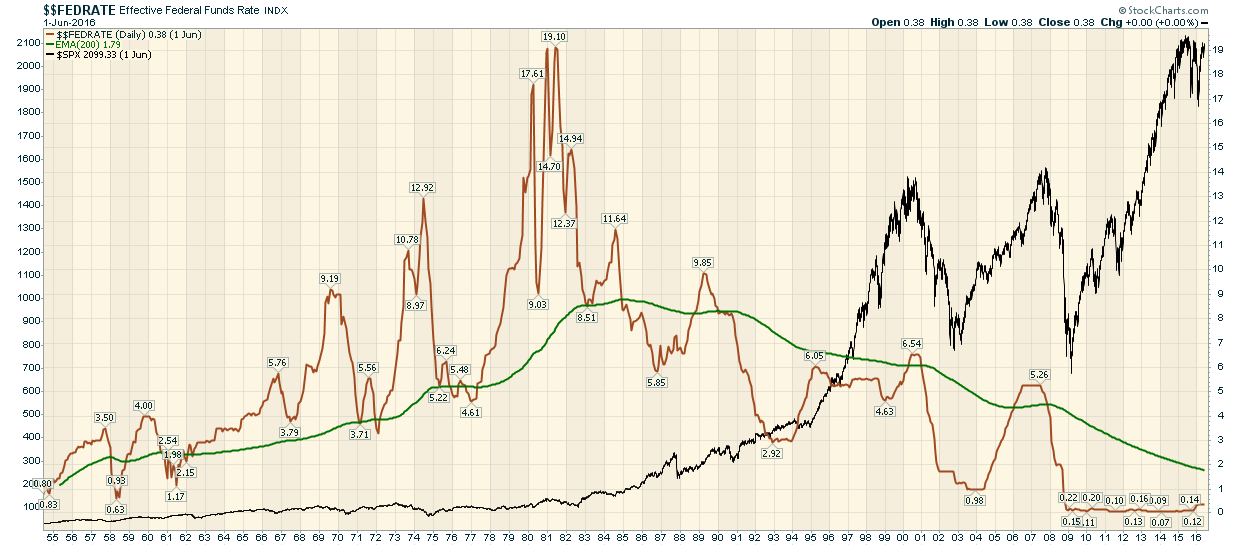

Take the last 2 bear markets(2000-2003)-(2007-2009) as the stock market tanked the 30 year Treasury's yield dropped... flight to safety. Now you have the market rising and Treasury's yields dropping the opposite of what happened. Why?

Thanks.

You must be kidding, if you say you don't know the answer for this.

In the U.S, it's one word "QE".

The fed has spent a few trillion buying the long bonds and mortgage securities. As a result, Bond prices rise and yields drop. Simple.

After the QE ended, the drop is because of the safe haven trade.

Most of the western world have zero or negative yields

http://www.bloomberg...ets/rates-bonds

In Europe it's a more complicated story. While Spanish, Portugese and Italian bonds are slightly positive, German and Swiss bonds are negative. People wonder how on earth can this happen. It's spain, portugal, italy and ireland which are deleveraging, while Germany and Switzerland has been performing relatively well and their bond yields drop. That's because the spanish, portugese and other buyers are piling on to German bonds, which they consider a safe haven.

Distortion, distortion, distortion everywhere.

Until the deleveraging process completes, these distortions would continue.You would think the deleveraging would complete some day. But both the public and private sector are only levering up, more and more. Debt (both private and public sector) only keeps exploding. The zero percent interest rates or NIRP (perhaps in the future) will never end until this deleveraging is complete. Once the deleveraging is complete, we have a another big problem to deal with. How will the Fed unwind it's 4.5 trillion balance sheet ? Imagine what would happen to the bond yields when these trillions of bonds are dumped into the market by the Fed ? Or will it ever ? Can it ?

It's a Friggin' mess !

200 months from 2009 is 2025. By 2025, Fib's 200 month MA will be near zero. Then we will be in a eternal bubble forever :-)

P.S - Thankfully we don't need all these macro-economics to trade the markets. Simple price and MA are sufficient.

Edited by NAV, 10 July 2016 - 09:14 AM.