https://www.armstron...t-government-3/

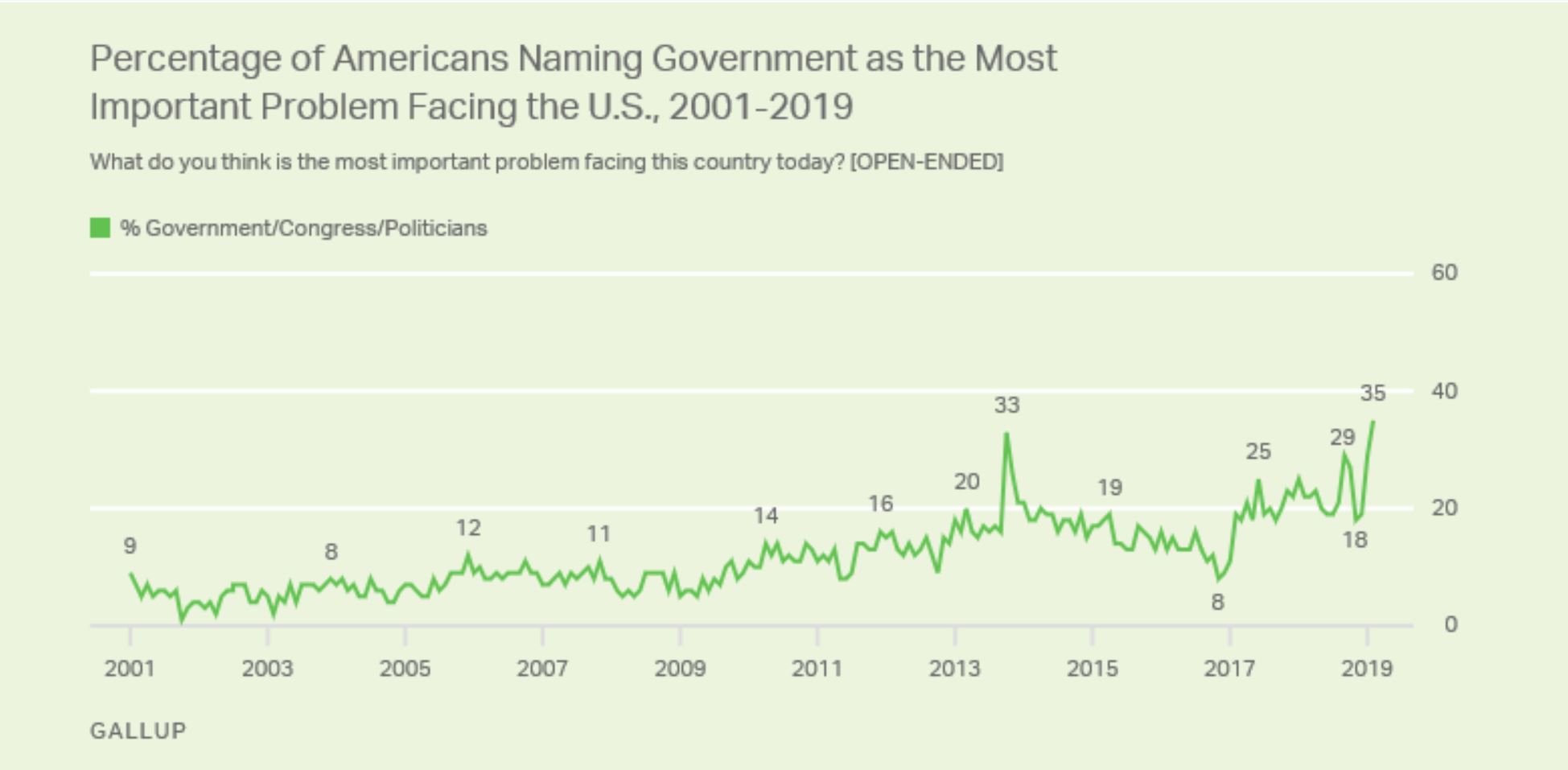

"Gold will be the hedge against political uncertainty and government ONLYwhen the people reach that critical point of losing faith in government. We are at the 35% level where people believe the government is the number one problem. When that crosses the 45% mark, things will start to become different."