FED & CONGRESS vs OCTOBER CRASH HISTORY

#1

Posted 03 October 2020 - 12:16 PM

From RAJ CYCLES:

Many wonder why October has often been volatile as we had many historic crashes in October, including 1847, 1857, 1907, 1929, 1937, 1987, 1990, 1997, 2002 and more recently in October 2008 and 2018, to name a few.

The actual hidden reason that October is often "panicky" is that in Vedic Astrology the Vedic Sun, which represents the Self and Self Confidence, is debilitated in Libra every year between Mid October and Mid November. This lack of confidence in the markets often shows up as Panics and crash waves.

In addition, to add fuel to the fire this year:

1. Mars, the planet of War, arguments and aggression is retrogade the whole month of October 2020 (9/9-11/13).

2. Mercury, the planet of Business, communication and trade is retrograding from 10/14 through 11/3.

3. The uncertainty and divisiveness around the USA elections from now into 11/5 is certainly not helping.

4. The "Mother Divine" Crash Cycle could get activated as it is also due in October-November 2020

.

I have written about the potential Mother Divine Crash cycle in the past.

Have your popcorn ready as it should be interesting to watch

#2

Posted 03 October 2020 - 12:20 PM

The Next Market Low and Election Rally | Larry Williams | Real Trading Special (10.01.20) - YouTube

#3

Posted 03 October 2020 - 12:24 PM

--'

KEY POINTS

Weaker-than-expected job creation in September kindled concerns about the health of the economic recovery.

The report is a potential early flare from the business community that a rebound during which 11 million jobs were refilled in four months could be petering out.

Economic scarring is likely to become more apparent in Q4, said Seema Shah, chief strategist at Principal Global Investors.

Investors will be watching the path of Covid-19 and the stimulus negotiations in Washington to determine the economys fate.

https://www.cnbc.com...-be-fading.html

#4

Posted 03 October 2020 - 12:27 PM

#5

Posted 03 October 2020 - 12:32 PM

Stimulus and FED-speak may prevent or delay this. NOTE POWELL SPEAKS THIS WEEK... he should be bullish.

--

High Wage Layoffs Will Sink Stocks Soon

Oct. 01, 2020 6:06 PM ETAAL, COP, CVX...436 Comments127 Likes

Summary

With the expiration of PPP and airline industry programs, as well as a second wave of coronavirus, unemployment is about to get worse.

Hundreds of thousands of people will not be contributing to retirement plans, and therefore the stock market, in coming weeks.

By January, many people will be taking distributions from retirement plans and choosing to take six months off while they wait out a vaccine.

Stocks are in for a rough fourth quarter and maybe a rough first quarter of 2021

https://seekingalpha...article/4377268

#6

Posted 03 October 2020 - 01:52 PM

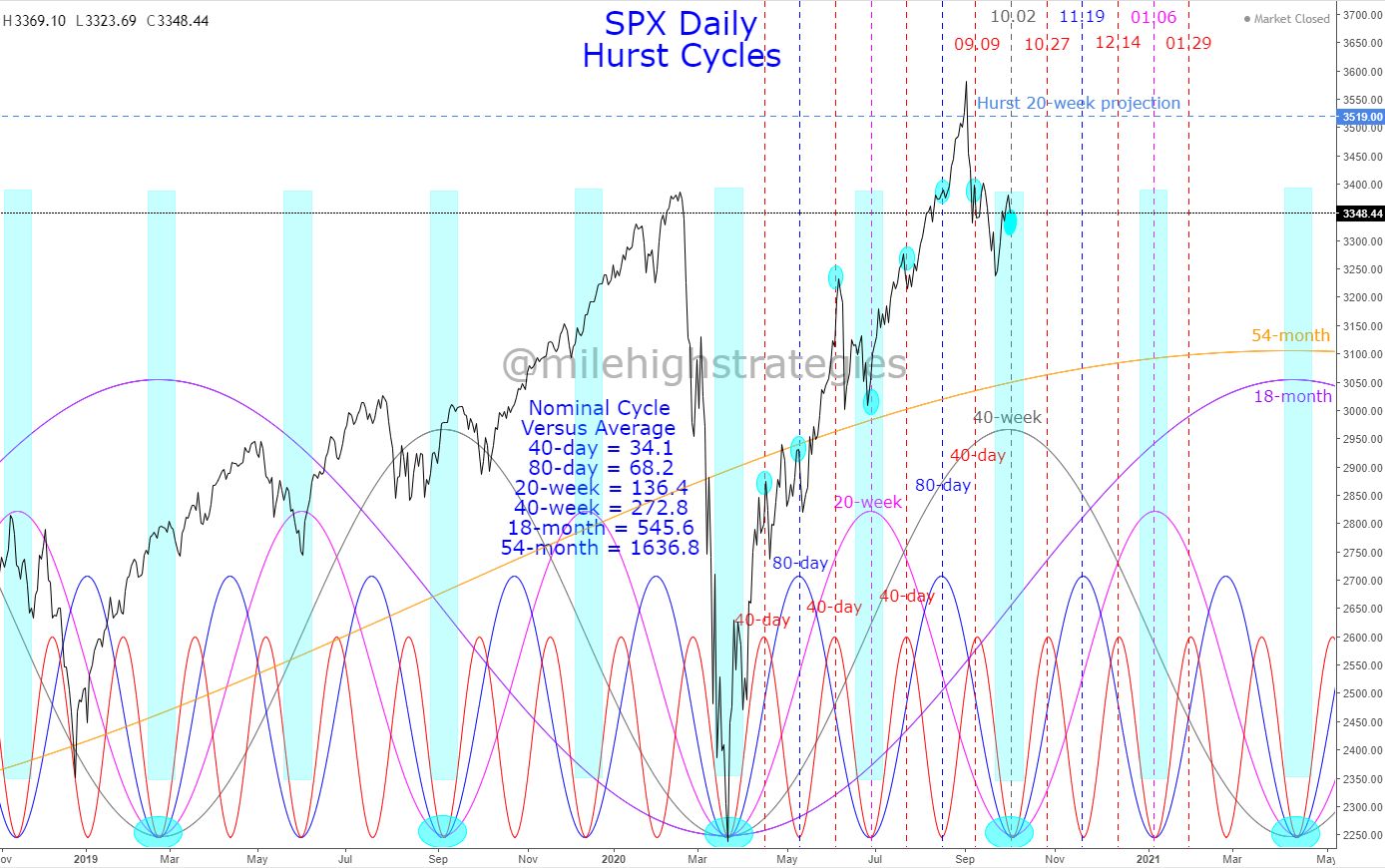

From the other perspective, Friday was the approximate inflection point of 10.2.20, which was the confluence of the 40-day, 80-day and 20-week cycle troughs, though as that date is approximate, it could be a trading day or two late...

The point is, those cycles are now moving upward, or close to doing so, and joining the larger 18-month and 54-month cycles upward, and as I said weeks ago, with the larger cycles pointing upward, this particular trough, as in the other cyan highlights across the chart, where lows were opposite highs, the decline was likely to be more on the mild side...

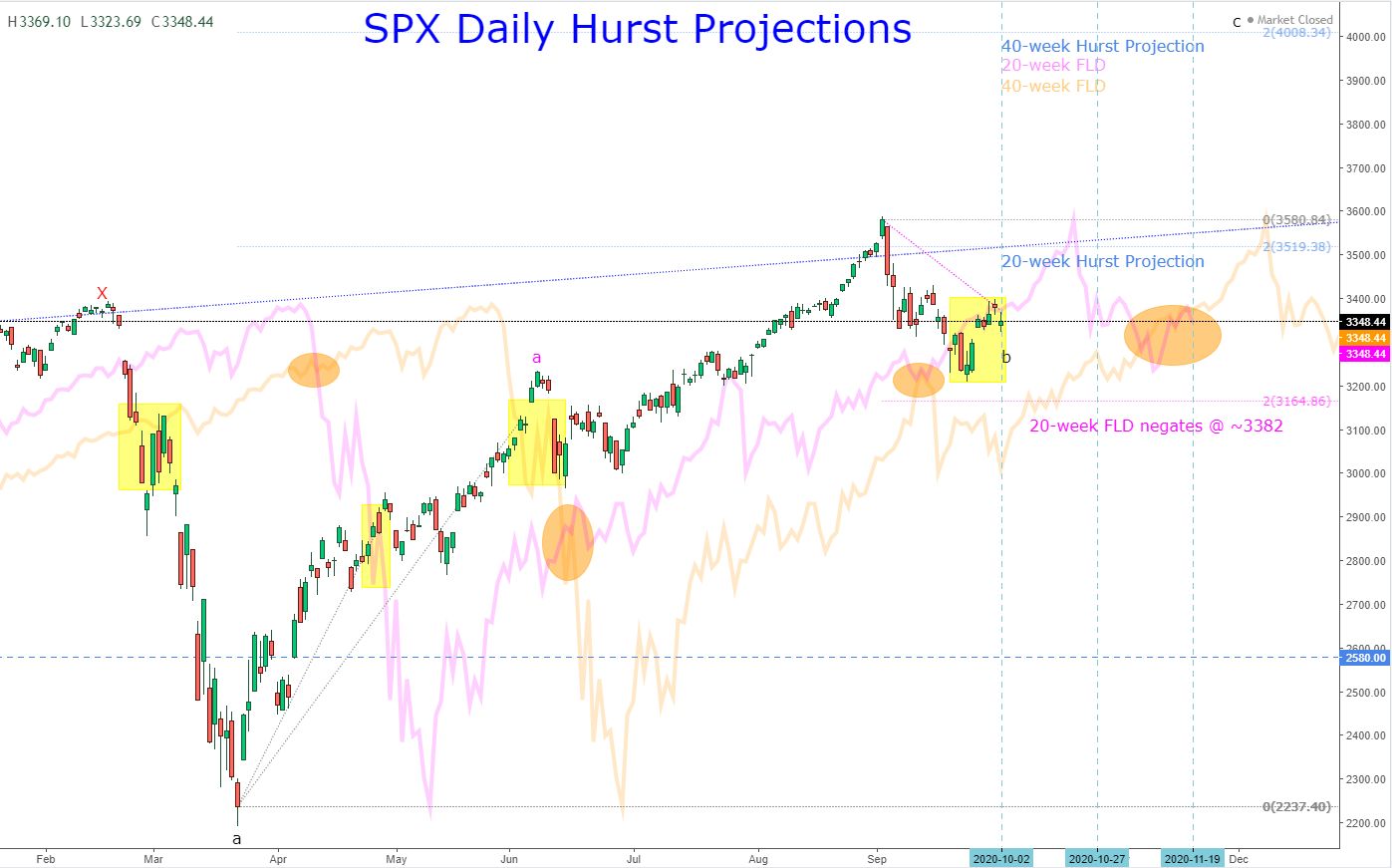

This brings the possibility that the Hurst 40-week projection, up in the ~4008 range is absolutely a distinct possibility - The fractal structure on the daily SPX is still not clear, and with three possibilities, all of which are valid, and marked on the chart, I won't take time to expound on them again...

I will however, point to the potential RH&S formation that could take the price much higher from here, and with the decent momentum reset, could be the beginning of a push to that still outstanding Hurst 40-week projection up in the ~4008 range...

#7

Posted 03 October 2020 - 02:49 PM

There is a huge risk for any one whos short of getting f..ked very bad

Its highly likely in short term and absolutely certain in long term

We talking S&P500 4,000-4,200 in next year or so

Now 3350

Someones gonna get hurt very bad 🤔

#ES_F $SPX $NDX $SPY

(https://twitter.com/...1384400899?s=03)

#8

Posted 03 October 2020 - 02:50 PM

Have a good weekend! Major news weekend for $SPX- where dust settles after open is key

My plan: Main setup is a large bullish inverse H&S. If we hold above (or recover) 3310 will be looking long for a breakout to 3470

For bears: If 3310 fails we see 3235- last lvl before 3110 https://t.co/rMPaPQwrdc

(https://twitter.com/...1929986050?s=03)

#9

Posted 03 October 2020 - 02:51 PM

And that 40-week upward projection is still valid and the 20-week downward projection was just elevated a bit, and could be negated this week:

#10

Posted 03 October 2020 - 02:56 PM

---

Lance Roberts (@LanceRoberts) tweeted at 10:59 am on Sat, Oct 03, 2020:

Could a #Biden win also be a #positive for the #markets? @DougKass thinks so because it will speed up more #fiscal #support which as discussed last week is #critical for the #Fed to continue supporting markets.

https://t.co/DNTAdZCUp7https://t.co/DJu5xLyfEH

(https://twitter.com/...9859485696?s=03)