SPX been on borrowed time ever since. Nothing else matters. Also, Attilla has looks like a fool on Twitter as of late with his bull blowoff calls.

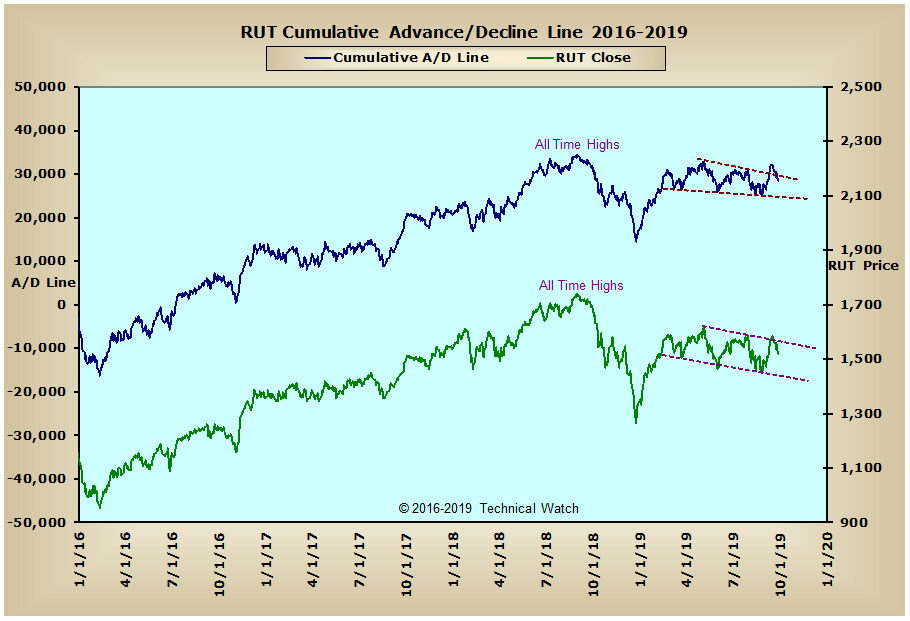

R2K topped literally over a year ago

#2

Posted 02 October 2019 - 11:06 AM

SPX been on borrowed time ever since. Nothing else matters. Also, Attilla has looks like a fool on Twitter as of late with his bull blowoff calls.

Yep! Currently VST trading SDS and VXX.... Taking profits before the EOD..... An oversold bounce is not out of the question, but this is day 9 of IWM being below its 10 DMA - A sell signal for me...

Daily

IWM now under its 200 DMA too..... Where are the BTFDer's?

https://stockcharts....088&a=690411574

Weekly

https://stockcharts....685&a=690411575

For the record: I trade VXF at Vanguard and the trades are free..... (VXF is like the S Fund for TSP traders) [bleeeep], it looks like everyone be going to free trades now..... Is that a tell?

Edited by robo, 02 October 2019 - 11:14 AM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#3

Posted 02 October 2019 - 11:16 AM

SPX been on borrowed time ever since. Nothing else matters. Also, Attilla has looks like a fool on Twitter as of late with his bull blowoff calls.

Yep! Currently VST trading SDS and VXX.... Taking profits before the EOD..... An oversold bounce is not out of the question, but this is day 9 of IWM being below its 10 DMA - A sell signal for me...

Daily

IWM now under its 200 DMA too..... Where are the BTFDer's?

https://stockcharts....088&a=690411574

Weekly

https://stockcharts....685&a=690411575

For the record: I trade VXF at Vanguard and the trades are free..... (VXF is like the S Fund for TSP traders) [bleeeep], it looks like everyone be going to free trades now..... Is that a tell?

Gap filled and then some..... Maybe some stops hit at the 200 DMA for IWM.... The June lows are up next, but that is not a guess on how much lower we might go.... I trade what I see, not what I think. The trend remains down, but oversold..... We shall see how it plays out....

Day 9 since I went to a cash position at Vanguard with my VXF position....

Good Trading and have a nice day!

https://stockcharts....088&a=690411574

Edited by robo, 02 October 2019 - 11:25 AM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#4

Posted 02 October 2019 - 11:35 AM

The Miners.... Did we just see a higher low for GDXJ? Still below the 10 DMA so I remain in cash...... Waitng, but VST trading NUGT and DUST when I like the setup..... Flat GDXJ.... Keeping an eye on XES for another trade..... went to cash 10 days ago once it moved under the 10 DMA.... Some say using the 10 DMA is silly......I just laugh and say - I use the KISS system with free trades.....Very easy to BT my system and no guesses required. I don't care about getting whipsawed. I'm trying to catch the major trends up and avoid the down trends.....

I trade what I see, not what I think will happen.

Good Trading!

https://stockcharts....027&a=690411581

Edited by robo, 02 October 2019 - 11:43 AM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#5

Posted 02 October 2019 - 12:29 PM

#6

Posted 02 October 2019 - 12:45 PM

From some recent studies out there the RUT typically leads going into major tops. Not even close to the current configuration where RUT is lagging badly. So this should not be a significant top.....SPX running with a rising 200 day, and the 40 day above that.

His point was the IWM top already happened. The LT data supports it for now, so we shall see how it plays in the months ahead. However, no one knows for sure, and since I don't make guesses like many others do time will tell. The current daily trend is down and nothing else matters to me as a trader. Long SDS and VXX...

I trade what I see, not what I think will happen....

The LT data and the rate cut cycle...... So will IWM make a new high after the rate cut cycle starts. It better be different this time if it's going to happen. I'm using the 2000 and 2008 market tops....

https://stockcharts....145&a=691227920

It doesn't matter to me since I trade the trend, but that was the point on this link, and so you disagree. That's the beauty of a simple trend trading system. No need to make guesses, or ride down 20% moves like many do....

Good Trading and we shall see how it plays out. With all that said - You could be correct.

Edited by robo, 02 October 2019 - 12:54 PM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#7

Posted 02 October 2019 - 01:03 PM

#8

Posted 03 October 2019 - 08:17 AM

Through 9/27/19:

Edited by fib_1618, 03 October 2019 - 08:18 AM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#9

Posted 03 October 2019 - 08:24 AM

Through 9/27/19:

Nice Chart!

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#10

Posted 03 October 2019 - 08:51 AM

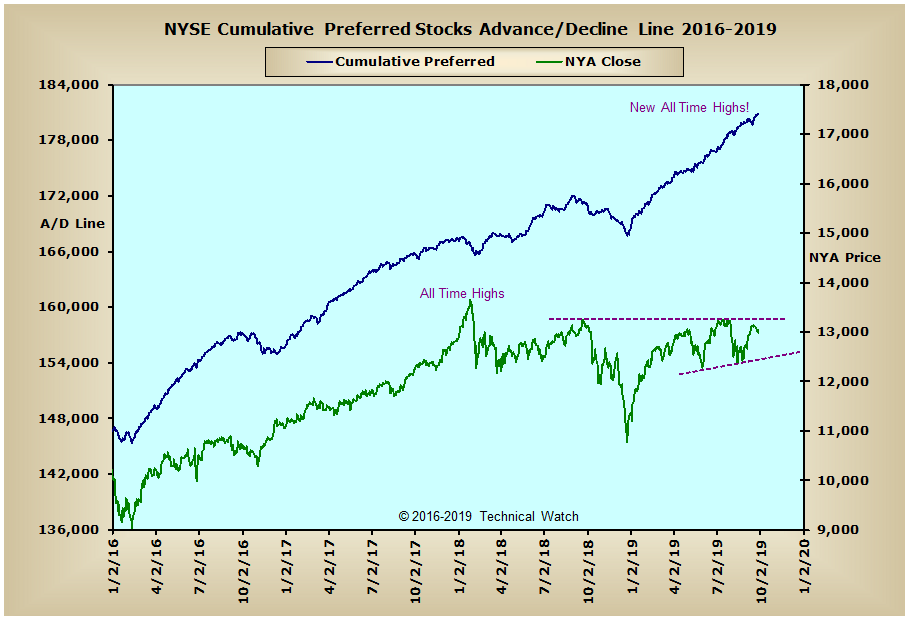

For you salivating bears out there, the New York Composite Index topped out on January 26, 2018...shown here with the NYSE Preferred Stocks Only advance/decline line through 9/27/19::

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions