I also meant "..close to 23 Tropical Taurus", not 26 Taurus for the second pass Mercury in 2016.

Heads Up on the Uranium Mining Space

#11

Posted 31 May 2022 - 08:28 PM

#12

Posted 31 May 2022 - 09:15 PM

$Gold:

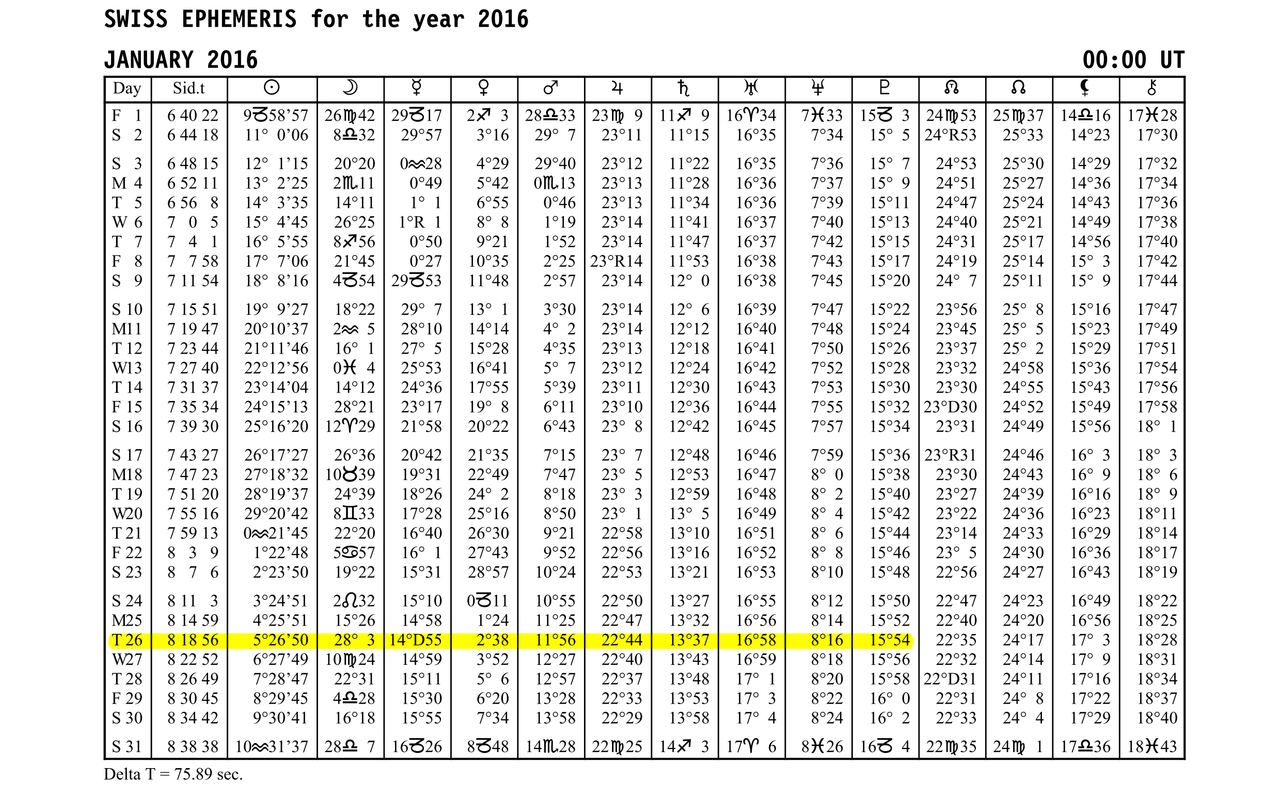

January 26, 2016: Mercury D. Station conjunct Venus - ~12 deg. Orbs of influence are doubled with stations.

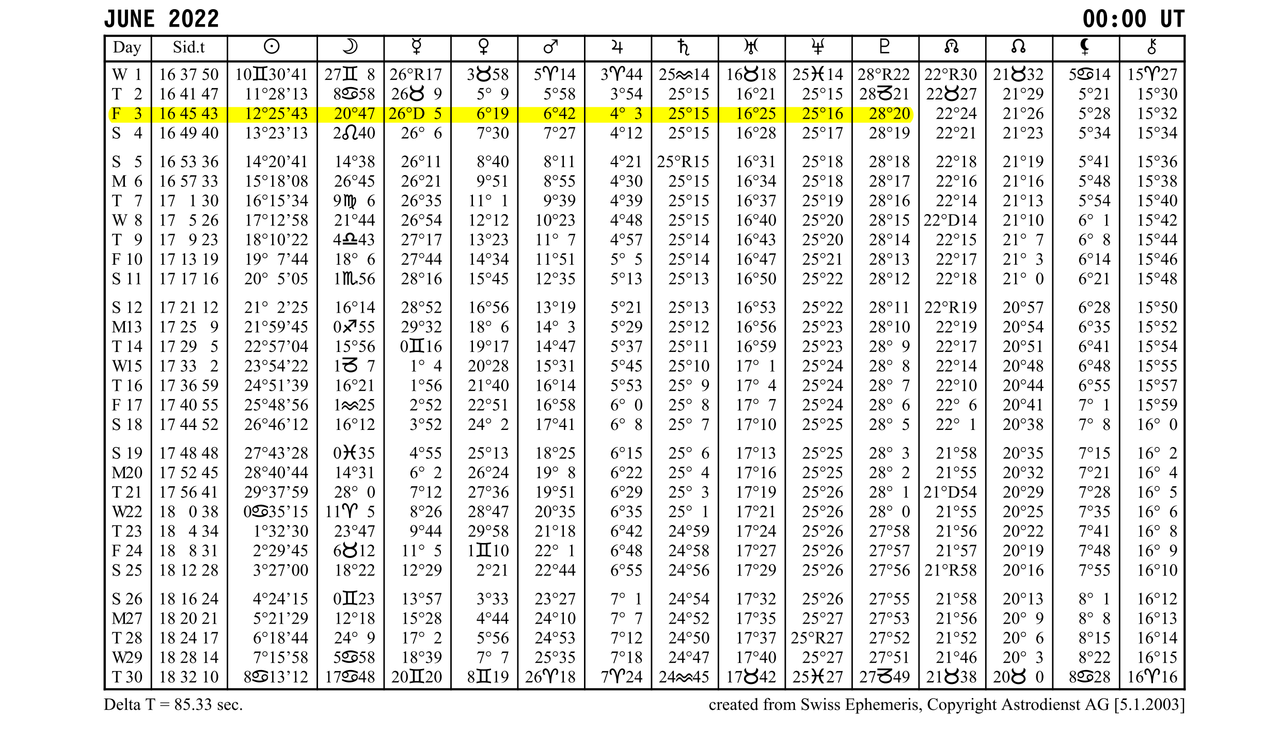

June 3, 2022: Mercury D. Station conjunct Venus - ~ 20 deg. (little wide), but Venus transits to come up to meet that 26 Taurus position about June 20.

Favorable Lunar aspect to this conjunction - June 16 & 17 as we have a Lunar Trine (120 deg.) to this approaching conjunction to the station position.

So I consider this whole setup to be a high probability analogue to the first half of 2016 in the PMs.

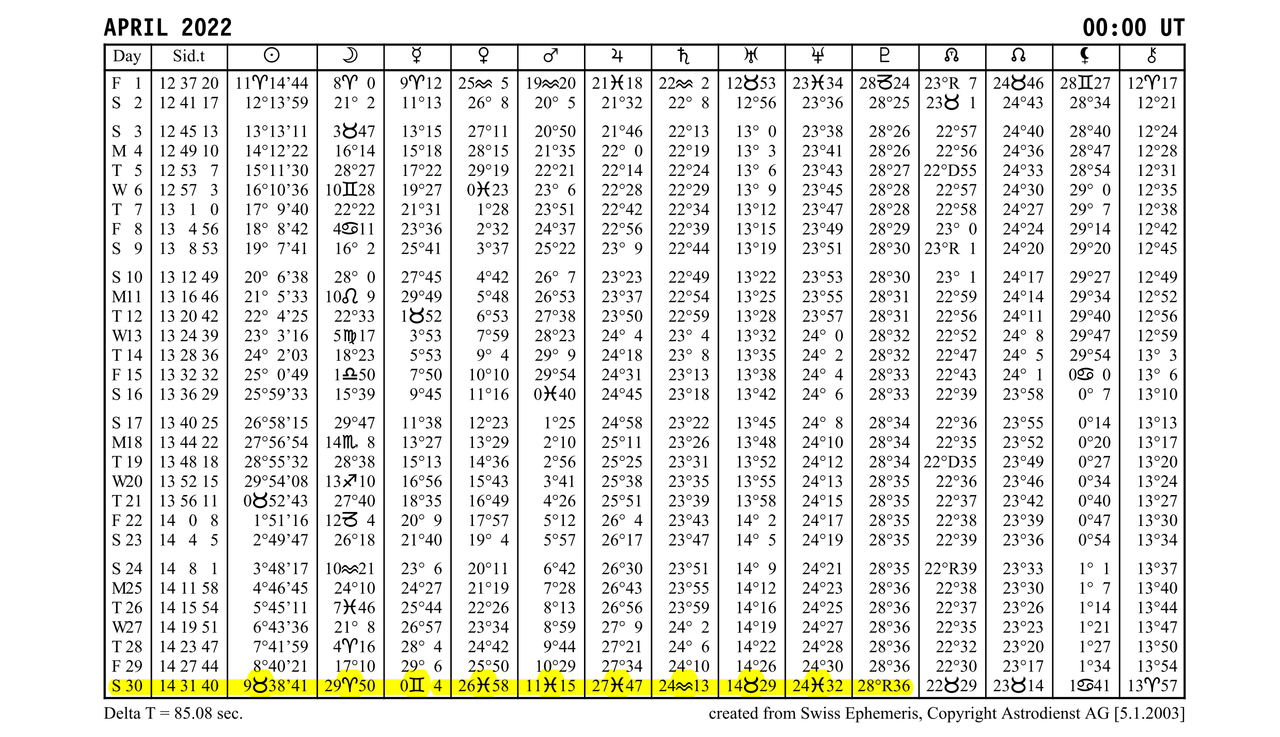

This Taurus position is important from another aspect -- Mercury Station June 3 occurring very close to the April 30 Solar Eclipse position (~10 Tropical Taurus) conjunct Uranus (~14 Tropical Taurus). Also very important for the Tech Sector, but when Mercury backs down on this position, all these markets will launch,

I believe. Again, orbs of influence are doubled with stations.

#13

Posted 31 May 2022 - 11:12 PM

Cafeflorida - thank you so much.

An ephemeris is Greek to me ..from about what date do you expect this gold upmove might start?

#14

Posted 01 June 2022 - 11:07 AM

If I were forced to make a call based on this model, then according to the strict parameters of the planetary model, I would have to say to wait and let Mercury make it's D. Station on June 3.

If the gold retracement is done and we advance from this trading range, then THE tell will be the favorable Lunar trine

aspect (120 deg.) to the Mercury D. Station position on June 7 & 8.

-That- is the day that really has my attention. Fortunately, we don't have challenging -=Square=- Lunar aspects to that Mercury

position (which is squaring Saturn - a complication) during this week leading up the June 3rd D. Station. Good so far.

If the controlling configuration has been passed off successfully to this Mercury D. Station, then the trigger & pointer to that

controlling configuration is that 120 deg. Lunar aspect June 7 & 8.

If we advance -very- strongly on either of THOSE two days and break out of this range on June 7th or 8th, then we're done with this

retracement I believe and we have a price advance ahead of us that has legs.

The fact that Mercury is backing down on a 90 degree aspect to Saturn complicates the picture somewhat.

My sense is that this square -=could=- pull the PM's down into a short term low from which it begins a strong price advance on

or about that June 3rd date. Totally makes sense.

This square to Saturn does potentially complicate it and makes analysis more difficult -because- under normal circumstances by itself, this squaring aspect to Saturn is bearish for the PM's.

It could be that this bearish square is already priced in or it is possible that the energy of that bearish configuration has yet to be

exhausted and we test the mid May lows with a tighter square aspect than when Mercury made it's Rx Station on May 10th within

reach of a square to Saturn.

There is a rule that says lows are often tested. Could happen.

This is not plagiarized work, only my own (but it is not in the public domain).

This is my honest appraisal adhering strictly to the parameters of the model which considers the oddities of stimulus by D. & Rx Stations.

I could be wrong in that the Mercury/Saturn square is more of a bi*ch than I even thought, but I just don't think this is a big risk, as

we have already put in a significant retracement in the PM's because of this square.

There are way too many elements lining up here for a high probability analogue to the 2016 gold bull.

#15

Posted 01 June 2022 - 12:07 PM

Thanks Cafeflorida, appreciate your post and the considerations.

In my simple understanding gold often turns when Mercury goes direct, so around Friday is worth watching.

#16

Posted 01 June 2022 - 08:36 PM

It was a lot info yet there is still so much more. It's been on my mind for a very long time.

I just want to help by offering a slightly different perspective and see participants think differently about the problem.

One of the issues is that even when all the data points are considered, the sample size is too small and is statistically insignificant.

So instead of reasoning from cause to effect and testing the data against the rival hypothesis, chance, you observe

an effect and infer a cause by pairing the effect with simultaneous phenomena which would be likely suspects for a causal mechanism

.......inverse probability, or causal inference they call it.

You cannot really "do" science in this field because you cannot:

1) replicate the experimental design

2) have a control data set

3) show a causal mechanism

But economists and sociologists have exactly the same problem.

It is like pouring out my soul because I have been looking at all this for such a long time.

Yeah, I do have skin in the game, but with the largest cash position I've had ever.

I will patiently wait. Won't be long.

#17

Posted 06 June 2022 - 12:53 AM

very nice cafe that june 7 june 8 time frame is also 90 days from the top in gld on mar 8

and also 233 trading hours from the top in gdx on april 18 sp there is a time confluence

right in that area . dont have long to wait

#18

Posted 07 June 2022 - 11:47 AM

GM - I love the confirming input from another perspective, as I don't count waves. Nor do I know anything about Gann.

But I don't really get the connection w/ the 233 trading hrs. from the GDX top. I could use some guidance on that. What is that?

From my watch, it is all about planetary configurations w/ Sun + Lunar aspects working on the controlling configuration.

June 7 & 8:

Right now, it's all about the controlling configuration centered around that Mercury D. Station, with the favorable Lunar 120 deg. aspect to it (trine) today & tomorrow June 7 & 8.

The Lunar aspect is the pointer to the controlling configuration.

Mercury is past its 90 deg. aspect to Saturn & is departing that position, clearing out that delaying action.

This is also important as I believe that this negative energy has been exhausted. This has been a complicating factor.

Venus is on top of & departing the April 30 Solar Eclipse position at approx Tropical 10 Taurus 30 (16 Aries 18 Sidereal).

We are waiting for the Lunar trigger to provide the stimulus by trine aspect to Mercury.

This has application to the general markets, but especially to the PM's, Uranium & Crude.

This is a very big test of the planetary model.

Folks, there is no wiggle room; no grey area here: This is either dead right or dead wrong.

I'm with the former. If it's the latter, well, I did my best working in strict conformity to the model.

One important thing I have learned about study of the controlling configuration is that it absolutely requires a favorable Lunar stimulus aspect to run.

Points of inflection are driven by the Moon.

Before that happens, the markets can't get going.

#19

Posted 07 June 2022 - 11:53 AM

Guess who authored this chart on June 3.

#20

Posted 07 June 2022 - 11:59 AM

Can't see the chart?