The bonds saved my butt during March decline.

I thought you would like it if you had not seen/heard it yet. It is dated June 21st.

I agree with JS. I am in that process already.Sell Bonds, buy Stocks. Jerry Siegel, worth a listen.

https://ritholtz.com/2020/06/mib-jeremy-siegel-covid-market/

My instincts said the clearance sale in March in stocks was a good time to begin switching.

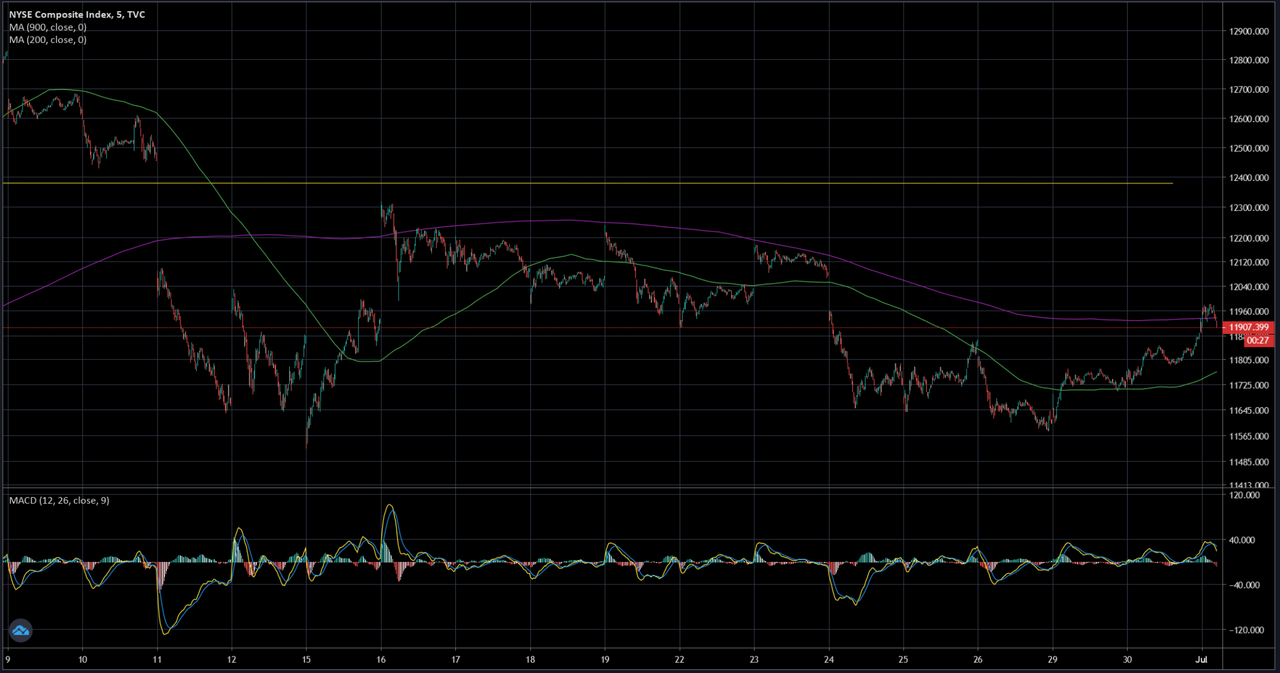

So far so good. If my target is reached in July, I am very likely to hit the sidelines.

I am becoming more and more risk averse as an octogenarian.

PDX - what is your target?