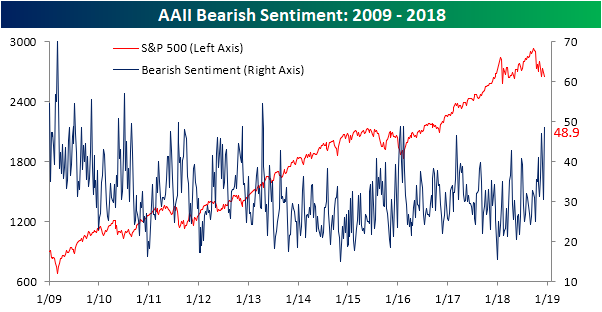

- Investor sentiment (a contrarian indicator) is the most bearish in the last five years. (Bespoke)

The biggest threats?

- A breakdown in trade talks.

- A more aggressive Fed.

- An “earnings recession.”

- Sentiment reducing the P/E multiple.

What might go right?

I will mention some of the scenarios they see, and then add a few more ideas in the final thought. Without endorsing a specific person, target, or idea, here are some of the scenario elements.

- Solid S&P earnings growth. The group sees $170 – 178 for the S&P 500. Only 5-6% growth with no added tax reduction stimulus. (This is actually less than the first-rate analysis of bottoms-up estimates (9-10%) from Brian Gilmartin).

- Progress on the China trade front in early 2019.

- Attractive valuations, after the recent selling.

- Moderation in Fed rate increases – maybe one or two.

- Limited downside risk.

Ed Yardeni notes that “You had a bear market in the P/E multiple, but a bull market in earnings.” This is another way of describing emotion in place of analysis.

https://seekingalpha...-ahead-go-right