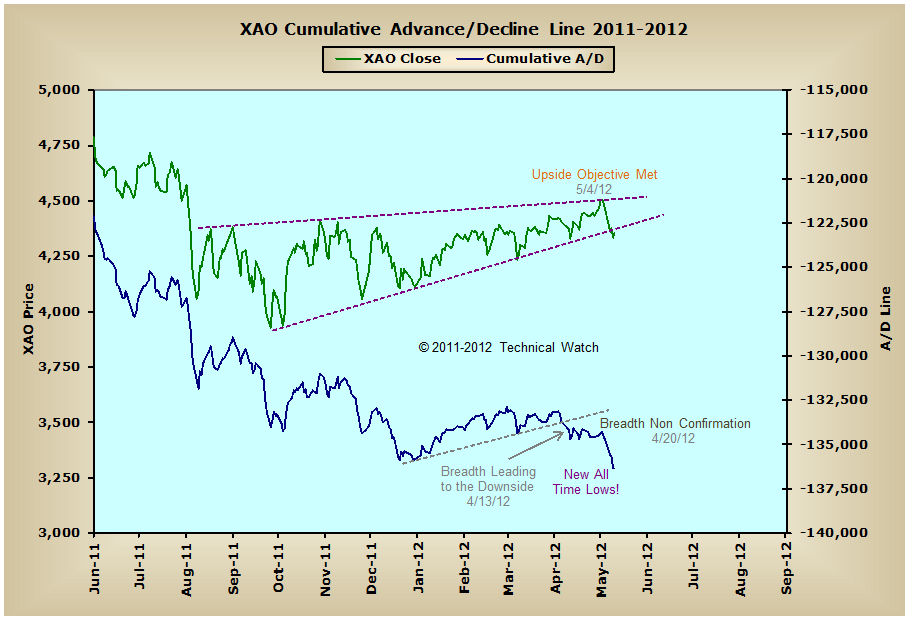

The breadth non confirmation we've witnessed over the last month with Australia's All Ordinaries Index did indeed make up for lost time with the price action collapsing from last weeks touch of the ascending wedge formation while the Aussie advance/decline line powered itself to new all time lows. The expectation for now is for a test of last October's price lows in the XAO where, by that time, we should have a better feel on whether the recent accommodative push from the FRB will be enough for prices to at least get toe hold on this slippery slope or not.The problem though with such news worthy announcements (the 1/2 point cut in interest rates on April 30th) is that equity prices tend to see a reflex rally as a sigh of relief, but as we see with the Aussie advance/decline line, there continues to be a real lack of money moving in with the news. With our meeting the upside price objective of the upper end of the wedge formation now complete, a vacuum has now been created that needs to be corrected. So the short term expectation is for prices on the All Ordinaries Index to move toward the lower end of this same wedge formation to fill this gap between this breadth to price dynamic in quick order...

Fib