SPAC BUBBLE will finally implode later this year

Hold on for one more day

Courtesy of Joshua M Brown

Yes I’m quoting a Wilson Phillips song. I don’t know why.

Yes I’m quoting a Wilson Phillips song. I don’t know why.

But I talked about holding on for one more day at the end of February at a moment where it felt hopeless to be a responsible, diversified investor while everyone around you is getting insanely rich buying the craziest sh*t imaginable.

And now a lot of the easy money stuff is being blown to pieces. They take the stairs up and the elevator shaft down.

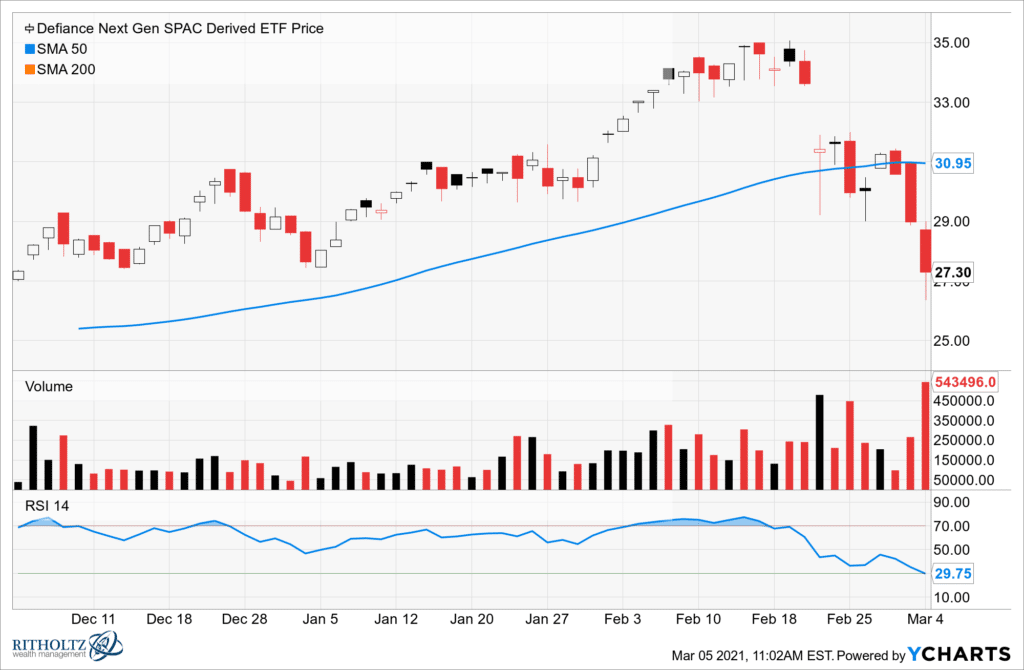

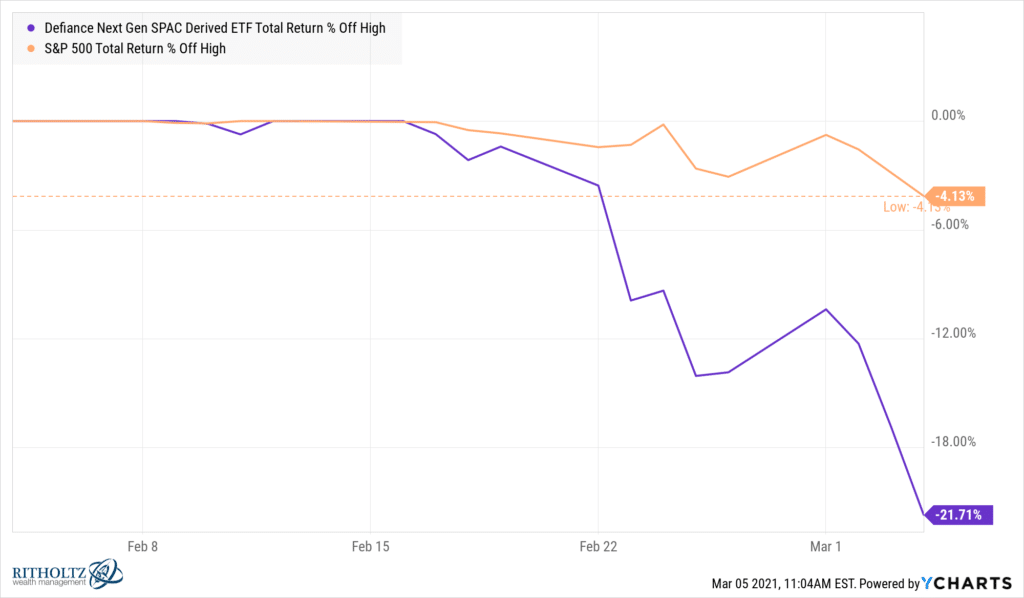

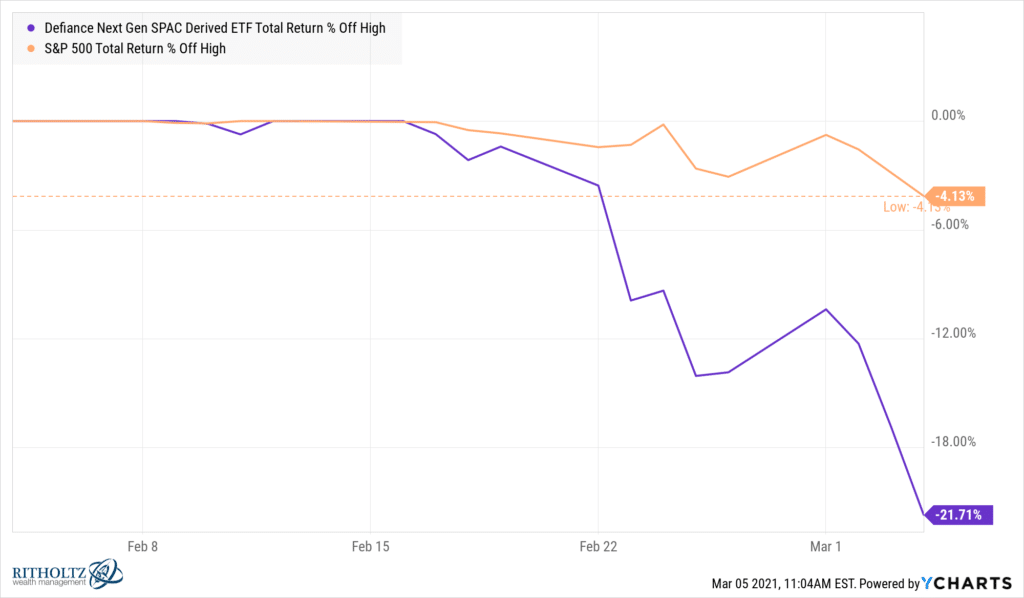

The SPAK ETF and related SPAC index is now in a 20% plus drawdown, negative year to date and getting annihilated relative to the S&P 500. Of course it is. They were bringing 5 of these public a day at one point during the frenzy and, eventually, there just isn’t enough money available to support all of them – trading at premiums over cash! Are you kidding me?

At the end of February it was really hard to sit tight with a rational asset allocation. It only took two weeks or so from when I wrote Substack Vertigo and three weeks from when I wrote The Big Long for a lot of damage to be inflicted in the wildest parts of the market.

Hope you held on and didn’t bite the lure. Greed is every bit as uncontrollable as fear, it’s just activated by a different part of our brains. Greed and envy and FOMO are all toxic impulses. We must be always on our guard.

Some of this stuff will bounce back but a lot of it won’t. If you went all-in on the SPAC bubble, binged on negative earnings stocks and IPOs and threw money at whatever else seemed to be a one-way rally, well, at least you’re walking away with a souvenir – the experience. Remember what this moment feels like and never forget it. You will see and feel it again.

https://www.philstoc...or-one-more-day