Nothing to add, nothing new to say except to wait.

#1

Posted 12 April 2015 - 03:40 PM

Gold should trade just for a few more days above $1,200 and then drop for the rest of the month imo.

May could be a small rebound/consolidation month and then..............., then here comes the Judge.

Sorry, I mean then comes the infamous June low.

Eric speaks of a late June/early July low.

SilentOne, John has the 22/23 week cycle low is due in April.

All I have, are these two babies "borrowed" from my friend Eddie in the T-theory forum.

http://stockcharts.com/h-sc/ui?s=$GOL...7&cmd=print

http://stockcharts.c...p...7&cmd=print

Needless to say I plan to short any 8,4,2 or even hourly overbought RSI readings later this week.

No need whatsoever to plan from now, when or at what level the summer low may come.

I am sure we will have some pointers for such an event.

-tria

In the world of 0 and 1: "austerity" is the right thing to SAY; "spent more, print more" is the right thing to DO.

"You miss 100% of the shots you don't take."

~ Wayne Gretzky

#2

Posted 12 April 2015 - 05:29 PM

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#3

Posted 12 April 2015 - 05:45 PM

Russ, I have posted them before a few times as well, but sorry for the problem.Tria,

Your chart links are not working.

Russ

http://stockcharts.com/h-sc/ui?s=$GOL...7&cmd=print

http://stockcharts.c...p...7&cmd=print

-tria

In the world of 0 and 1: "austerity" is the right thing to SAY; "spent more, print more" is the right thing to DO.

"You miss 100% of the shots you don't take."

~ Wayne Gretzky

#4

Posted 12 April 2015 - 05:55 PM

Russ, sorry for the problem. I have posted them a few times in the past.Tria,

Your chart links are not working.

Russ

http://stockcharts.com/h-sc/ui?s=$GOL...7&cmd=print

http://stockcharts.c...p...7&cmd=print

http://stockcharts.com/h-sc/ui?s=$GOL...id=p63162214257

-tria

In the world of 0 and 1: "austerity" is the right thing to SAY; "spent more, print more" is the right thing to DO.

"You miss 100% of the shots you don't take."

~ Wayne Gretzky

#5

Posted 12 April 2015 - 09:11 PM

"marxism-lennonism-communism always fails and never worked, because I know

some of them, and they don't work" M.Jordan

#6

Posted 12 April 2015 - 09:16 PM

the old charts he annotated, one can see that, as he says, the 25 week

cycle low to low is dominant.

https://www.hightail...0OW4wMEg0WjhUQw

He comments on the phenomenon in a chapter from the gold tutorial, an

.mp3 from 2012.

https://www.hightail...qVEhwM25WUThUQw

#7

Posted 13 April 2015 - 02:34 AM

Terry Laundry did establish a 25 week cycle low in gold, and from one of

the old charts he annotated, one can see that, as he says, the 25 week

cycle low to low is dominant.

https://www.hightail...0OW4wMEg0WjhUQw

He comments on the phenomenon in a chapter from the gold tutorial, an

.mp3 from 2012.

https://www.hightail...qVEhwM25WUThUQw

Terry's 4/16/3012 chart

Gold's 30 Week Optimum Moving Average vs 25 Week Cycle Low Pattern

https://ttheoryforum...-25wk-cycle.pdf

-tria

In the world of 0 and 1: "austerity" is the right thing to SAY; "spent more, print more" is the right thing to DO.

"You miss 100% of the shots you don't take."

~ Wayne Gretzky

#8

Posted 14 April 2015 - 07:31 PM

Terry Laundry did establish a 25 week cycle low in gold, and from one of

the old charts he annotated, one can see that, as he says, the 25 week

cycle low to low is dominant.

https://www.hightail...0OW4wMEg0WjhUQw

He comments on the phenomenon in a chapter from the gold tutorial, an

.mp3 from 2012.

https://www.hightail...qVEhwM25WUThUQw

Terry's 4/16/3012 chart

Gold's 30 Week Optimum Moving Average vs 25 Week Cycle Low Pattern

https://ttheoryforum...-25wk-cycle.pdf

-tria

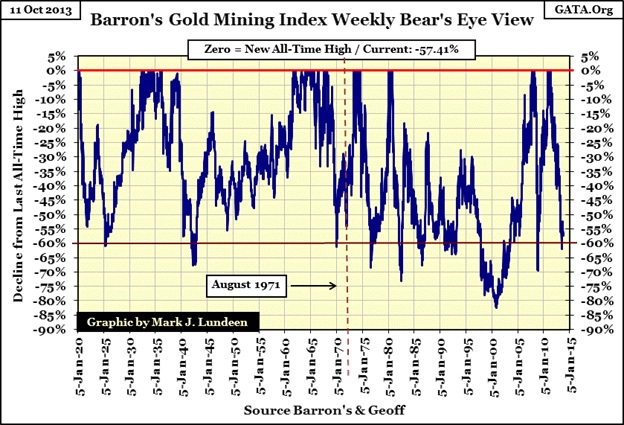

For perspective ...

In 75 years of data, the largest % declines in the BGMI (for a 4 year period max.) have ranged from 68 - 75% as follows:

March '08 - 2008 lows 68%

1980 high - 1982 lows 71%

1996 high - 2000 lows 75%

2011 high to present. 71.5%

N.B. 1635 - 467 (March '15 low)/1635 = 71.5%

Edited by SilentOne, 14 April 2015 - 07:33 PM.

#9

Posted 14 April 2015 - 09:10 PM

interesting john, the gann guy has been saying something similarTerry Laundry did establish a 25 week cycle low in gold, and from one of

the old charts he annotated, one can see that, as he says, the 25 week

cycle low to low is dominant.

https://www.hightail...0OW4wMEg0WjhUQw

He comments on the phenomenon in a chapter from the gold tutorial, an

.mp3 from 2012.

https://www.hightail...qVEhwM25WUThUQw

Terry's 4/16/3012 chart

Gold's 30 Week Optimum Moving Average vs 25 Week Cycle Low Pattern

https://ttheoryforum...-25wk-cycle.pdf

-tria

For perspective ...

In 75 years of data, the largest % declines in the BGMI (for a 4 year period max.) have ranged from 68 - 75% as follows:

March '08 - 2008 lows 68%

1980 high - 1982 lows 71%

1996 high - 2000 lows 75%

2011 high to present. 71.5%

N.B. 1635 - 467 (March '15 low)/1635 = 71.5%

perspective is everything

dharma

#10

Posted 15 April 2015 - 08:07 PM

Russ, sorry for the problem. I have posted them a few times in the past.Tria,

Your chart links are not working.

Russ

http://stockcharts.com/h-sc/ui?s=$GOL...7&cmd=print

http://stockcharts.c...p...7&cmd=print

http://stockcharts.com/h-sc/ui?s=$GOL...id=p63162214257

-tria

Yes Tria, I have followed those charts before, very good stuff. Thanks for re-posting them.

Russ

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/