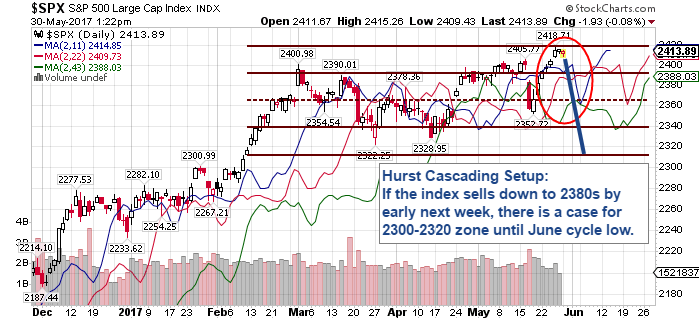

Better decline appears close

#11

Posted 30 May 2017 - 09:54 AM

You mentioned in your latest posting that you foresee an unsustainable level of inflation ahead. What are your thoughts about the future path of both interest rates and precious metals?

#12

Posted 30 May 2017 - 10:27 AM

What you make of this test of support on $NBI (Nasdaq Biotechs) today... if it closes here, looking like THREE BLACK CROWS...

Any close under 3000, looks like trouble.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#13

Posted 30 May 2017 - 11:18 AM

Arb,

You mentioned in your latest posting that you foresee an unsustainable level of inflation ahead. What are your thoughts about the future path of both interest rates and precious metals?

I think the rates will go higher eventually to 10 year US bonds near 3.50-3.75%. This may take months or years and probably not much higher...

See this:

https://twitter.com/...378267354583040

Semi, Biotechs usually rally at the end of bull cycles very well as you know, so I won't be surprised that this also tops and goes through a decline from here. I really think this market is overvalued, there is buying exhaustion and in fact, too much speculative activity to carry the weights.

I do see a lot of the growth sectors (tech, consumer, industrials, even healthcare) are still showing resilience despite the weak breadth and new highs. I think this is because we are simply seeing a secular bull market and any cyclical correction will resume somewhat higher or continue sideways instead of 2000-2003 or 2007-2009.

#14

Posted 30 May 2017 - 12:41 PM

DB heading for a foreclosure in the fall...maybe sooner.

GS down 5 this morning...

There's another "Hank Paulsen" moment coming on this derivative dynamite...

Edited by SemiBizz, 30 May 2017 - 12:43 PM.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#16

Posted 30 May 2017 - 02:49 PM

If we don't see any last minute buying in these beat up biotechs and energy stocks here, we could open down on volume in them tomorrow...

Stops are getting hit here...

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#17

Posted 30 May 2017 - 03:02 PM

No bounce at all... DJUSEN finished on the low within pennies...

NBI finished down 43 points...

Go figure, Nasdaq Composite... only had a 17 point range total...

There was compression in some places and unwind in others...

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#18

Posted 04 June 2017 - 05:00 PM

Although the market is still blowing off, I am generally getting a decline into June...

Perhaps as high as SPX 2450.

It is also the Fib extension from 2322 and 2400...

Edited by arbman, 04 June 2017 - 05:01 PM.

#19

Posted 11 June 2017 - 07:40 PM

The statistical scans are still giving a selloff to low $SPX 2300 until August.

I think the delay in the decline somewhat reduced the downside potential until the cyclical lows due in July.

Edited by arbman, 11 June 2017 - 07:42 PM.

#20

Posted 18 June 2017 - 06:07 PM

Just following up on the weekly highs and lows, about 2441-2393. Getting closer now.

Last week was indicated about 2430s, surprised the market refused to sell on Friday under 2420s, I think it was the options expiry week.

PS. These projections are only for the next 2-3 weeks (error will grow significantly thereafter) and subject to change with the price action.

Edited by arbman, 18 June 2017 - 06:09 PM.