Zweig Breadth Thrust

#1

Posted 06 October 2022 - 05:01 AM

Is there a symbol on stockcharts.com that can provide this?

Does this indicator use the 10 day simple or the 10 day exponential moving average?

Thank you in advance.

#2

Posted 06 October 2022 - 05:35 AM

#3

Posted 06 October 2022 - 10:15 AM

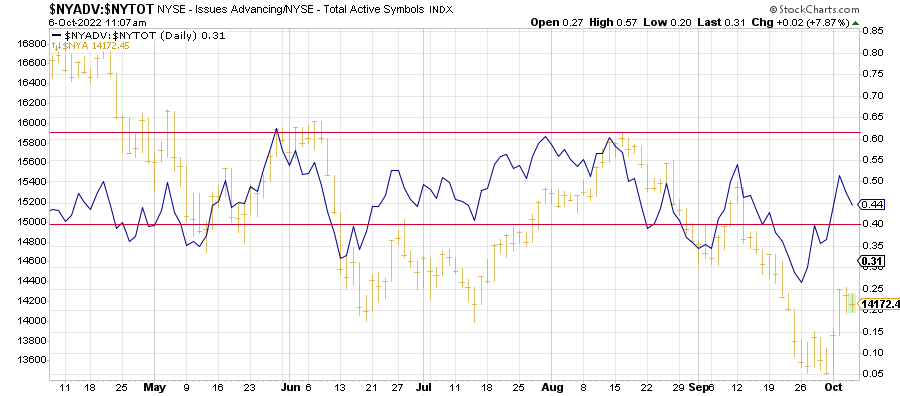

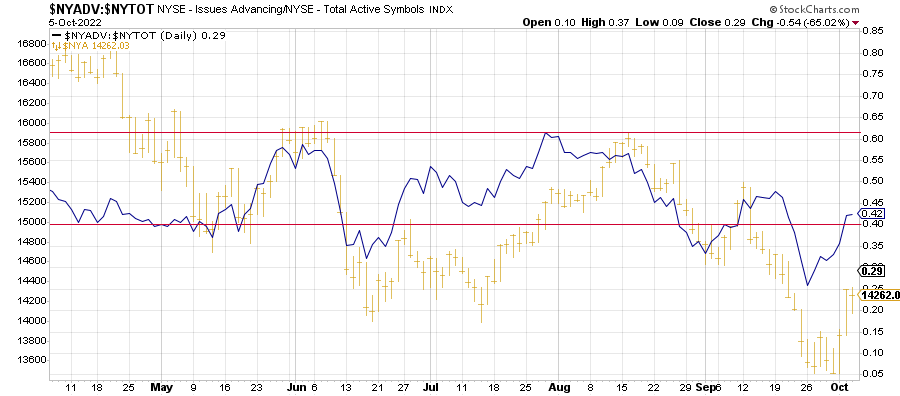

First chart is using a 10 day EMA...now on day 4.

Second chart is using a 10 day SMA...now on day 3.

Neither one is likely to give a buy signal by day 10.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#4

Posted 06 October 2022 - 11:42 AM

Ack! cannot post, sry

Edited by Chilidawgz, 06 October 2022 - 11:44 AM.

#5

Posted 06 October 2022 - 12:23 PM

Many are talking about the recent "THRUST" possibilities:

writes in #SentimentEdge

This from a mail from Sentiment Trader:

What the research tells us- On consecutive sessions, more than 5 times as many securities on the NYSE advanced as declined.

- Even more notably, more than 10 times as much volume flowed into advancing than declining securities.

- Both types of thrusts have always preceded a positive one-year return in the S&P 500.

- Short-term returns tended to be weak as buyers took a temporary breath.

#6

Posted 06 October 2022 - 12:31 PM

Very similar to the action in March 2020, Monday and Tuesday witnessed overwhelming buying interest. On the NYSE, five times more securities advanced than declined, and ten times more volume flowed into advancing than declining securities.

It's rare to see so many stocks, preferred securities, and fixed income rising at the same time. Even going back to 1928, this hasn't happened too many times. We have less confidence in breadth metrics before 1950, so we'll limit the lookback to then.

When five times as many securities rose as declined on consecutive sessions, the S&P 500 never suffered a negative one-year return. Even over the next six months, there was only a single small loss.

The maximum decline even up to a year later was minuscule on average, though five of them suffered drawdowns larger than -5%. Every signal saw a maximum gain of more than +15% within the following year.

And when more than ten times as much volume flowed into advancing versus declining securities, returns were even more consistently positive. The sample size was smaller, but the results were more consistent.

Breadth thrusts have failed this year, depending on how they're defined, and what time frame we use. But before this week, we hadn't seen a thrust as powerful, as widespread, or coming from such low levels. What the research tells us

- On consecutive sessions, more than 5 times as many securities on the NYSE advanced as declined.

- Even more notably, more than 10 times as much volume flowed into advancing than declining securities.

- Both types of thrusts have always preceded a positive one-year return in the S&P 500.

- Short-term returns tended to be weak as buyers took a temporary breath.

#7

Posted 07 October 2022 - 01:01 PM

#8

Posted 07 October 2022 - 08:03 PM

Edited by pdx5, 07 October 2022 - 08:04 PM.