I realize this is a very unconventional view - and a massively unpopular one even among some of the very best analysts. I suspect most will disagree....or worse.

Below are some excerpts from this week's SevenSentinels.com weekend comments:

--------

We have found it interesting this week just how ubiquitous the "bull market top is at hand" idea has become recently, even.... or perhaps especially among some of the very best technical analysts in the business. As just one example, here is Carl Swenlin's view:

".... In fact, we can't even say that there has been a cycle crest yet, although, given the proximity of current prices to the tops in 2000 and 2007, it is likely that a long-term top will be put in soon....the ten-year trading range of the S&P 500 Index suggests that a major price top should be arriving sometime in the first half of 2013, maybe within three months."

That general view takes a whole lot of forms as we see constant warnings and predictions of impending doom for the Bull Market Cycle (or stock prices in general) based on currencies, oil, precious metals, cycles, volume, earnings, valuation, national debt, sequestration and all sorts of other very reasonable and logical arguments.

It is entirely possible that "they" are right. We will not assume otherwise. But neither will we accept that view unless or until the market tells us that indeed a real and lasting cyclical top is in and a bear market is underway. Over the years we have again and again seen that the most magnificent and profitable market moves occur precisely when the vast majority of traders and analysts are expecting the opposite. 1998-9 and 2006-7 come to mind as excellent examples of that last point. Fortunes were made, especially in the market leaders, during those periods.

Again, at very least, when the Bull Market peak truly is "in" and a Bear Market is underway, that Bear Market will be shown via the following chart by price trading below the declining 13 month ema, Monthly MACD on sell and CCI below zero, as we saw in late 2000 and early 2008, for example:

http://stockcharts.com/c-sc/sc?s=$SPX&p=M&yr=13&mn=6&dy=0&i=p21043597269&a=181755078&r=783.png

Please do NOT misunderstand. We are NOT arguing that we cannot possibly be in the vicinity of a Bull Market Peak currently. We are instead strongly suggesting that we are at a critical juncture here that could eventually develop into a long term top....OR....could develop into a magnificent bull market run during which the "public" who've hated every day, week and month of this Bull Market since the SPX 666 low in March 2009... finally begin to embrace this bull cycle and enthusiastically drive it higher.

Our overriding point here is this: We will let The Market --- not our biases, beliefs, expectations, or even preliminary cycle analysis--- make that call and tell us when, indeed, the "top is in" and the Bear Market is underway. If that happens this month or next, we'll be listening and will take action. If instead the opposite occurs, again we'll continue to ride the uptrend.

Meantime, let's review a few of the indications we've been observing this week that suggest that there is at least the possibility of a whole new leg upward - perhaps a massively profitable leg characterized by public embrace of the Bull Market - in coming weeks (though we will be reviewing latter in this article the extreme overbought Short Term condition which is likely to hold back bring on a Short Term correction /consolidation in days immediately ahead}.

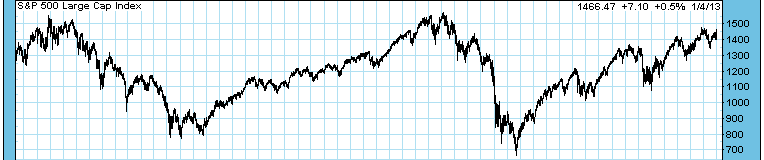

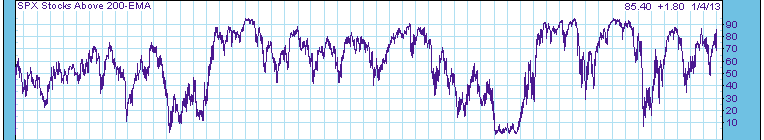

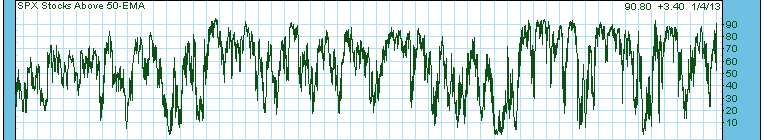

Let's examine, for example, the percentage of NYSE stocks over their 200, 50 and 20 day moving averages NOW versus known cyclical top in the past 12 years- 2000 and 2007:

We've said here more times than we can count: "external follows internal as night follows day". A prime example of that is the percentage of stocks that are above their moving averages as we approach, then achieve, a market peak. That percentage peaks and starts falling long before the final price high. By the time price DOES peak, the percentage of stocks in uptrend mode will have shown very marked deterioration. External follows internal. Internal peaks early - price peaks later.

Carefully note the percentage of stocks above their 200-day ma's at the 2000 price peak and the 2007 price peak and compare those to current numbers. At the 2000 price peak the % had deteriorated to under 60. At the 2007 peak the % was only about 70. And currently? Currently that percentage is 85.40%. The message: the final price peak is very likely at least several months ahead still, at least as indicated by this measure. Now same comparison 50-day ma's. 2000 top: 70%. 2007 top: 79%. And now? Currently that % is 90.8. We are not even close- just yet, by this measure anyhow. And the 20-day ma's... At 2000 price peak reading: 75%. At 2007 price peak, 80%. And now? The current reading is 92.8%...not yet near what we the deterioration we need for a price peak.

And the NYSE advance-decline line? We all know the history there by now--- it peaks BEFORE price as in 2000 and 2007. And now? All Time Highs and sharply rising:

http://stockcharts.com/c-sc/sc?s=$NYAD&p=W&yr=13&mn=6&dy=0&i=t48294945004&a=271375935&r=1357504188957.png

--------------

Covered also in that article:

Now consider the McClellan Summation. Briefly stated, major market price peaks come when this measure has deteriorated to under 500 at new price peaks, as we see in 2000 when at final price peak McSum was only 250....

{chart}

...and 2007 price peak when McSum was only 150:

{chart}

....and now? Currently McSum is +533 and sharply rising........strongly suggesting that the cycle peak in prices could be at least many months down the road.

--------------------

Now let's talk about the short term extreme overbought condition and how we will trade....

--------------------

Finally, a quick word on the new Collective2 tracking account. .....We will be offering substantial discounts to SevenSentinels.com subscribers ......