Kerberos007 Retweeted Bloomberg Markets

This is what happens when speculators are all-in bullish $GOLD futures $GC. Massive Stop loss level triggered at around 1462. Weak hands shakeout, planned weeks ahead. I will be waiting at $1,400, all-in long. Magnet..

Kerberos007 added,

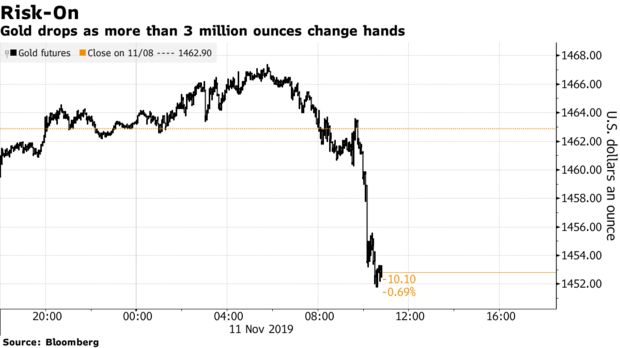

Bloomberg MarketsVerified account @marketsGold futures tumbled to a three-month low as contracts equal to over 3 million ounces changed hands in half an hour https://bloom.bg/33BjnVD8:33 AM - 11 Nov 2019

The magnet price for GLD is now up based on the data I use..... However, that is a guess since the current trend for GLD is down, SPY up, and VXX down. That's how I will be trading it until the trend changes....

There are lots of warning signs that are hitting extremes so I went to cash, but my system remains long.... A Risk Management move for me....

Good Trading!

https://stockcharts....271&a=699316839

Edited by robo, 11 November 2019 - 01:02 PM.