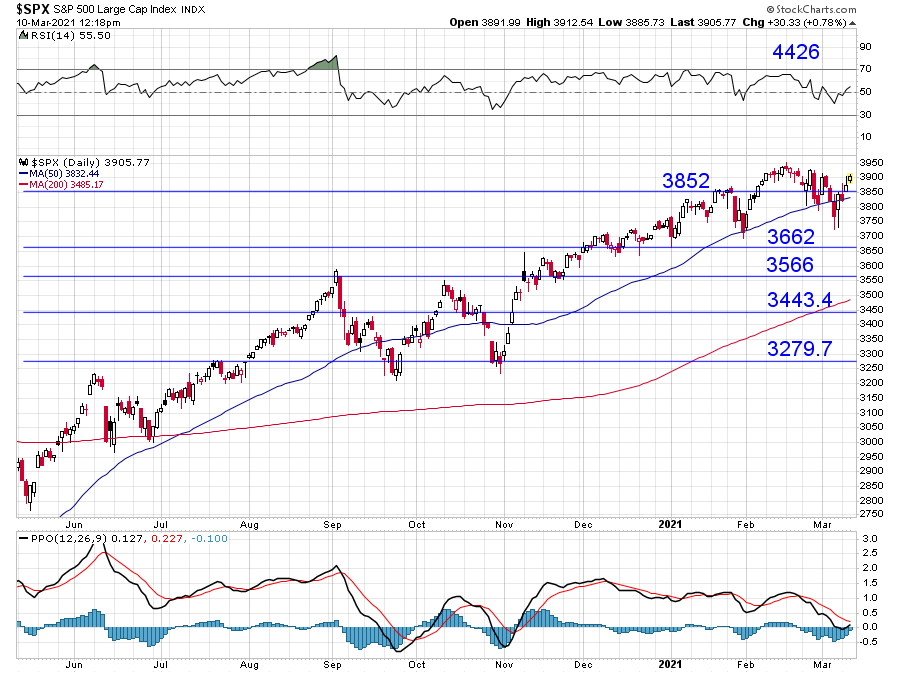

It may be less than 3% from a top.

Posted 09 March 2021 - 01:23 PM

It may be less than 3% from a top.

Posted 09 March 2021 - 01:29 PM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

Posted 09 March 2021 - 05:58 PM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Edited by pdx5, 09 March 2021 - 05:59 PM.

Posted 10 March 2021 - 03:34 AM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Just standard sell in May and go away? I have a hard time being too bearish if the Fed is saying that they plan to ease another 2 years.

Posted 10 March 2021 - 11:47 AM

A similar legal (and convoluted) count for the industrials.

Posted 10 March 2021 - 02:09 PM

For the S&P:

Near to my earlier count off the March floor:

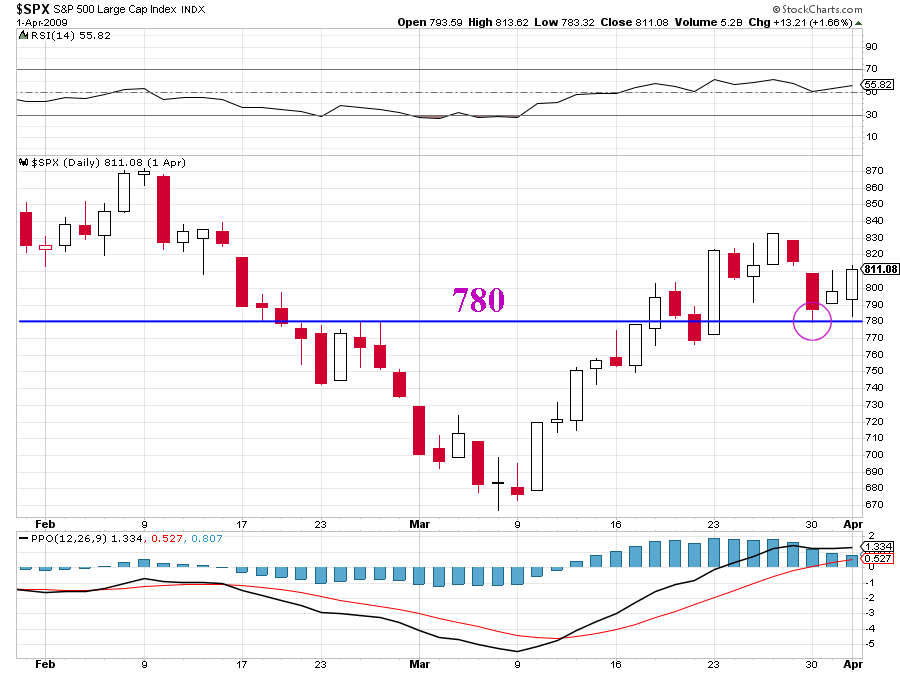

And my earlier count off the 2009 floor:

A pullback below 3662 would invalidate the count.

Posted 10 March 2021 - 04:03 PM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Just standard sell in May and go away? I have a hard time being too bearish if the Fed is saying that they plan to ease another 2 years.

This year, it is just reducing risk. I have significant paper profits on stock index funds bought last March-April period.

I can afford to skip any additional gains coming in 2021, but do not want to risk losing the gains present.

Edited by pdx5, 10 March 2021 - 04:04 PM.

Posted 10 March 2021 - 10:15 PM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Just standard sell in May and go away? I have a hard time being too bearish if the Fed is saying that they plan to ease another 2 years.

This year, it is just reducing risk. I have significant paper profits on stock index funds bought last March-April period.

I can afford to skip any additional gains coming in 2021, but do not want to risk losing the gains present.

Ah, makes sense.

Posted 14 March 2021 - 07:29 AM

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Just standard sell in May and go away? I have a hard time being too bearish if the Fed is saying that they plan to ease another 2 years.

This year, it is just reducing risk. I have significant paper profits on stock index funds bought last March-April period.

I can afford to skip any additional gains coming in 2021, but do not want to risk losing the gains present.

It is a big rally...... Because of this I'm now staying away from Small Caps, moving back into mid and large caps... Looking at everything considered, I do see more money coming into the market from the stimulus, so much of it will continue to find it's way into the market... In the future I do see transition back out of the market, but I'm thinking June at the moment....

Barry

I plan to be out of the market by end of April/mid-may by the latest. Will start selling longs in mid-March.

Just standard sell in May and go away? I have a hard time being too bearish if the Fed is saying that they plan to ease another 2 years.

This year, it is just reducing risk. I have significant paper profits on stock index funds bought last March-April period.

I can afford to skip any additional gains coming in 2021, but do not want to risk losing the gains present.

thats why very few make it to the top of k2 ...nose bleeds and fear of heights......:>)