1040 (23% retrace of the 6/21 - 7/1 swing)

1060 (38.1% retrace of 6/21 - 7/1 swing)

1072 (50% retrace of 6/21 - 7/1 swing)

1085 (68.1% retrace of 6/21 - 7/1 swing)

1092 (38.1% retrace of the entire decline from April highs)

Downtrend line on daily charts from April highs.

Various Gann angle resistances

Horizontal resistances at (1040, 1105)

Plethora of moving average resistances on various timeframes.

and has to now contend with the following

200 SMA

Andrews pitchfork center line

1116 (50% retrace of the entire decline from April highs)

1142 (61.8% retrace of the entire decline from April highs)

1130 (Horizontal resistance)

1173 (horizontal resistance)

Plethora of moving average resistances on various timeframes.

A new bear cub is born at every one of these magic points

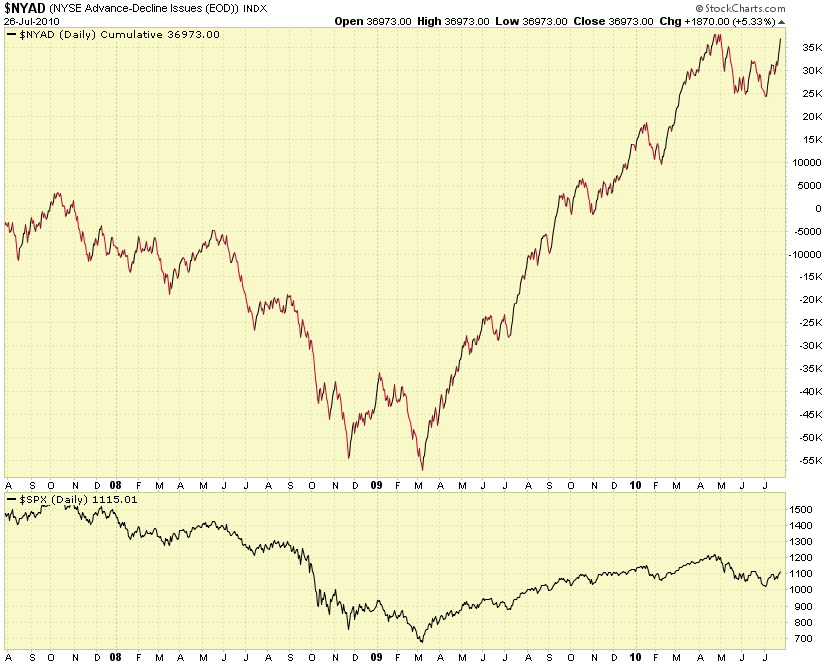

Now, here's my question. How the hell would anyone play any trend, if they worry about so many mythical lines and magic numbers ? Do these lines have any meaning against a trend in progress ? I think there's a clear choice as far as i am concerned. Have faith in the trend until it turns or get scared by these magic numbers, and i will choose the former any day.

My trendicator remains in power uptrend mode. Will update when it changes.

Warning: We are in a cardinal climax window Aug 1 (+/- 1 week). Take care.