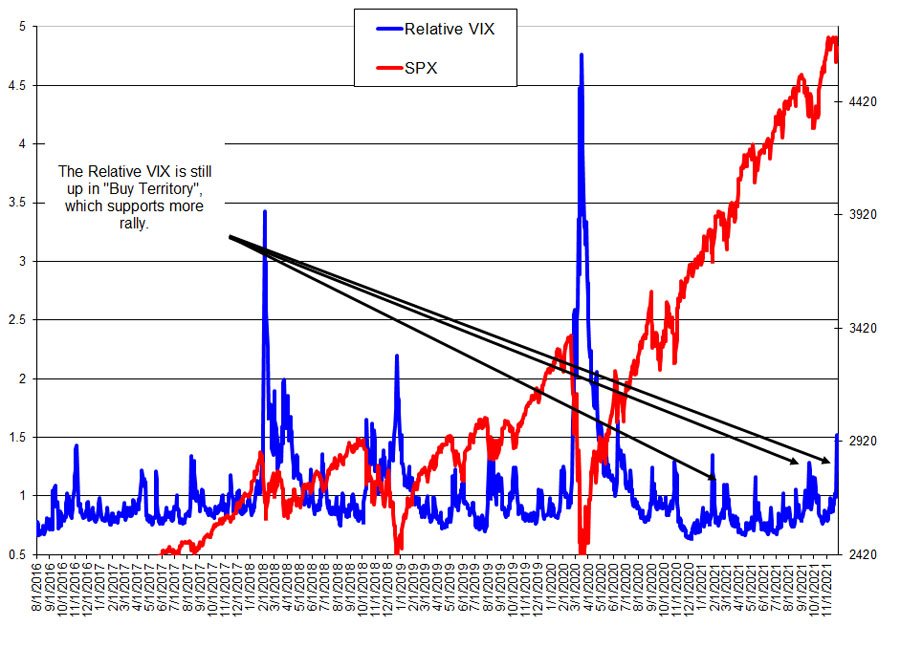

We got a Relative VIX Buy Friday, and it's still up there in Buy territory. This is a good bottom Spotter, especially with the "Secret Hedge Fund" Buy (also from Friday).

Relative VIX Buy

#1

Posted 30 November 2021 - 09:59 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#2

Posted 30 November 2021 - 10:13 AM

hmmmmm really what about those 3 massive spikes what were those??

#3

Posted 30 November 2021 - 11:38 AM

Edited by LMF, 30 November 2021 - 11:40 AM.

#4

Posted 30 November 2021 - 11:48 AM

hmmmmm really what about those 3 massive spikes what were those??

The last one was the Covid Bear Market. The first one was the blow-up of those VIX etf's. The middle one was a bona fide Bear (as of 12-17-18). Bear Markets are different. Excesses are excessive.

Are we going into a Bear Market? I don't think so, but I could be wrong.

I'm not at all surprised by the test/lower low, as we had too many amateurs Bulled up, but if we're not starting a Bear, we're probably near a good low.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#5

Posted 30 November 2021 - 11:58 AM

#6

Posted 30 November 2021 - 12:09 PM

Funny thing is all government officials are idiots and never get anything right yet people continue to go back to them for the answers which I'm shocked about almost everyday lol! My biggest concern on the market is calls are still overpriced can't believe with a -88 point S&P and they're still hoping for an upside, when they finally flip I might get more bullish otherwise I'm thinking more of a sideways market to say the least.....then there are those gaps around 4480.....hmmmmm

#7

Posted 30 November 2021 - 12:09 PM

whoops sorry 4380...

#8

Posted 30 November 2021 - 12:16 PM

The bear case is dying along with oil pushing toward the mid 60's now.

Edited by MikeyG, 30 November 2021 - 12:17 PM.

mdgcapital@protonmail.com

papilioinvest.com

@papilioinvest

"One soul is worth more than the whole world."

#9

Posted 30 November 2021 - 12:29 PM

ya seems like it lol!!! Although I am long now after my shorts made +85 points lol!

#10

Posted 30 November 2021 - 12:37 PM