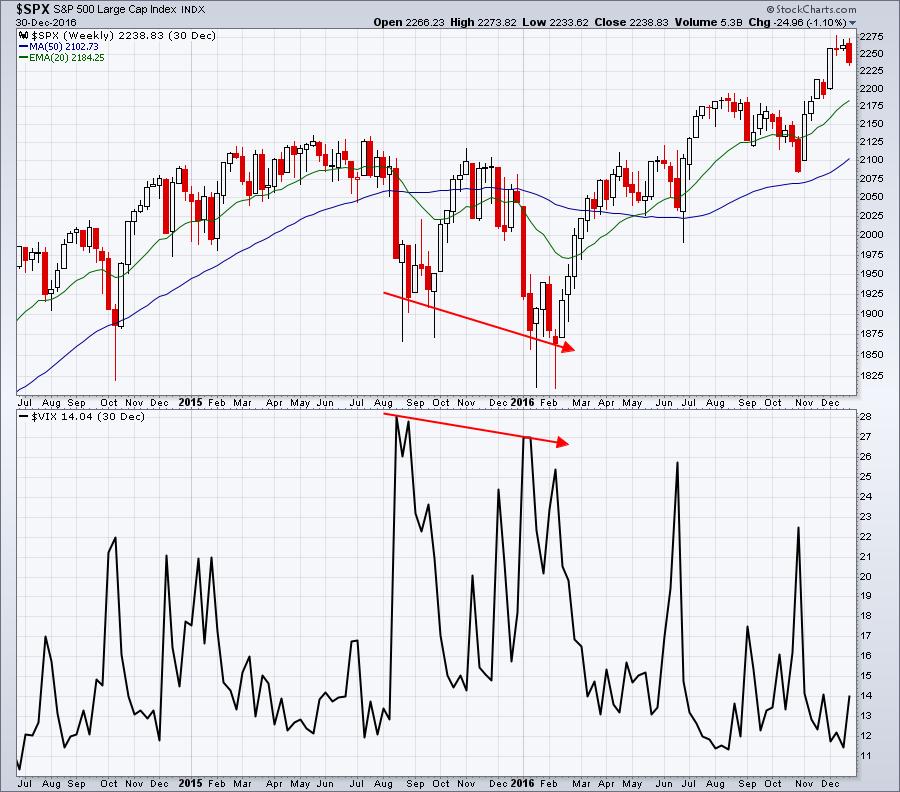

Such a wide range reflects the uncertain, troubled, apprehensive, and volatile few months.

Persistent inflation presents problems that are beyond this FED's capabilities, especially with the delay & timidity of this FED, and the supply chain/War problems.

I still think the LOW for 2022 will be during the traditional September/October bearish period but in the current

global environment anything is possible.

Not active now, want to continue enjoying my vacation, Limit orders filled last week, more orders placed.

Will hold all TLT CALLS, continue to build a UVXY PUT position, and also SPY & QQQ CALLS when market declines.

The FED looks a bit too indecisive and is actually admitting a recession is difficult to avoid. Someone tell the FED that the recession started at least a month ago and is in progress...

"Apart from the pain on Main Street and potential political problems ahead of the mid-term elections, the divergence makes it more difficult for the Fed to effectively communicate its thinking and strategy to the public and markets alike.

For investors, this raises the risk of misreading the Fed and mispricing its reaction function, potentially triggering a wave of distortion and volatility across markets."

https://www.reuters....tep-2022-06-30/