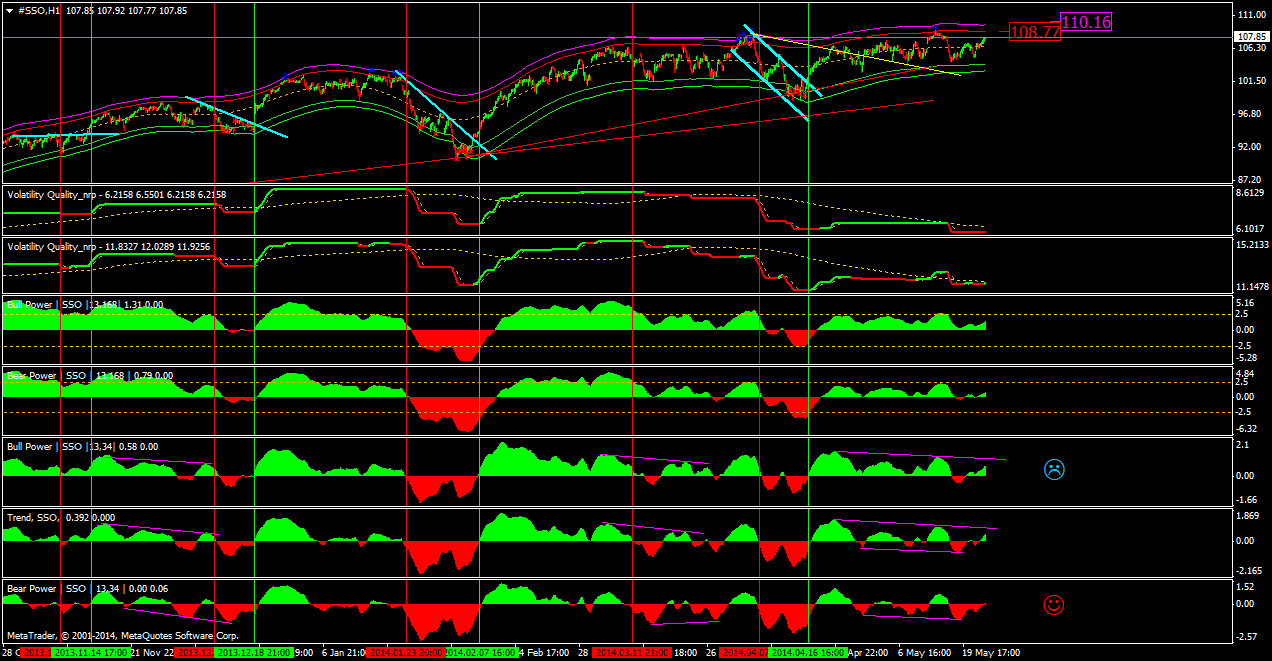

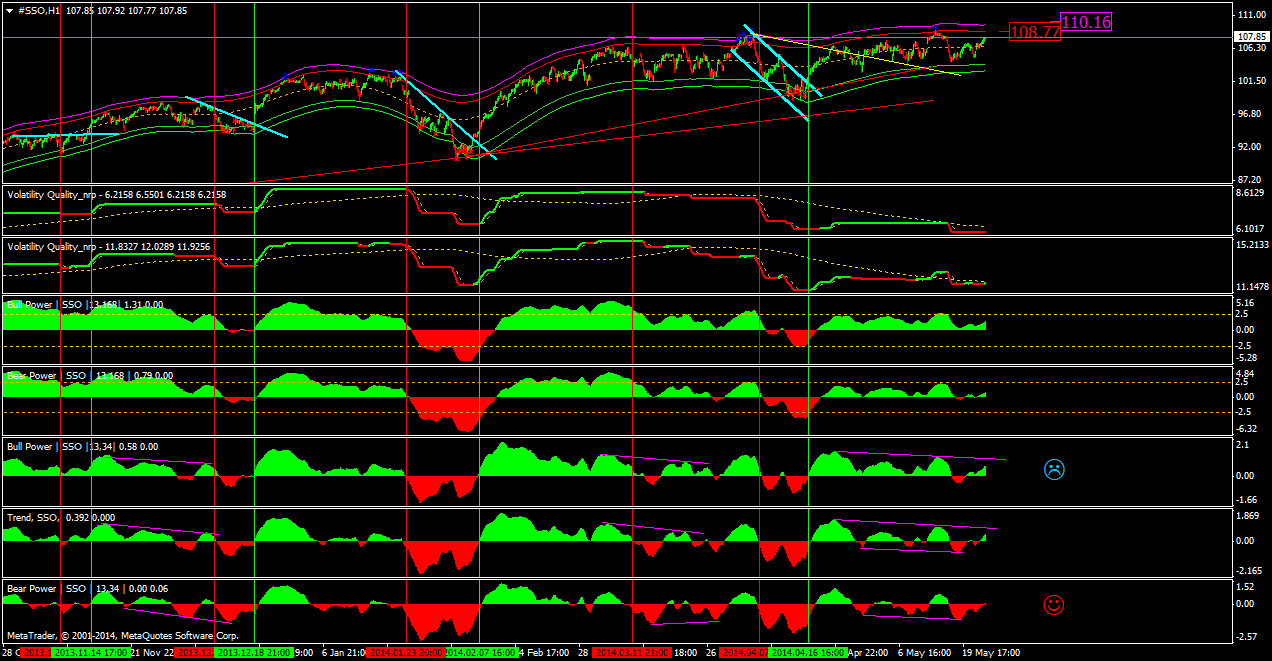

SSO has resistance ~ 108.77 and 110.16. I will be inclined to lock my profits for ST trade around this level.

Posted 22 May 2014 - 10:21 AM

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

Posted 22 May 2014 - 10:34 AM

..else Bears are going to come back fiercely.

SSO has resistance ~ 108.77 and 110.16. I will be inclined to lock my profits for ST trade around this level.

Posted 22 May 2014 - 10:46 AM

Thanks for your input.SSO is the ETF based on SPY. If I were you, I wouldn't use support and resistance on the leveraged ETF as it decays over time and is more based on the futures contracts that the fund managers use to reach their targets. Best of luck..else Bears are going to come back fiercely.

SSO has resistance ~ 108.77 and 110.16. I will be inclined to lock my profits for ST trade around this level.

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

Posted 22 May 2014 - 10:52 AM

Thanks for your input.SSO is the ETF based on SPY. If I were you, I wouldn't use support and resistance on the leveraged ETF as it decays over time and is more based on the futures contracts that the fund managers use to reach their targets. Best of luck..else Bears are going to come back fiercely.

SSO has resistance ~ 108.77 and 110.16. I will be inclined to lock my profits for ST trade around this level.

Actually, SSO holds ~60% in equities and rest in SWAPs. In term of decay this is much better than many other leveraged ETF (whose holdings are entirely SWAPs).

Posted 22 May 2014 - 10:56 AM

I actually do. For this post I used SSO since it is least effected by dividend payout (as my real time data feed is not dividend adjusted).I stand partially corrected. Why wouldn't you still use the SPX or SPY for resistance and support as this fund wouldn't be likely to move against it?

Edited by Harapa, 22 May 2014 - 10:59 AM.

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.