I should have bought longs today. May be too late on Tuesday with a gap up.

VST Signal

#11

Posted 04 September 2020 - 09:58 PM

#12

Posted 05 September 2020 - 08:05 AM

With the last two days selloff PC ratio has switched from bearish into bullish mode:

https://stockcharts....id=p05629810979

Edited by redfoliage2, 05 September 2020 - 08:09 AM.

#13

Posted 05 September 2020 - 08:45 AM

I am sitting on 75% flat....getting tempted to jump on longs on Tuesday depending....

#14

Posted 05 September 2020 - 12:34 PM

what is your indicators or system in general?

#15

Posted 05 September 2020 - 01:15 PM

I will use options P/C ratio to spot tops mostly from now on. Breadth diverged for 2 weeks and 200 more SPX points up before the top, that's too early and not very useful. Sometimes breadth is very early, or late a couple days or drops the same day as the top.

#16

Posted 05 September 2020 - 05:11 PM

what is your indicators or system in general?

My system is simple....folllow the trend but pay attention to valuations.

If market turns positive next week, trend remains up.

However valutions are over extended so must exercise extra caution, and limit exposure.

Right now I want no more than 40% exposure to longs.

#17

Posted 05 September 2020 - 06:52 PM

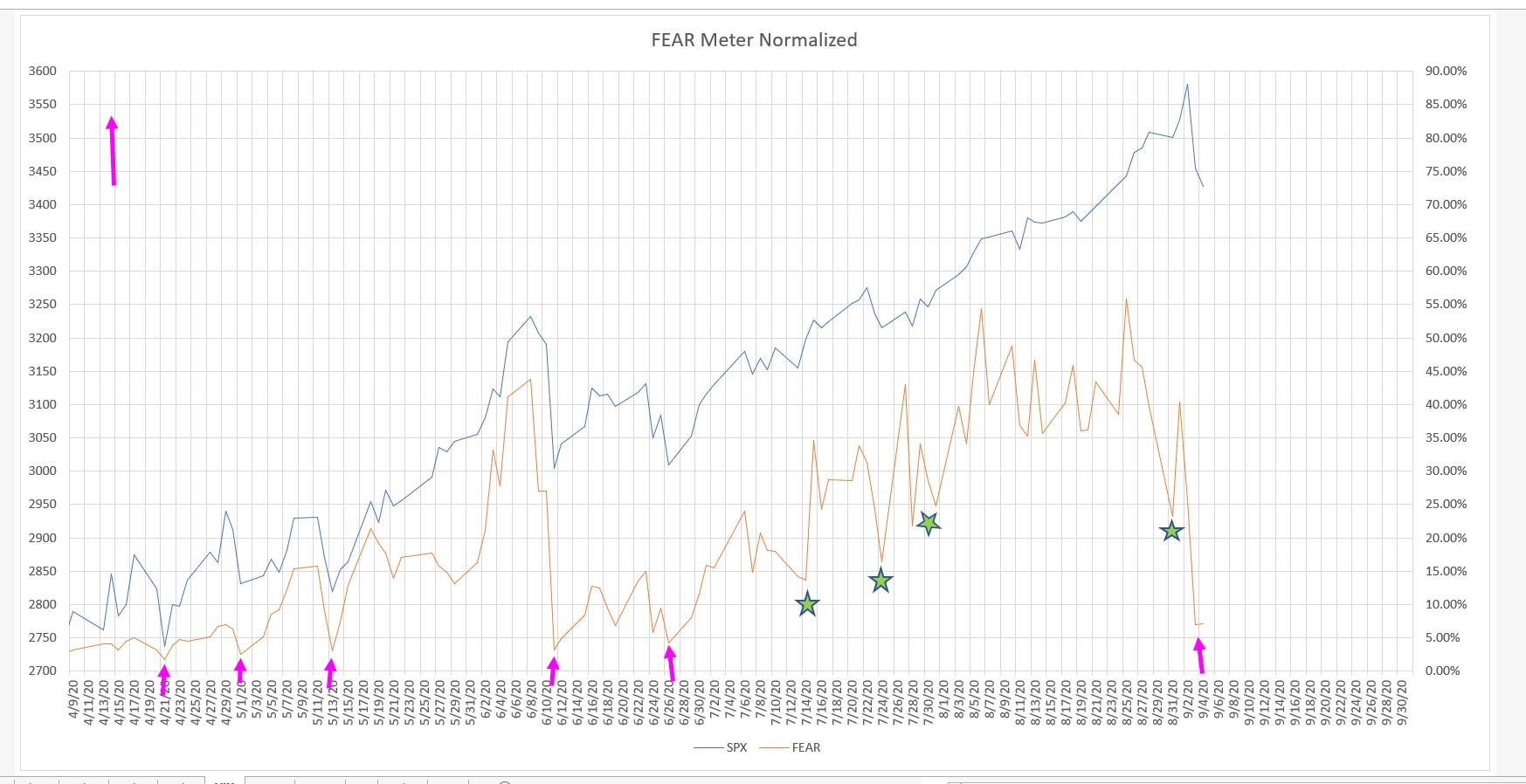

Fear Meter suggests equity LONG accumulation. TQQQ has accumulated 3.3 Billion Dollars in new outstanding shares the last two days. Key upcoming Market dates for volume are Sept 10th Futures Rollover, Sept 18th Quad Witch, and Sept 25th end of month rebalance if they do this on the last Friday of each quarter. One of those dates could produce a retest of 3350 similar to how we retested SPX 3000 after June 11th on June 26th.

#18

Posted 06 September 2020 - 12:24 PM

I don't usually use Renko, but this is a rare TQQQ sell on low volume, needs to print a reversal

on this next rally or the volume builds high within the new sell first leading to a new buy, or there could

be follow through on this sell. A new buy print here could be very bullish though.

#19

Posted 06 September 2020 - 07:06 PM

NQ bounced off 4 month trend line support. I think 13k and see if it tops from divergences or not.

#20

Posted 06 September 2020 - 07:59 PM

Initially SPX should bounce up to 3500 that is like a magnet and then we will see from there.................

Edited by redfoliage2, 06 September 2020 - 08:01 PM.