Edited by SilentOne, 03 March 2010 - 12:48 PM.

Posted 03 March 2010 - 12:47 PM

Edited by SilentOne, 03 March 2010 - 12:48 PM.

Posted 03 March 2010 - 01:14 PM

Posted 03 March 2010 - 03:59 PM

Posted 04 March 2010 - 01:40 AM

Posted 04 March 2010 - 03:16 AM

Chem

Chem

Posted 04 March 2010 - 08:14 AM

agree w/u stubaby, i said good bye to margin just now

dharma

Posted 04 March 2010 - 11:43 AM

Posted 04 March 2010 - 11:48 AM

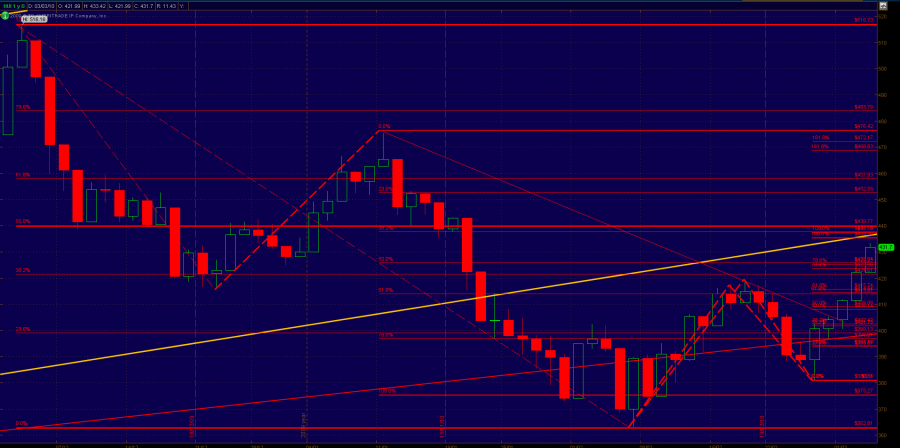

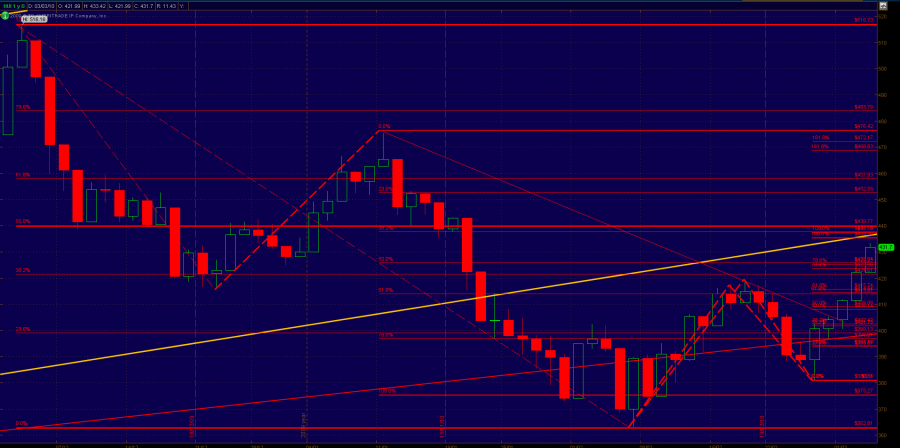

Gold reversing at 55% retrace to me points to a continuation of the move that was retraced - in this case not only can't new lows be ruled out but should probably be expected. There is something about this retrace level that tends to attract/repel gold - it shows up again and again over the years to the point where I see it as the decision level for the underlying trend.

Chem

Posted 04 March 2010 - 12:11 PM

Edited by dharma, 04 March 2010 - 12:16 PM.