d

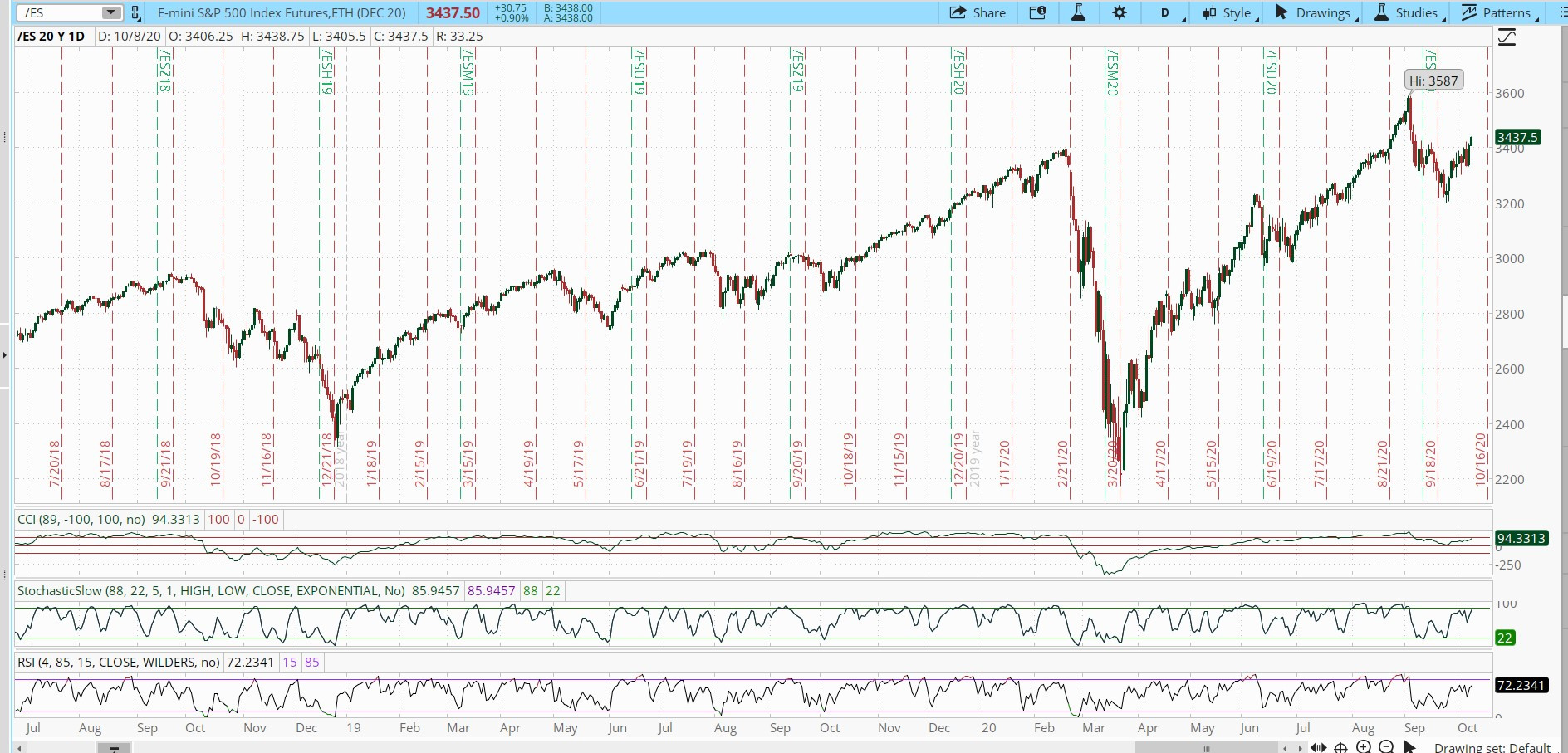

The rally is the Mr. Market's reaction to the fact that there have been too many bears expecting a crash in October. Have they covered yet or they are going for more shorting? Institutional investors are likely positioning for after-election .................

I meant after-election up-run on abundant liquidity when Dems win......................

lets not start "dems win with who ?