Semi, it looks like we did take it out but not on bigger volume. Is that what you said?

It says all the upside since 5/8 is a Bearish Upthrust.

OK then. I understand that. Thanks.

Posted 10 June 2009 - 09:51 PM

Semi, it looks like we did take it out but not on bigger volume. Is that what you said?

It says all the upside since 5/8 is a Bearish Upthrust.

Posted 10 June 2009 - 09:53 PM

It's telling us that the entire upside since the week of 5/8 is an upthrust...

Good Luck.

Posted 10 June 2009 - 09:53 PM

It's telling us that the entire upside since the week of 5/8 is an upthrust...

Good Luck.

Posted 10 June 2009 - 10:03 PM

i'm sure there's a reason why you mark the "present" on a past time frame?

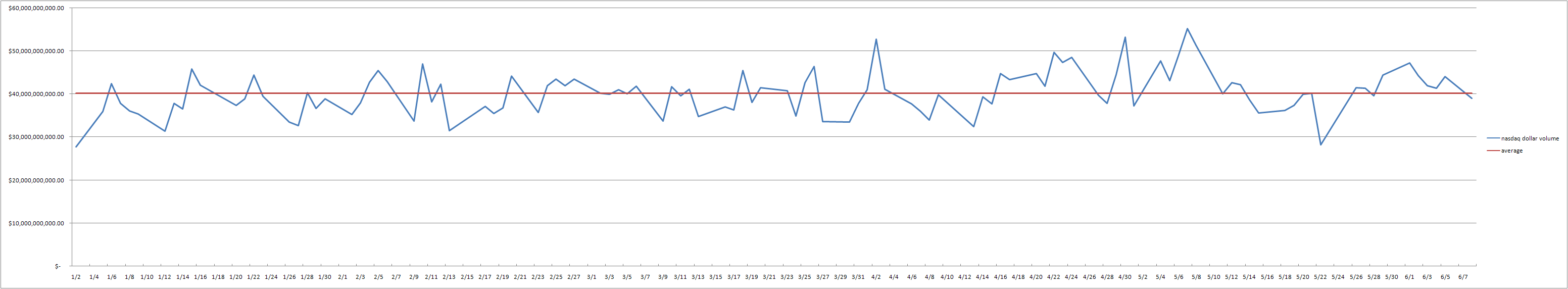

Its all the volume from today going back all the way to one year ago, "this past 12 months" would have been a clearer title.

Posted 10 June 2009 - 10:07 PM

It's telling us that the entire upside since the week of 5/8 is an upthrust...

Good Luck.

So if 5/8/09 had taken out the highs on the first try, you would agree on my analysis?

To me this is all consolidation before the next leg up. I don't think 1600 holds on the first test either.

Posted 10 June 2009 - 10:12 PM

This is entirely correct, unfortunately people are ignoring for whatever peculiar reason the breakthrough of price on all major indices on considerably less volume. Yet because of summer volume/holiday/<insert reason here> volume is disregarded.

My only confusion is to how long this can continue, because we have broken quite a few price ranges on lower volume...

Posted 10 June 2009 - 10:13 PM

i'm sure there's a reason why you mark the "present" on a past time frame?

Its all the volume from today going back all the way to one year ago, "this past 12 months" would have been a clearer title.

OK. That makes sense. But from a laymans perspective, if it was really that simple, we would eventually roll into the trough and settle where the lowest volume is marked and the markets never move again. Who's gonna turn off the lights.

Posted 10 June 2009 - 10:14 PM

If it was really that simple, we would eventually roll into the trough and settle where the lowest volume is marked and the markets never move again. Who's gonna turn off the lights.

Edited by MoneyFriend, 10 June 2009 - 10:24 PM.

Posted 10 June 2009 - 10:31 PM

Posted 10 June 2009 - 10:38 PM