'Hindenburg Omen' Flashes

#1

Posted 13 August 2010 - 05:54 PM

"The confluence of data used by the Omen was officially tripped this week. There were 92 companies that hit new 52-week highs on Thursday, or 2.9% of all companies traded on the New York Stock Exchange. There were also 81 new lows, or 2.6% of the total. Each number must exceed 2.5% for the Omen to occur, according to Mr. Miekka.

Other criteria include a rising 10-week moving average for NYSE and a negative McClellan Oscillator, a technical indicator that measures market fluctuations. Mr. Miekka said the appearance of one signal is usually an indication of a market top, but the Omen becomes more accurate when there are two or more close together"

====

By STEVEN RUSSOLILLO And TOMI KILGORE

Forget about Friday the 13th. Many on Wall Street took to whispering about an even scarier phenomenon—the "Hindenburg Omen."

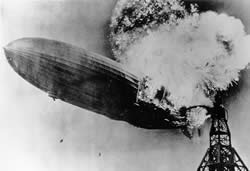

The Omen, named after the famous German airship in 1937 that crashed in Lakehurst, N.J., is a technical indicator that foreshadows not just a bear market but a stock-market crash. Its creator, a blind mathematician named James Miekka, said his indicator is now predicting a market meltdown in September.

Wall Street has been abuzz about whether the Hindenburg Omen will come to bear, with some traders cautioning clients about the indicator and blogs pondering all the doom and gloom. But Andrew Brenner, managing director at Guggenheim Securities, told his clients: "Personally, it sounds like [people] are starting their weekend drinking early."

Technical indicators, with names like "The Death Cross" and "The Bearish Abandoned Baby" have been attracting mainstream attention in recent months. Amid an increasingly volatile market, investors have been searching for any clues about stocks' direction, especially this past week where major indexes fell more than 3%.

"We always love good conspiracy theories," said Joseph Battipaglia, chief market strategist of the private-client group at Stifel Nicolaus. But he noted that market watchers sometimes make too much of what could be mere coincidences. "I for one dismiss all these things because they usually erupt most numerously during bear markets."

Mr. Miekka came up with the Omen in 1995 as a way to predict big market downturns, developing a formula that parses data like 52-week stock levels and the moving averages of the New York Stock Exchange. He said the Hindenburg Omen's name was coined by a fellow market technician, Kennedy Gammage, when they found out the name "Titanic" already had been taken.

The confluence of data used by the Omen was officially tripped this week. There were 92 companies that hit new 52-week highs on Thursday, or 2.9% of all companies traded on the New York Stock Exchange. There were also 81 new lows, or 2.6% of the total. Each number must exceed 2.5% for the Omen to occur, according to Mr. Miekka.

Other criteria include a rising 10-week moving average for NYSE and a negative McClellan Oscillator, a technical indicator that measures market fluctuations. Mr. Miekka said the appearance of one signal is usually an indication of a market top, but the Omen becomes more accurate when there are two or more close together.

The Omen was behind every market crash since 1987, but also has occurred many other times without an ensuing significant downturn. Market analysts said only about 25% of Omen appearances have led to stock-market declines that can be considered crashes.

"The Hindenburg Omen does show some deteriorating internals, which signals some major concerns," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. "But it isn't a reason to move to 100% in cash. We're taking a wait-and-see approach, but considering its recent history, we're considering it more than other indicators."

Mr. Miekka, who writes a Wall Street newsletter called "Sudbury Bull & Bear Report" out of his homes in Maine and Florida, wasn't even aware that his own Hindenburg Omen indicator was activated. The 50-year-old former physics teacher, who is an avid target shooter, said he was "taken by surprise" after he plugged the data into his model.

He didn't say whether it is a good time to bail out of the market, but he isn't exactly in a bullish mood when it comes to stocks. "I'll be dancing close to the door," he said.

—Donna Kardos Yesalavich contributed to this article.

http://online.wsj.co...=googlenews_wsj

A few of the other HINDENBURG articles here:

'Hindenburg Omen' foreshadows imminent FTSE crisis, warns BGC's David Buik

Will the stock market crash or will it soar to new highs?

http://www.telegraph...David-Buik.html

http://hk.ibtimes.co...-hindenburg.htm

http://www.thestreet...cm_ven=GOOGLEFI

#2

Posted 13 August 2010 - 09:45 PM

News - Hindenburg Omen Signaled, But Also Not

Thursday August 12 was a Hindenburg Omen day, and it also was not. There is a rules conflict which does not matter very often, but matters this time.

Created by Jim Miekka, the Hindenburg Omen involves the simultaneous appearance of comparatively high values for both New Highs and New Lows, while the market is in an uptrend. Normally, the market sees more stocks making new 52-week highs versus new lows during an uptrend, but having a larger number of new lows appear at the same time can signal the sort of rotation that can be problematic for the health of the uptrend.

The ominous sounding name of this signal comes from the late Kennedy Gammage.... Read More

Edited by Rogerdodger, 13 August 2010 - 09:46 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#3

Posted 13 August 2010 - 10:21 PM

He said the Hindenburg Omen's name was coined by a fellow market technician, Kennedy Gammage, when they found out the name "Titanic" already had been taken.

I fell off my chair when I read this, too funny!

#4

Posted 13 August 2010 - 10:39 PM

Mainstream media abuzz with HINDENBURG OMEN

"The confluence of data used by the Omen was officially tripped this week. There were 92 companies that hit new 52-week highs on Thursday, or 2.9% of all companies traded on the New York Stock Exchange. There were also 81 new lows, or 2.6% of the total. Each number must exceed 2.5% for the Omen to occur, according to Mr. Miekka.

Other criteria include a rising 10-week moving average for NYSE and a negative McClellan Oscillator, a technical indicator that measures market fluctuations. Mr. Miekka said the appearance of one signal is usually an indication of a market top, but the Omen becomes more accurate when there are two or more close together"

====

By STEVEN RUSSOLILLO And TOMI KILGORE

Forget about Friday the 13th. Many on Wall Street took to whispering about an even scarier phenomenon—the "Hindenburg Omen."

The Omen, named after the famous German airship in 1937 that crashed in Lakehurst, N.J., is a technical indicator that foreshadows not just a bear market but a stock-market crash. Its creator, a blind mathematician named James Miekka, said his indicator is now predicting a market meltdown in September.

Wall Street has been abuzz about whether the Hindenburg Omen will come to bear, with some traders cautioning clients about the indicator and blogs pondering all the doom and gloom. But Andrew Brenner, managing director at Guggenheim Securities, told his clients: "Personally, it sounds like [people] are starting their weekend drinking early."

Technical indicators, with names like "The Death Cross" and "The Bearish Abandoned Baby" have been attracting mainstream attention in recent months. Amid an increasingly volatile market, investors have been searching for any clues about stocks' direction, especially this past week where major indexes fell more than 3%.

"We always love good conspiracy theories," said Joseph Battipaglia, chief market strategist of the private-client group at Stifel Nicolaus. But he noted that market watchers sometimes make too much of what could be mere coincidences. "I for one dismiss all these things because they usually erupt most numerously during bear markets."

Mr. Miekka came up with the Omen in 1995 as a way to predict big market downturns, developing a formula that parses data like 52-week stock levels and the moving averages of the New York Stock Exchange. He said the Hindenburg Omen's name was coined by a fellow market technician, Kennedy Gammage, when they found out the name "Titanic" already had been taken.

The confluence of data used by the Omen was officially tripped this week. There were 92 companies that hit new 52-week highs on Thursday, or 2.9% of all companies traded on the New York Stock Exchange. There were also 81 new lows, or 2.6% of the total. Each number must exceed 2.5% for the Omen to occur, according to Mr. Miekka.

Other criteria include a rising 10-week moving average for NYSE and a negative McClellan Oscillator, a technical indicator that measures market fluctuations. Mr. Miekka said the appearance of one signal is usually an indication of a market top, but the Omen becomes more accurate when there are two or more close together.

The Omen was behind every market crash since 1987, but also has occurred many other times without an ensuing significant downturn. Market analysts said only about 25% of Omen appearances have led to stock-market declines that can be considered crashes.

"The Hindenburg Omen does show some deteriorating internals, which signals some major concerns," said Ryan Detrick, senior technical strategist at Schaeffer's Investment Research. "But it isn't a reason to move to 100% in cash. We're taking a wait-and-see approach, but considering its recent history, we're considering it more than other indicators."

Mr. Miekka, who writes a Wall Street newsletter called "Sudbury Bull & Bear Report" out of his homes in Maine and Florida, wasn't even aware that his own Hindenburg Omen indicator was activated. The 50-year-old former physics teacher, who is an avid target shooter, said he was "taken by surprise" after he plugged the data into his model.

He didn't say whether it is a good time to bail out of the market, but he isn't exactly in a bullish mood when it comes to stocks. "I'll be dancing close to the door," he said.

—Donna Kardos Yesalavich contributed to this article.

http://online.wsj.co...=googlenews_wsj

Okay, what's wrong with this picture??

#6

Posted 16 August 2010 - 01:45 AM

http://www.mcoscillator.com/

News - Hindenburg Omen Signaled, But Also Not

Thursday August 12 was a Hindenburg Omen day, and it also was not. There is a rules conflict which does not matter very often, but matters this time.

Created by Jim Miekka, the Hindenburg Omen involves the simultaneous appearance of comparatively high values for both New Highs and New Lows, while the market is in an uptrend. Normally, the market sees more stocks making new 52-week highs versus new lows during an uptrend, but having a larger number of new lows appear at the same time can signal the sort of rotation that can be problematic for the health of the uptrend.

The ominous sounding name of this signal comes from the late Kennedy Gammage.... Read More

Carl Swenlin, founder of Decision Point and original Fearless Forecasters board.