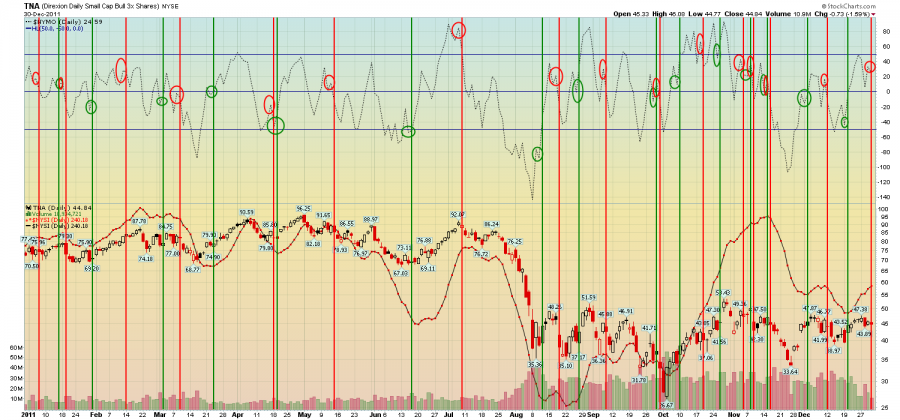

I kind of think I've said this before but I'll say it again anyway -- look for a low above a low on the NYMO (after a deep sell off, the aggressive trader's buy) and then look for an upturn in the NYSI soon after to confirm the rally. If I may rewrite an old maxim -- the breadth is your friend. McClellan signals are simple and precise -- there is either a low above a low on the NYMO or there isn't, the NYSI is either going up or it isn't. Not a lot of room for interpretation. And sometimes that combination of signals falls apart (mostly in bearish times) and sometimes they lead to a strong rally, like the one going on now.

On the current NYSI rally it so happens both of those events happened to happen on the same day, Dec 20th of last year. But given that the NYSI lags on up turns and down turns, there come times when starting to clear the table on strength before the feast is finished avoids overeating, heart attacks, and might just let one live longer. Today might be as good a day as any to start cleaning up.

Some examples of what can a happen with a strong NYMO/NYSI rally:

Among the leveraged ETFs on this rally (at the moment): TNA is up approximately 23 percent; TQQQ up 25 percent; UPRO up 17 percent; FAS up 28 percent; DRN up 24 percent; UYM up 23 percent; and a leader, SOXL up 46 percent; and a laggard, ERX, up 11 percent.

Among notable stocks: AAPL, up 14 percent; IBM up 22 percent; BAC up 37 percent; GS up 22 percent, FSLR (one of my favorites for philosophical reasons), up 28 percent; and a leader, NFLX, up 66 percent; and a laggard, AMZN, up less than one percent.

Among the stocks that happen to be in my "nifty-fifty": CF, up 27 percent; TPX up 29 percent; WTW up 31 percent; and because nothings perfect, there are also losers: CRR down 23 percent, QCOR down 21 percent. And if one happened to own GGC in the window of this NYSI rise, it's up 90 percent on a buyout -- as Linda Raschke says...(see the sayings below

).

I'm posting these examples just for a perspective on the magic that sometimes happens in the context of the McClellan Oscillator.

Good luck and good trading.

P.S. Posted this on Fearless Forecasters yesterday and today, linking it here for the record:

28 DAYS LATER

Good luck and good trading.

Edited by diogenes227, 31 January 2012 - 02:10 PM.

This topic is locked

This topic is locked