This is a long BUT very informative *essay* LOL

But, good.... may not agree with everything

Technically Speaking: Can The Fed’s Reversal Save The Bull?

Written by Lance Roberts | Jan, 29, 2019

“A WSJ article suggesting that the Fed would not only stop hiking interest rates but also cease the balance sheet reduction which has been extracting liquidity from the market.

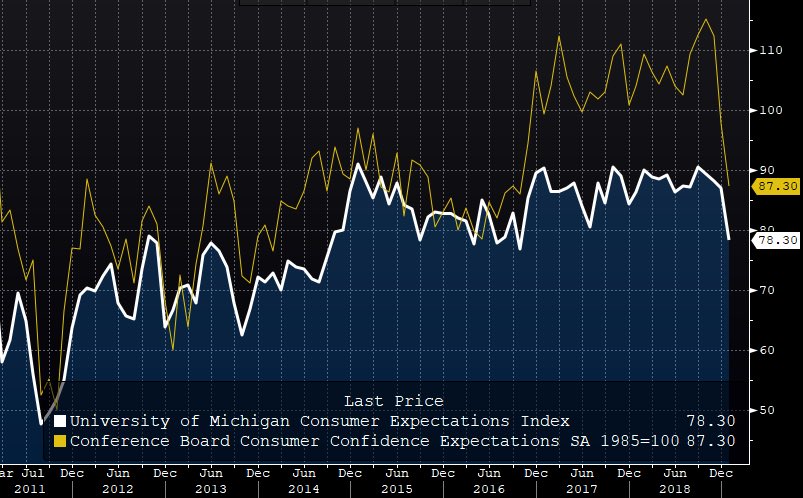

In mid-2018, the Federal Reserve was adamant that a strong economy and rising inflationary pressures required tighter monetary conditions. At that time they were discussing additional rate hikes and a continued reduction of their $4 Trillion balance sheet.

All it took was a rough December, pressure from Wall Street’s member banks, and a disgruntled White House to completely flip their thinking.”

This is a change for Jerome Powell, who was believed to be substantially against Fed interventions, shows his worst fear being realized – being held “hostage” by the markets. A look at Fed meeting minutes from 2013 was his recognition of that fear.

“I have one final point, which is to ask, what is the plan if the economy does not cooperate? We are at $4 trillion in expectation now. That is where the balance sheet stops in expectation now. If we have two bad employment reports, the markets are going to move that number way out. We’re headed for $5 trillion, as others have mentioned. And the idea that President Kocherlakota said and Governor Duke echoed— that we ’re now a captive of the market — is somewhat chilling to me.”

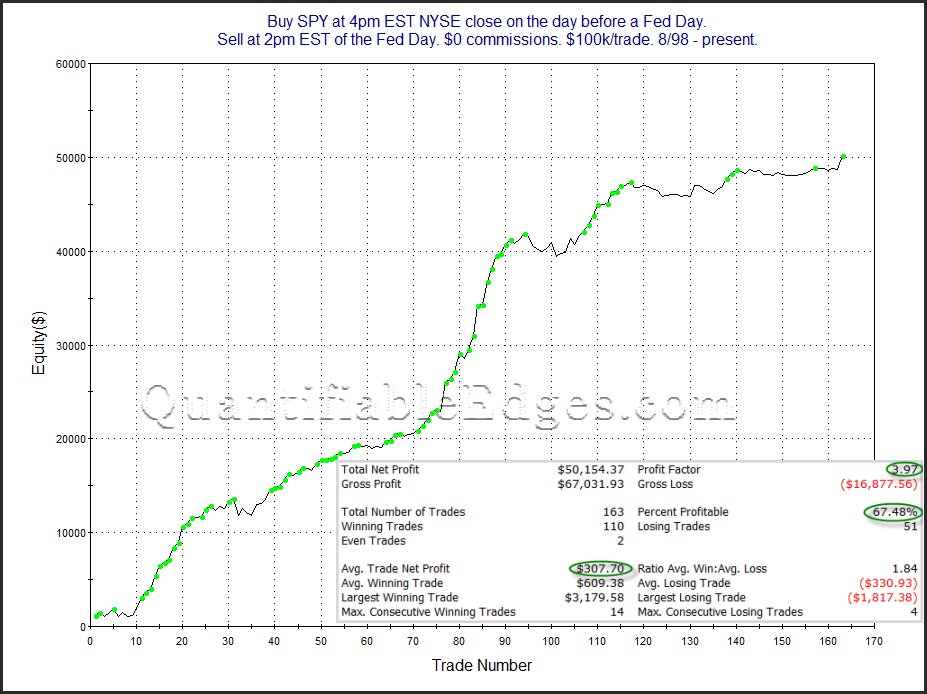

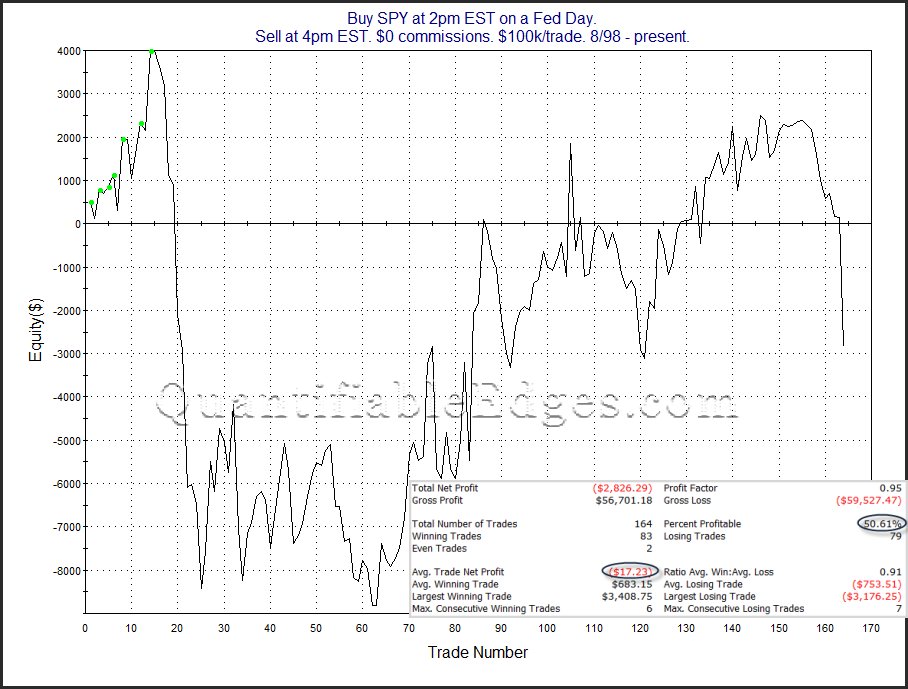

This week, the Fed meets to discuss their next policy moves. If the Fed announces a reduction/elimination of future rate hikes and/or a reduction/elimination of the balance sheet reduction, stocks will likely find a bid.

At least in the short-term.

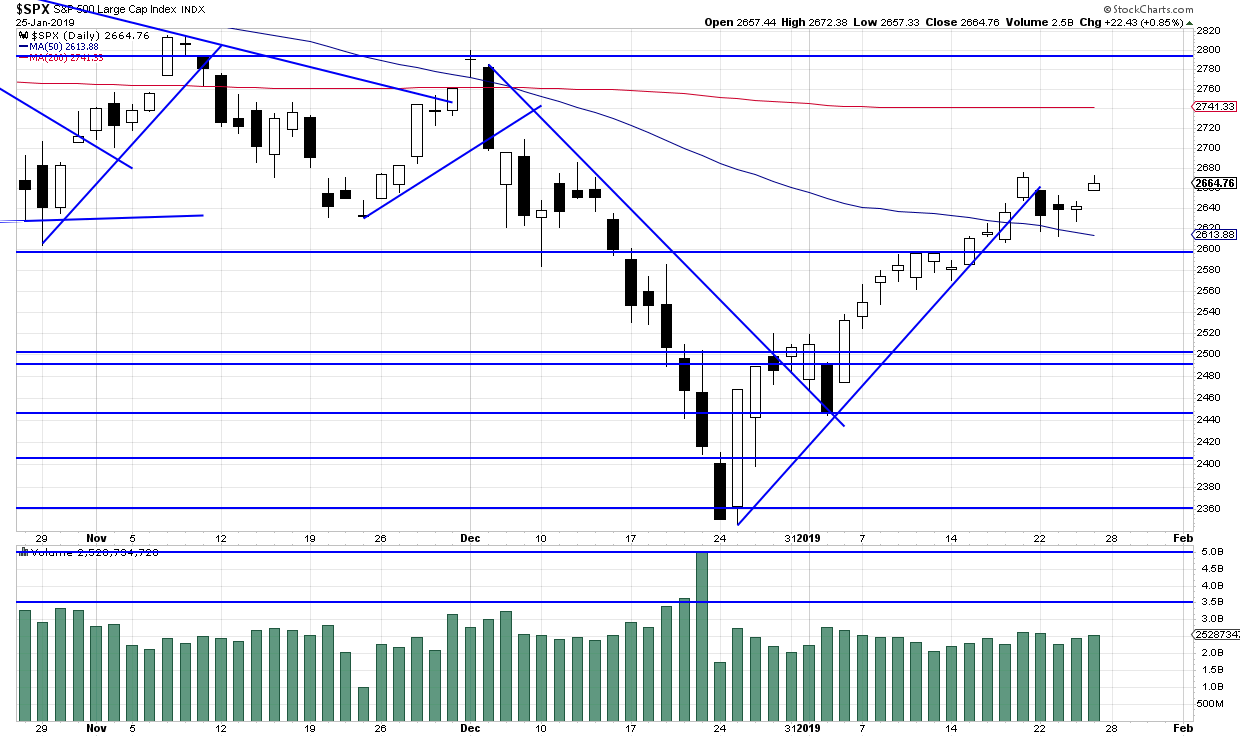

Longer-term the markets are still dealing with an aging economic growth cycle, weakening rates of earnings growth, and rising political tensions. But from a technical basis, they are also dealing with a break of long-term trend lines and very major “sell” signals.

The problem for the Fed is that while ceasing rate hikes and balance sheet reductions may be a short-term positive, monetary policy is already substantially tighter than it was at the lows. In other words, “stopping” tightening is not the same as “easing.”

Back To The Future – 2015/2016

We have seen a similar period previously. During the 2015-2016 correction, the Fed had just announced it’s intent to start hiking rates and had stopped reinvesting liquidity into the markets. (Early tightening.)

The market plunged sharply prompting several Fed Presidents to make announcements reminding markets they still remained extremely “accommodative.”

Click link to continue, if still interested....

https://realinvestme...l-save-the-bull

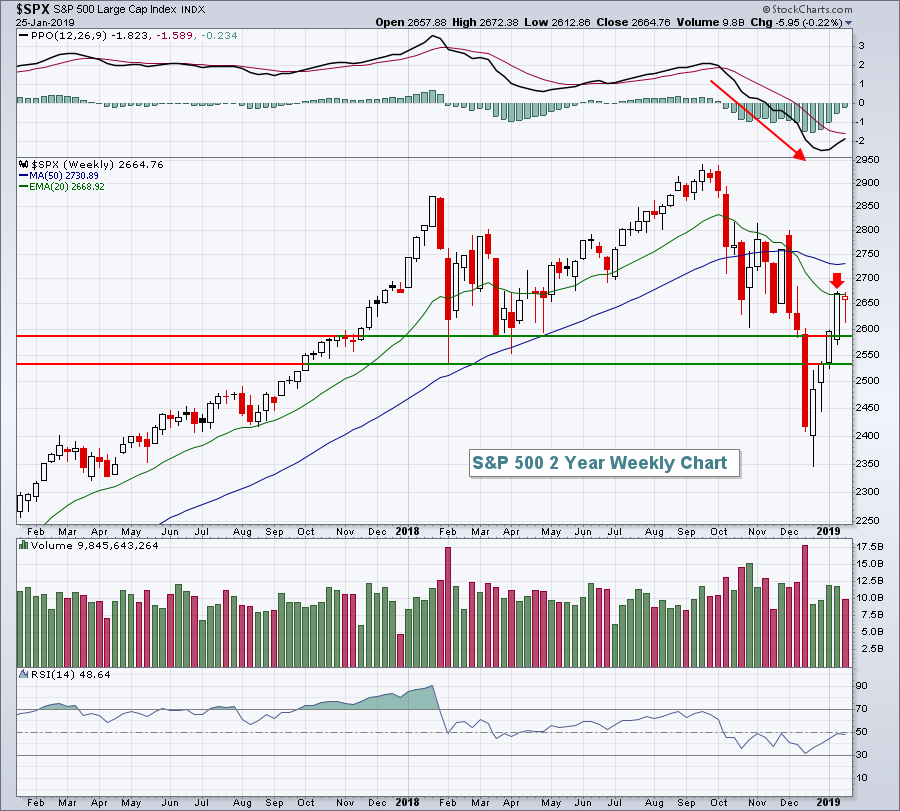

During periods of downtrending price action, weekly PPOs tend to remain negative, weekly RSIs typically top in the 50-60 range and overhead 20 week EMAs provide critical resistance. Despite all the strength off the December low, these three bearish traits remain intact. The bulls' worries are not over. Thus far, the bulls have been incredibly resilient and that's a good sign, but more tests remain. This morning, a warning from Caterpillar (CAT) will likely test the bulls' mettle once again.

During periods of downtrending price action, weekly PPOs tend to remain negative, weekly RSIs typically top in the 50-60 range and overhead 20 week EMAs provide critical resistance. Despite all the strength off the December low, these three bearish traits remain intact. The bulls' worries are not over. Thus far, the bulls have been incredibly resilient and that's a good sign, but more tests remain. This morning, a warning from Caterpillar (CAT) will likely test the bulls' mettle once again.