from the fed https://cdn-ceo-ca.s...I Inflation.jpg

dharma

Posted 15 November 2021 - 09:00 AM

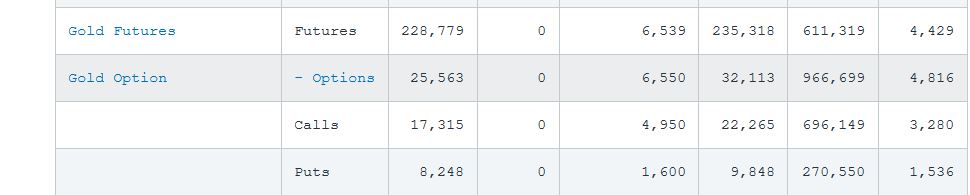

Is this a lot of calls? It seems like it!

Posted 15 November 2021 - 09:24 AM

Welcoming The Bull Back To The Metals

By Avi

If you have been reading carefully over the last several weeks, I have had questions as to whether the bull market was going to resume in the metals complex. The structures we were seeing across quite a number of charts did not provide us with initial 5-wave rallies, whereas others were not terribly clear in their initial 5 wave structures off the lows. In fact, most charts I was tracking had at least one issue.

The action this past week has resolved many of those issues. First, the GDXJ not only completed the clearest 5 wave rally off the recent lows, which I have been outlining over the last few weeks, but it also invalidated a setup for a lower low in a bigger 4th wave when it broke over the top of its prior 5-wave high. As soon as I saw this, I sent an alert our to our membership to explain that this was a major signal in the market to me, and it began to turn the probabilities towards the resumption of the bull market sooner rather than later.

Thereafter, both silver and gold both completed a potential 5th wave high off the recent lows, which further solidified the potential that the metals complex was moving back into its next bull trend. And, it was at this point that I began to more confidently view the metals complex as entering our next bull market phase where one can more confidently buy pullbacks.

Now, I want to explain that there is a big difference – at least to me – between riding long positions in a bull trend and having a set up to place an aggressive trade. Since we began buying individual mining stocks back in the last quarter of 2015, when everyone else thought we were crazy for doing so, I have been trading around my core position and attempting to hedge my long positions when I saw potential for pullbacks to begin. So, at this time, I am looking to sell the remaining hedges I hold on the next pullback or on a break out of resistance I have been noting on GDXJ and GDX.

But, in order for me to take an aggressive long position using leverage (options or 3X ETF’s), I must have a tight set up for risk management purposes. For if an aggressive long position turns on your when your risk parameters are too great, it can cause a lot of un-needed pain to your portfolio simply because you were being too greedy. Therefore, I always look for a series of 1’s and 2’s to suggest that the heart of a 3rd wave is about to take hold before I am willing to take an aggressive posture. Moreover, when you have a 1-2, i-ii structure in place, it provides you with a tighter risk management posture so that you minimize any losses if the 3rd wave does not trigger.

And, due to the ugly structures we have been seeing in many of the charts we track, and while there is potential for a sizeable rally in the metals complex to be seen as we look towards 2022, I have learned from experience that I am must follow my rules in order to avoid the pain of a failure of pattern. So, I am going to be waiting for the standard 1-2 structure to take shape I want to see in the various charts I track before I begin buying aggressive long positions.

Starting with silver, although it counts best as a leading diagonal, we now have 5 waves off the recent lows. Moreover, we are also striking the ideal target for a 5th wave in a leading diagonal. This leads me to begin looking for a wave [2] pullback as long as we do not break back over 25.87. And, as you look at the bigger picture on the SLV weekly chart, I believe this should begin our rally to at least the 34 region in SLV as we look towards 2022.

GC has also completed 5 waves up, and I am “reasonably” looking for a wave [ii] pullback in the coming days. But, when I step back on the daily GLD chart, it suggests that GLD may actually be several wave degrees ahead of silver at this point in time. So, I have taken the liberty of adding a 60-minute GLD chart this week so you can see the micro-picture a bit better in GLD, and why it may be ahead of the other charts.

In fact, once we break out over the pivot, that pivot will then become our main support, with an ultimate target of at least the 217.50 region. Normally, 5th waves target the 2.00 extension of the first two waves. However, in metals and most commodities, we usually look for at least the 2.618 extension, and oftentimes even higher. For now, I will use the 2.618 extension as my minimum target for this next run in the gold market.

While some of you may ask why I have not presented this picture to you before, my answer is simply that when you have retracements in excess of .764 twice in a row (waves [ii] and 2), it is an extremely rare occurrence that it will retain a bullish structure. For this reason, I have discounted this potential as a high probability wave count until now.

As far as GDX and GDXJ are concerned, I still like the high we just struck as a b-wave within a 2nd wave in GDXJ, and a potential wave i in GDX, but it can also be a higher b-wave. The structure is certainly not a clear 5 wave rally. But, both suggest we “should” see an imminent start to a pullback.

Of course, if they break out directly from their respective resistances, then I would have view us as begin in the heart of a 3rd wave, with the bottom of their respective pivot boxes becoming near term support of importance.

In summary, the best path from a structure standpoint is to see the market “rest” after this run up, and provide us with more of a pullback before we continue higher. Ultimately, I think we have now moved to a point where pullbacks in the metals complex can be buying opportunities at this time, at least for the coming several months. But, unless I see an appropriate set up, I will simply ride my long positions without any additional leveraged positions. Should the market provide us with the pullback I want to see right here, then I will provide an outline as to how one can move into aggressive long positions within a tight framework for risk management purposes.

Posted 15 November 2021 - 09:27 AM

This is extracted from Zerohedge post. Gold bull is now consensuses as everyone sees this 12-12 count.

Posted 15 November 2021 - 09:43 AM

Welcoming The Bull Back To The Metals

By Avi

If you have been reading carefully over the last several weeks, I have had questions as to whether the bull market was going to resume in the metals complex. The structures we were seeing across quite a number of charts did not provide us with initial 5-wave rallies, whereas others were not terribly clear in their initial 5 wave structures off the lows. In fact, most charts I was tracking had at least one issue.

This guy is a lot smarter than most.

Posted 15 November 2021 - 11:13 AM

The now insanely negative yielding in real terms 30 yeer rates 4 hour chart looking for clear air space here on the 2nd attempt at it...

2nd attempts are quite often successful....

You have to think that AT SOME POINT, reality is going to set in here???

Perhaps may only be days away....

Edited by K Wave, 15 November 2021 - 11:14 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 15 November 2021 - 12:10 PM

yes, its unbelievable the bond issuer guarantees that you will get less money back for your return. and not counting inflation. why someone would buy a bond is beyond me!

the 19th is the full moon it is an eclipse(something hidden from view will be revealed). the market is overbought on the oscillators. so some kind of correction or consolidation is in order. i believe the full moon will trigger that. if in fact we are in a 3of 3 this pullback will be a big buying opportunity. i think that we are going to see new highs in the sector. and at some point the steeds ie silver , plat/palladium will start to gallop. and maybe its my new glasses but it sure looks to me like the broad market is extended. going back into the past pullbacks/consolidations in the broad market have caused funds to be deployed in the metals complex. i am not talking about a crash , that will affect the metals , as it has in every other crash

i like what i am seeing in the pm complex. its a very small cap complex when money comes in the door will not be wide enough!

dharma

by the way i am still holding dba which i believe will go alot higher. food prices are going higher. dont worry its all transitory . and for that matter so is life!

will brainard take over the reins. is powell out!?

Edited by dharma, 15 November 2021 - 12:14 PM.

Posted 15 November 2021 - 01:01 PM

Silver coiling after the launch off the $24 platform...

As expected, $25 is a battle ground...

Above that little Bat Signal is where things would likely start to go Very Wrong for the Bears....

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 16 November 2021 - 11:02 AM

we probably finished one wave up off the low in these indices now going into a wave ii

correction . i am talking about gold and the miners