Hulbert Sentiment extreme?

#11

Posted 26 November 2009 - 02:23 AM

#12

Posted 26 November 2009 - 07:24 AM

#13

Posted 26 November 2009 - 11:35 AM

I invite anyone to point out even one historical example of a market, any market, that went parabolic, which wasn't followed by a complete and total collapse after the market surge exhausts. There is always a good story attached to a parabola. Does "peak oil" ring a bell? Of course, oil shortages are likely to occur and the fundamental story.....very compelling; but that didn't prevent crude oil from collapsing to $30 after that market went on a parabolic run to $147. I don't think it matters what the story is or how easy it is to understand the fundamental reasons a market is going up. It's the very fact that a market goes parabolic that virtually assures that market will suffer a devastating collapse, at least historically. Good luck to those that think the current story is so compelling it will be different this time. I don't know where this one ends but I'm guessing it may be at one of the fib expansion targets (+/- $20): $1200, $1350, $1500. Timing for potential turns in gold market are week of 12/4/09 and 1/15/10 to 2/7/10 time frame.

Happy Thanksgiving....

Kimston

Kimston:

I like your monicker! I currently reside in Central America on a small farm (Finca) and I

occasionally get that good prick or scratch from the barb-wire fences that poliferate the area. The word for "barb" in spanish is "púas" (pronounced 'poo’-ah'), which is probably the sound most will make when this correction begins.

I personally don't think it will amount to that much 'percentage-wise' - down to or near 1,070-1,075, but it will be sharp and fast, however what will be the "tell" for me will be the PM's performance relative to the gold move down.

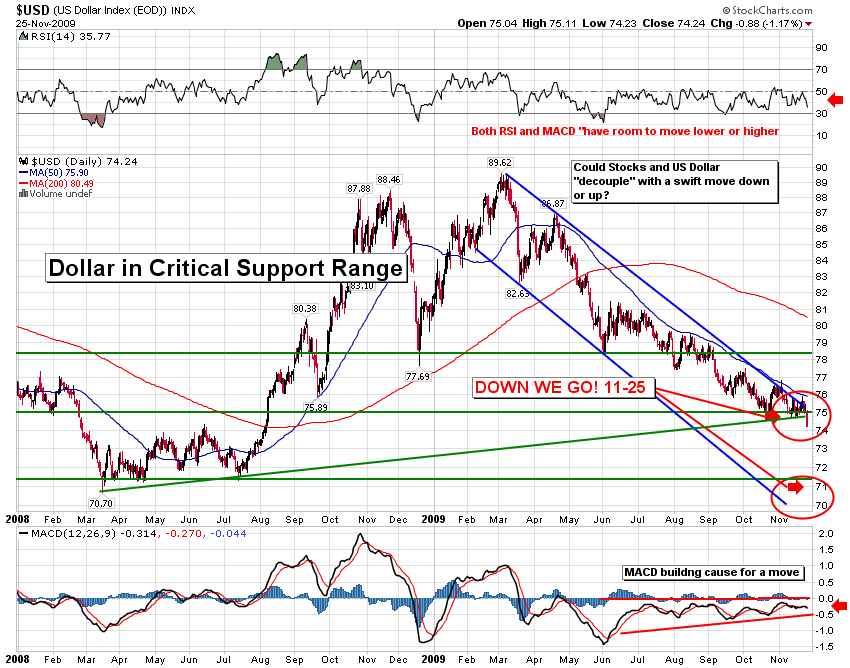

The technical damage to the US dollar yesterday looks like there was some capitulation - today we are reversing - may last a couple of days - then I expect a move towards 71-72 into January.

Oil looks vulnerable here as well!

stubaby

#14

Posted 26 November 2009 - 12:23 PM

I invite anyone to point out even one historical example of a market, any market, that went parabolic, which wasn't followed by a complete and total collapse after the market surge exhausts. There is always a good story attached to a parabola. Does "peak oil" ring a bell? Of course, oil shortages are likely to occur and the fundamental story.....very compelling; but that didn't prevent crude oil from collapsing to $30 after that market went on a parabolic run to $147. I don't think it matters what the story is or how easy it is to understand the fundamental reasons a market is going up. It's the very fact that a market goes parabolic that virtually assures that market will suffer a devastating collapse, at least historically. Good luck to those that think the current story is so compelling it will be different this time. I don't know where this one ends but I'm guessing it may be at one of the fib expansion targets (+/- $20): $1200, $1350, $1500. Timing for potential turns in gold market are week of 12/4/09 and 1/15/10 to 2/7/10 time frame.

Happy Thanksgiving....

Kimston

Kimston:

The point I get out of your post is that as you say "you're guessing" as to where this market tops. It will definitely not be different this time...it's always the same. A strong bull market takes place, and some folks always try to pick the top, usually unsuccessfully. Maybe it will be different this time, as you say, but so far I saw maybe 8-9 folks on this site the other day trying to short this market at what are now lower prices. Nothing seems different to me.

One of these day the market will finally find a top, just as oil did. And if you will recall, oil actually built a top where distribution took place. There was time to liquidate longs, and to get short. Gold may end up being a different animal. It may simply peak one day and reverse. If so, if you're long you'll give back a little. That may be less than what you lost trying to pick the top on the way up.

This game of trading is not only about a chart, a fib extension, an ewave, or an oscillator on a chart. If those are your tools, you're going to miss many of the major market moves. The fundamental story is always a part of it. And in this case, the story is that governments all over the world are debasing their currencies simultaneously. Personally I don't see an end to that, but I'm going to let the chart tell me. Right now all the chart tells me is that it's going up.

IT

#15

Posted 26 November 2009 - 09:26 PM

#16

Posted 27 November 2009 - 11:15 AM

Senor: you re-enter your DZZ play yet? enquiring amigos want to know

Nope, I actually bought a little gdxj near 26.20 this morning.

BSing away

Senor

#17

Posted 27 November 2009 - 01:18 PM

#18

Posted 28 November 2009 - 12:40 PM

I invite anyone to point out even one historical example of a market, any market, that went parabolic, which wasn't followed by a complete and total collapse after the market surge exhausts. There is always a good story attached to a parabola. Does "peak oil" ring a bell? Of course, oil shortages are likely to occur and the fundamental story.....very compelling; but that didn't prevent crude oil from collapsing to $30 after that market went on a parabolic run to $147. I don't think it matters what the story is or how easy it is to understand the fundamental reasons a market is going up. It's the very fact that a market goes parabolic that virtually assures that market will suffer a devastating collapse, at least historically. Good luck to those that think the current story is so compelling it will be different this time. I don't know where this one ends but I'm guessing it may be at one of the fib expansion targets (+/- $20): $1200, $1350, $1500. Timing for potential turns in gold market are week of 12/4/09 and 1/15/10 to 2/7/10 time frame.

Happy Thanksgiving....

Kimston

Kimston:

The point I get out of your post is that as you say "you're guessing" as to where this market tops. It will definitely not be different this time...it's always the same. A strong bull market takes place, and some folks always try to pick the top, usually unsuccessfully. Maybe it will be different this time, as you say, but so far I saw maybe 8-9 folks on this site the other day trying to short this market at what are now lower prices. Nothing seems different to me.

One of these day the market will finally find a top, just as oil did. And if you will recall, oil actually built a top where distribution took place. There was time to liquidate longs, and to get short. Gold may end up being a different animal. It may simply peak one day and reverse. If so, if you're long you'll give back a little. That may be less than what you lost trying to pick the top on the way up.

This game of trading is not only about a chart, a fib extension, an ewave, or an oscillator on a chart. If those are your tools, you're going to miss many of the major market moves. The fundamental story is always a part of it. And in this case, the story is that governments all over the world are debasing their currencies simultaneously. Personally I don't see an end to that, but I'm going to let the chart tell me. Right now all the chart tells me is that it's going up.

IT

IT

I made a very simple and straightforward request. Instead of showing me all the examples of blow-off moves that did not result in a total collapse, you provide some information that makes me nervous. Sharing privileged, inside information about governments debasing their currencies may start an investigation by the CFTC if their web bots come across this.

You entirely missed the point of my post, but I'm glad that you will know when to get out of a market that has gone parabolic. Please let everyone else on the board know when we've entered the distribution phase. The key points I thought I had made, but will try to clarify here, are as follows:

>It doesn't matter what the story is. When a market goes parabolic, the parabola will be followed by a collapse. This has been the case in 100% of the examples I can find throughout the history of trading.

>I assumed that people could deduce from bullet one, that a high probability of something happening (100% occurrence historically) in a market would be something that just might happen again and they may want to attempt to profit from said market behavior. All trading and market forecasting is probabilistic. There is no quantitative certainty in trading or predicting market movement. But a 100% historical track record of a market movement is something a trader might want to take a shot at.

>I'm not trying to pick "the" top. I'm buying a few long-term puts along the way as the parabola and market sentiment continues to escalate. The fib projections are simply areas where the market may top. The mathematical relationships of market movements are there for all to see if one conducts some open-minded research of the empirical evidence.

Thanks for enlightening me about how the "game of trading" works. I've been at this for 30 years now and doing just fine using Ewave, Gann, sentiment and any other tools I've found to be of value. Don't assume that because you have not been able to profit from analysis of a market's structure as reflected in charts, that others can't. I bought Dec 2008 DJX puts in Dec 2007 and road them all the way down, selling them on the day of the November 2008 low. How is that for missing a major market move? How did you do last year? I went all in on mining stocks in 2001 and road them for 5 years before going more to a swing trading mode for metals. These trades were based on charts, Ewave patterns, cycles and sentiment.

Thanks also for your concern about my potential losses from shorting another parabola. I forget once in awhile that long-term options are the instrument to use for betting against a parabola and try shorting futures. But then I remember and buy some puts. The GLL calls I bought represent about 1/3 of 1% of my trading capital. If the precious metals continue higher I will probably put on another similar sized positions in ZSL calls, as silver is the much weaker market. I may go all the way to a 2% position before I'm done. I've made good money shorting parabolas in the past (with long-term puts), starting with Coleco and the Cabbage Patch Doll mania back in the early 80's, and more recently with gold, platinum and crude oil last year. Of course it may not work this time and I may lose money, but one cannot trade if they aren't willing to risk money.

The bottom line is, nothing has changed. The pundits and participants are at maximum bullishness, but only after the gold market has been running up for 8 years and has now gone parabolic. I don't rule out a run to 1350, 1500, or even 2000 here. On the other hand, it may not get over 1220. Who knows? However, I don't think it makes it past Jan/Feb time frame, if that long, before collapsing. BTW, I have a $3400 target for gold long term, but I think it's going to the 650 to 850 range first.

Kimston

#19

Posted 29 November 2009 - 06:22 PM

I invite anyone to point out even one historical example of a market, any market, that went parabolic, which wasn't followed by a complete and total collapse after the market surge exhausts. There is always a good story attached to a parabola. Does "peak oil" ring a bell? Of course, oil shortages are likely to occur and the fundamental story.....very compelling; but that didn't prevent crude oil from collapsing to $30 after that market went on a parabolic run to $147. I don't think it matters what the story is or how easy it is to understand the fundamental reasons a market is going up. It's the very fact that a market goes parabolic that virtually assures that market will suffer a devastating collapse, at least historically. Good luck to those that think the current story is so compelling it will be different this time. I don't know where this one ends but I'm guessing it may be at one of the fib expansion targets (+/- $20): $1200, $1350, $1500. Timing for potential turns in gold market are week of 12/4/09 and 1/15/10 to 2/7/10 time frame.

Happy Thanksgiving....

Kimston

Kimston:

The point I get out of your post is that as you say "you're guessing" as to where this market tops. It will definitely not be different this time...it's always the same. A strong bull market takes place, and some folks always try to pick the top, usually unsuccessfully. Maybe it will be different this time, as you say, but so far I saw maybe 8-9 folks on this site the other day trying to short this market at what are now lower prices. Nothing seems different to me.

One of these day the market will finally find a top, just as oil did. And if you will recall, oil actually built a top where distribution took place. There was time to liquidate longs, and to get short. Gold may end up being a different animal. It may simply peak one day and reverse. If so, if you're long you'll give back a little. That may be less than what you lost trying to pick the top on the way up.

This game of trading is not only about a chart, a fib extension, an ewave, or an oscillator on a chart. If those are your tools, you're going to miss many of the major market moves. The fundamental story is always a part of it. And in this case, the story is that governments all over the world are debasing their currencies simultaneously. Personally I don't see an end to that, but I'm going to let the chart tell me. Right now all the chart tells me is that it's going up.

IT

IT

I made a very simple and straightforward request. Instead of showing me all the examples of blow-off moves that did not result in a total collapse, you provide some information that makes me nervous. Sharing privileged, inside information about governments debasing their currencies may start an investigation by the CFTC if their web bots come across this.

You entirely missed the point of my post, but I'm glad that you will know when to get out of a market that has gone parabolic. Please let everyone else on the board know when we've entered the distribution phase. The key points I thought I had made, but will try to clarify here, are as follows:

>It doesn't matter what the story is. When a market goes parabolic, the parabola will be followed by a collapse. This has been the case in 100% of the examples I can find throughout the history of trading.

>I assumed that people could deduce from bullet one, that a high probability of something happening (100% occurrence historically) in a market would be something that just might happen again and they may want to attempt to profit from said market behavior. All trading and market forecasting is probabilistic. There is no quantitative certainty in trading or predicting market movement. But a 100% historical track record of a market movement is something a trader might want to take a shot at.

>I'm not trying to pick "the" top. I'm buying a few long-term puts along the way as the parabola and market sentiment continues to escalate. The fib projections are simply areas where the market may top. The mathematical relationships of market movements are there for all to see if one conducts some open-minded research of the empirical evidence.

Thanks for enlightening me about how the "game of trading" works. I've been at this for 30 years now and doing just fine using Ewave, Gann, sentiment and any other tools I've found to be of value. Don't assume that because you have not been able to profit from analysis of a market's structure as reflected in charts, that others can't. I bought Dec 2008 DJX puts in Dec 2007 and road them all the way down, selling them on the day of the November 2008 low. How is that for missing a major market move? How did you do last year? I went all in on mining stocks in 2001 and road them for 5 years before going more to a swing trading mode for metals. These trades were based on charts, Ewave patterns, cycles and sentiment.

Thanks also for your concern about my potential losses from shorting another parabola. I forget once in awhile that long-term options are the instrument to use for betting against a parabola and try shorting futures. But then I remember and buy some puts. The GLL calls I bought represent about 1/3 of 1% of my trading capital. If the precious metals continue higher I will probably put on another similar sized positions in ZSL calls, as silver is the much weaker market. I may go all the way to a 2% position before I'm done. I've made good money shorting parabolas in the past (with long-term puts), starting with Coleco and the Cabbage Patch Doll mania back in the early 80's, and more recently with gold, platinum and crude oil last year. Of course it may not work this time and I may lose money, but one cannot trade if they aren't willing to risk money.

The bottom line is, nothing has changed. The pundits and participants are at maximum bullishness, but only after the gold market has been running up for 8 years and has now gone parabolic. I don't rule out a run to 1350, 1500, or even 2000 here. On the other hand, it may not get over 1220. Who knows? However, I don't think it makes it past Jan/Feb time frame, if that long, before collapsing. BTW, I have a $3400 target for gold long term, but I think it's going to the 650 to 850 range first.

Kimston

Kimston, I agree that nearer term a $100 or more correction is very possible, but I've compared parabolic blowoffs of the past in gold and other markets, and larger period rate of change oscillators in gold are no where close to where previous parabolic blowoffs have ended, just my opinion FWIW.

NO BS

Senor

#20

Posted 29 November 2009 - 06:45 PM

I invite anyone to point out even one historical example of a market, any market, that went parabolic, which wasn't followed by a complete and total collapse after the market surge exhausts. There is always a good story attached to a parabola. Does "peak oil" ring a bell? Of course, oil shortages are likely to occur and the fundamental story.....very compelling; but that didn't prevent crude oil from collapsing to $30 after that market went on a parabolic run to $147. I don't think it matters what the story is or how easy it is to understand the fundamental reasons a market is going up. It's the very fact that a market goes parabolic that virtually assures that market will suffer a devastating collapse, at least historically. Good luck to those that think the current story is so compelling it will be different this time. I don't know where this one ends but I'm guessing it may be at one of the fib expansion targets (+/- $20): $1200, $1350, $1500. Timing for potential turns in gold market are week of 12/4/09 and 1/15/10 to 2/7/10 time frame.

Happy Thanksgiving....

Kimston

Kimston:

The point I get out of your post is that as you say "you're guessing" as to where this market tops. It will definitely not be different this time...it's always the same. A strong bull market takes place, and some folks always try to pick the top, usually unsuccessfully. Maybe it will be different this time, as you say, but so far I saw maybe 8-9 folks on this site the other day trying to short this market at what are now lower prices. Nothing seems different to me.

One of these day the market will finally find a top, just as oil did. And if you will recall, oil actually built a top where distribution took place. There was time to liquidate longs, and to get short. Gold may end up being a different animal. It may simply peak one day and reverse. If so, if you're long you'll give back a little. That may be less than what you lost trying to pick the top on the way up.

This game of trading is not only about a chart, a fib extension, an ewave, or an oscillator on a chart. If those are your tools, you're going to miss many of the major market moves. The fundamental story is always a part of it. And in this case, the story is that governments all over the world are debasing their currencies simultaneously. Personally I don't see an end to that, but I'm going to let the chart tell me. Right now all the chart tells me is that it's going up.

IT

IT

I made a very simple and straightforward request. Instead of showing me all the examples of blow-off moves that did not result in a total collapse, you provide some information that makes me nervous. Sharing privileged, inside information about governments debasing their currencies may start an investigation by the CFTC if their web bots come across this.

You entirely missed the point of my post, but I'm glad that you will know when to get out of a market that has gone parabolic. Please let everyone else on the board know when we've entered the distribution phase. The key points I thought I had made, but will try to clarify here, are as follows:

>It doesn't matter what the story is. When a market goes parabolic, the parabola will be followed by a collapse. This has been the case in 100% of the examples I can find throughout the history of trading.

>I assumed that people could deduce from bullet one, that a high probability of something happening (100% occurrence historically) in a market would be something that just might happen again and they may want to attempt to profit from said market behavior. All trading and market forecasting is probabilistic. There is no quantitative certainty in trading or predicting market movement. But a 100% historical track record of a market movement is something a trader might want to take a shot at.

>I'm not trying to pick "the" top. I'm buying a few long-term puts along the way as the parabola and market sentiment continues to escalate. The fib projections are simply areas where the market may top. The mathematical relationships of market movements are there for all to see if one conducts some open-minded research of the empirical evidence.

Thanks for enlightening me about how the "game of trading" works. I've been at this for 30 years now and doing just fine using Ewave, Gann, sentiment and any other tools I've found to be of value. Don't assume that because you have not been able to profit from analysis of a market's structure as reflected in charts, that others can't. I bought Dec 2008 DJX puts in Dec 2007 and road them all the way down, selling them on the day of the November 2008 low. How is that for missing a major market move? How did you do last year? I went all in on mining stocks in 2001 and road them for 5 years before going more to a swing trading mode for metals. These trades were based on charts, Ewave patterns, cycles and sentiment.

Thanks also for your concern about my potential losses from shorting another parabola. I forget once in awhile that long-term options are the instrument to use for betting against a parabola and try shorting futures. But then I remember and buy some puts. The GLL calls I bought represent about 1/3 of 1% of my trading capital. If the precious metals continue higher I will probably put on another similar sized positions in ZSL calls, as silver is the much weaker market. I may go all the way to a 2% position before I'm done. I've made good money shorting parabolas in the past (with long-term puts), starting with Coleco and the Cabbage Patch Doll mania back in the early 80's, and more recently with gold, platinum and crude oil last year. Of course it may not work this time and I may lose money, but one cannot trade if they aren't willing to risk money.

The bottom line is, nothing has changed. The pundits and participants are at maximum bullishness, but only after the gold market has been running up for 8 years and has now gone parabolic. I don't rule out a run to 1350, 1500, or even 2000 here. On the other hand, it may not get over 1220. Who knows? However, I don't think it makes it past Jan/Feb time frame, if that long, before collapsing. BTW, I have a $3400 target for gold long term, but I think it's going to the 650 to 850 range first.

Kimston

Kimston, I agree that nearer term a $100 or more correction is very possible, but I've compared parabolic blowoffs of the past in gold and other markets, and larger period rate of change oscillators in gold are no where close to where previous parabolic blowoffs have ended, just my opinion FWIW.

NO BS

Senor

Senor,

I agree, the weekly and monthly RSIs are not as extreme as they can get in blow-off situations. That's why I didn't rule out a possible run to 1350 or higher before this one is finished. On the other hand, sentiment has heated up enough to allow for significant top now. I do have a confluence of time squares and fib timing late Nov to early Dec. However, linear cycle timing for a final top of this leg is actually mid Jan to early Feb 2010. If pms are still running up into that time frame, I'll be adding another handful of long-term puts. The real show for me is the stock market and potential downside there. Shorting the pms blow-off is a sideshow at best.

Kimston