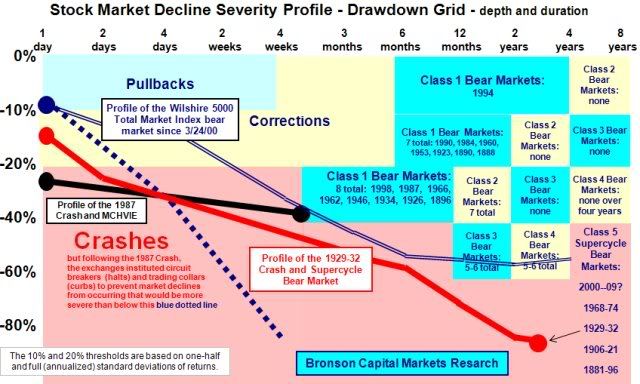

There would be two ways of looking at the above. The more bullish view is that the bottom has already occurred as shown in the chart. The other view is to align the market tops and the March bottom would more closely identify with the September 2001 low and the market is correcting for six months before the final low later this fall and next spring.