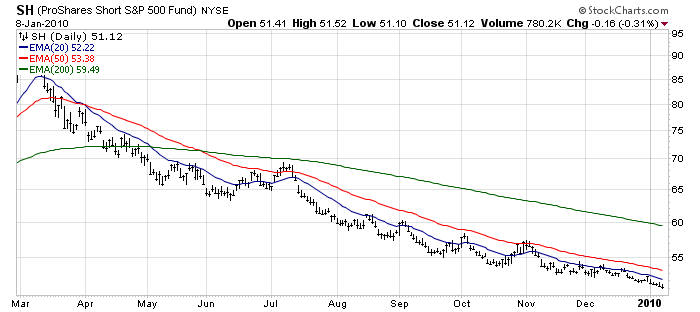

Excellent work Doc. Thank you for taking the time in helping with this exercise.Based solely on what we see here, what is (has been) the best viable trade?

Trading on the short side.

Does it continue to be an active strategy?

Yes. It would help to know if the spread between Price and 200ema is at historic highs.

When would be time to reduce our exposure and look for a long entry?

First step, Price trades above 50ema for more than a week.

Second step, 20 ema crosses above 50 ema.

Third step, Price crosses above 200ema.

Fourth step, 20ema crosses above 200ema.

Fifth step, 50ema also crosses above 200ema.

When does one trend end and a new one begin?

When the ema configuration fully reverses. Bullish configuration is with 20ema above 50 ema which is above 200ema. Bearish configuration is with 20ema under 50ema which is under the 200 ema. By this definition the bottom of the decline and the top of the climb is only known in hindsight. Ain't that usually the case anyway!

I'm sorry that "andr99" decided not to participate (and I am more than just a moving average trader...this was just an exercise).

Based on the strategy given by "andr99", the bottom line for something like this to be successful is knowing whether a trade will move in your favor or not...when the odds increase the likelihood that for your strategy will become a profitable one. As Doc points out, there's a lot that must happen before one can go with the kind of strategy that "andr99" presented above. As these "steps" unfold, not only will your chances of success increase as the market moves in your desired direction, each step provides another strategy that one must take to get their same objective. Markets just don't ring a bell and say "That's It!" (especially when it comes to stocks which tend to have rounding tops and spike bottoms). It's a slow, deliberate process despite the instant gratification that many look for these days. In this business, if the train is going from Los Angeles to New York, all we really want to do is get on in Las Vegas and get off in Philadelphia....to be on the train for the majority of the ride. More importantly, we need to also make sure that the train we're getting on is the right one and not the one going back to Los Angeles which would defeat the purpose of buying your ticket in the first place.

Going back to the chart for a moment, I presented this simple exercise to point out that there have been several times over the last 9 months when one could had traded "the initial drop that tells me the march rally is over" and this failed to go as planned. Each time the exponential moving averages were tested, the predominate trend held in place to the chagrin of many. With many continuing to be frustrated of when or where this might actually have the chance to occur, I thought this was a good place to add to the spirit to which the title of the thread conveys.

I fully understand that everyone here wants to enter a trade and be right as far as their timing. Nothing is better than immediate satisfaction and its possible acknowledgment by others. But without knowing which mood (friendly or hostile) the market is in to compliment an analytical opinion, your likely to be wrong more times than either your trading account or ego is likely to tolerate.

OK...here's the chart again with the symbol. For those who recognized it was SH, a gold star for you!

Fib

Based on the strategy given by "andr99", the bottom line for something like this to be successful is knowing whether a trade will move in your favor or not...when the odds increase the likelihood that for your strategy will become a profitable one..............................

You have understood nothing about my strategy. First of all I' m trying to see if indexes have reached or not important resistances. Second I try to look at divergences in some indicators I follow. Third and most important I try to understand if the march rally is corrective of the drop since 2008 or instead it is a new bull rally. IF it is corrective as I think, but I have no will to explain you why (not just me all around thinking it is corrective to say the truth), IF the indexes are at important resistances, IF there are absurd divergences in the indicators I follow..............well something is wrong with this rally. Does that mean I have to enter short at the first 2% drop ? No SIR. It means to me to be alerted and take a careful look at the nature of the rebound as soon as the indexes make a consistent drop. The nature of the rebound says it all about the nature of this march rally.