DEJA VU? Tomorrow is 1 year Anniversary of 2018 Top

#11

Posted 19 September 2019 - 08:19 PM

#12

Posted 19 September 2019 - 09:10 PM

either .;..or.....justabout covers it all......:>)

#13

Posted 20 September 2019 - 10:12 AM

SPX will finish flat today?

#14

Posted 20 September 2019 - 10:28 AM

problems?

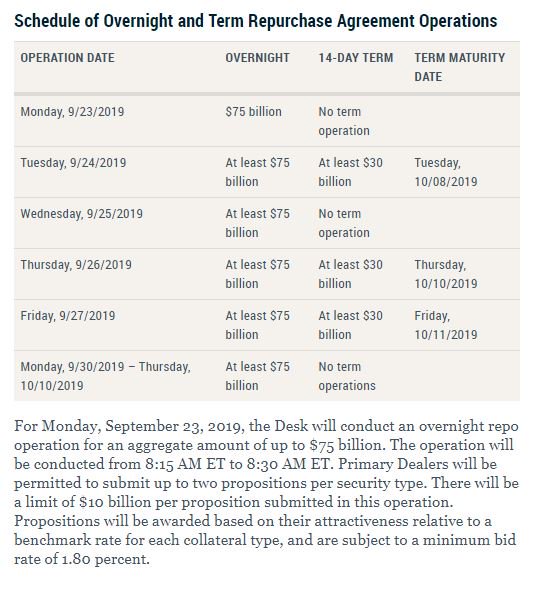

lots of liquidity will be gushed out during next 3 weeks!

This is like QE4 in disguise!

Feeding the bubble can be very expensive since you have to do it for a long time or else the bubble will devour you!

-

NY Fed Releases Statement Regarding Repurchase Operations https://www.newyorkfed.org/markets/opolicy/operating_policy_190920 …

3 replies16 retweets13 likesReply3Retweet1613Like

3 replies16 retweets13 likesReply3Retweet1613Like -

LiveSquawk Retweeted

Statement Regarding Repurchase Operations → https://nyfed.org/2kLCCef

#15

Posted 20 September 2019 - 10:30 AM

Lawrence McDonald Retweeted John Carney

Translation: NY Fed now financing hedge fund carry trades globally, nice.

Lawrence McDonald added,

#16

Posted 20 September 2019 - 10:34 AM

"The repo markets mystery reminds us that we are

flying blind" -- Financial Times

Good read on repo liquidity issues from @FT https://www.ft.com/content/35d66294-dadc-11e9-8f9b-77216ebe1f17 … “The fact that a “temporary” cash squeeze created so much drama shows that neither the Fed nor investors completely understand how the cogs of the modern financial machine mesh.”

#17

Posted 20 September 2019 - 10:45 AM

Jeez, never thought this was so big and potentially disastrous, but now a FED guy is asking questions!

zerohedge Retweeted zerohedge

Fed's Rosengren just asked this question

zerohedge added,

https://www.zerohedg...ink-unthinkable

#18

Posted 20 September 2019 - 10:52 AM

Will buy another lot of VXX around current levels 22.15 or lower if this ES move up off today's low continue

#19

Posted 20 September 2019 - 12:15 PM

munching almonds while nursing a short NQ trade whn markets suddenly dropped like a stone....

closed half NQ short and closed i lot VXX long

#20

Posted 20 September 2019 - 12:20 PM

Chinese toying with an increasingly worried foe

[RTRS] Montana Farm Bureau: China Delegation Cancels US Farm Visit To Montana - Agriculture Officials To Return To China Sooner Than Expected