Well the crowd that has lagged is being forced into the market as the year end approaches. The Monkey Man has been long QQQ the last 3 days. Follow on Twitter to see when he flips to short.

Long

#1

Posted 16 December 2019 - 11:03 AM

#3

Posted 16 December 2019 - 05:23 PM

What is the Twitter Handle?

#4

Posted 18 December 2019 - 06:53 PM

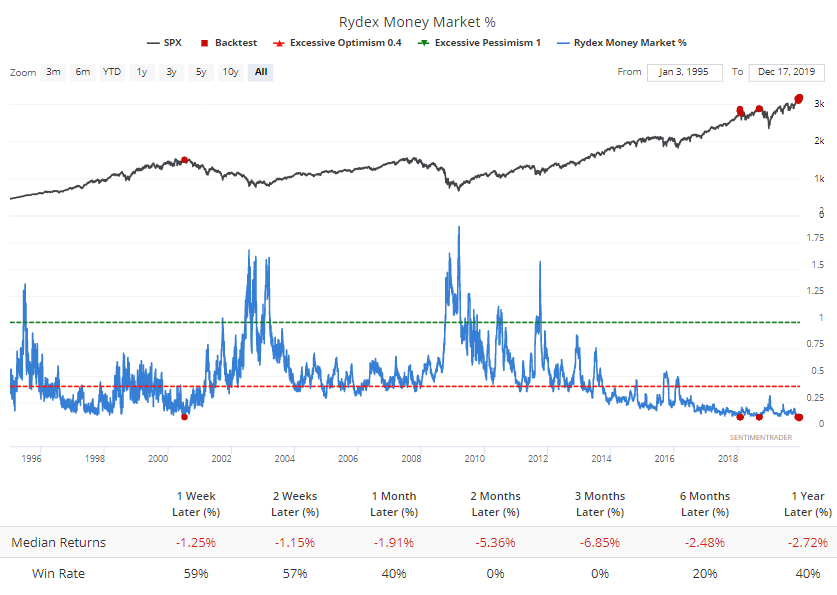

The trend remains up on my daily, weekly and Monthly charts. Watch the sky if you want to, but I just watch the daily and weekly trends and trade them..... I track the Rydex dudes too... I get my Rydex data from sentiment trader....

https://twitter.com/SentimenTrader

Mutual funds might not be cool anymore, but Rydex still holds more than $4 billion. Of that, less than 11% is being held in their money market, the lowest in history. A few dates saw *almost* this low of a cash cushion.

Warren Buffett’s most famous quote has to be: “Be fearful when others are greedy and greedy when others are fearful.” But how do we know when others are fearful or greedy?

I’ve written about margin debt as the, “index of the volume of speculation,” but there’s another indicator that can be useful in this regard and, like margin debt, it’s another real money indicator rather than just a survey of investor opinion. That is the Rydex Ratio, or the measure of Rydex traders’ assets in bear funds and money market funds relative to their assets in bull funds and sector funds.

There are a few different ways to use this ratio but the simplest is to just observe the overall level of the ratio. In the chart below, the ratio is inverted so that it corresponds better with the level of the S&P 500 Index. Currently, Rydex traders are just about as bullish as they were in early-2018, just prior to the Volmageddon sell off, and in the fall of 2018, just prior to the fourth quarter waterfall decline of that year.

But when you zoom out even further it becomes apparent just how greedy these traders have now become. Even at the peak of the dotcom mania, from late-1999 into early-2000, they weren’t as aggressively positioned as they are today.

https://thefelderrep..._eid=5b348a9ca0

Mutual funds might not be cool anymore, but Rydex still holds more than $4 billion. Of that, less than 11% is being held in their money market, the lowest in history. A few dates saw *almost* this low of a cash cushion.

https://thefelderreport.com/blog/

Edited by robo, 18 December 2019 - 06:55 PM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore