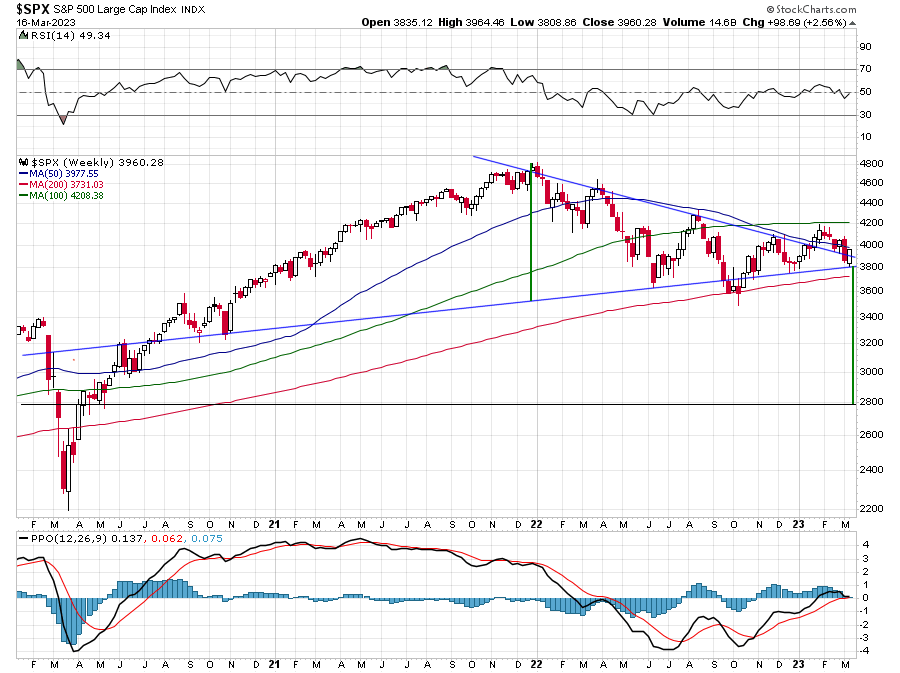

''there's a good chance the spx won't wait for next week to rise, but it will start rising tomorrow......in any case next week it will be pure fun''

you find it in thread.......Brrrrrr......

Posted 16 March 2023 - 12:21 PM

''there's a good chance the spx won't wait for next week to rise, but it will start rising tomorrow......in any case next week it will be pure fun''

you find it in thread.......Brrrrrr......

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 16 March 2023 - 01:33 PM

I'm leaning towards an upside surprise - really starting to question the validity of the bear market. I believe we were due for one when Jerome unleashed the mother of all helicopter cash drops, nipping the bear in the bud, creating an asset bubble and kicking off a surge of inflation. Investors may have misconstrued the decline from the bubble top and the consolidation of the prior bull gains as the early stages of a wicked bear market - which could actually still be ahead of us - or maybe it won't be needed because inflation is doing the job in real tems (and in a stealthy fashion, keeping the bears in anticipation of a crash in nominal terms that may have actually been averted). Jerome is not the idiot that he wants everyone to believe he is.

https://www.traders-...vention/page-11

Posted 16 March 2023 - 01:45 PM

I'm leaning towards an upside surprise - really starting to question the validity of the bear market. I believe we were due for one when Jerome unleashed the mother of all helicopter cash drops, nipping the bear in the bud, creating an asset bubble and kicking off a surge of inflation. Investors may have misconstrued the decline from the bubble top and the consolidation of the prior bull gains as the early stages of a wicked bear market - which could actually still be ahead of us - or maybe it won't be needed because inflation is doing the job in real tems (and in a stealthy fashion, keeping the bears in anticipation of a crash in nominal terms that may have actually been averted). Jerome is not the idiot that he wants everyone to believe he is.

Jerome definitely is no fool. I can't imagine why anybody would want the job. it's like walking around with a target on your back.

Posted 16 March 2023 - 02:12 PM

Stocks are rallying on the news thagt FED will not raise rates next week.

And big rescue of 2 failing banks is also bullish.

However all this increases inflation, and that is the fly in the ointment.

Inflation rise will force the hand of FED. Interest rates rose today!

We are very long away from 2% target inflation.

Market still down 20% from market high in January 2022.

Keep the longer term scenario fresh in minds.

Posted 16 March 2023 - 02:19 PM

Just only another "warning shot off the bow" in what continues to be the great battle for survival of Capitalism.

Fib

Edited by fib_1618, 16 March 2023 - 02:20 PM.

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Posted 16 March 2023 - 02:27 PM

Stocks are rallying on the news thagt FED will not raise rates next week.

I was well aware of that yesterday........but that is how the stock market behaves and what you can see before it happens if you know how to read the charts

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 16 March 2023 - 02:38 PM

The longer term scenario is to inflate-away 30+ trillion in national debt plus student loan debt plus future debt as it incurs. Everyone knows the 2% target is a hoax. They'll probably need more and bigger war as scapegoat for the consequences and obfuscation of the true villains - no doubt they will succeed in those efforts..

Posted 16 March 2023 - 03:07 PM

No. Our real problem is deflation. Inflation, it just depends on what definition of transitory you are willing to accept.

Posted 16 March 2023 - 04:27 PM

No. Our real problem is deflation. Inflation, it just depends on what definition of transitory you are willing to accept.

If there is deflation, why are both my kids getting double digit raises? One is a lawyer and other evaluates effectiveness of new cancer drugs.

Posted 16 March 2023 - 06:43 PM

Well, this isn't good. They're opening the spigots - bailing everyone out, Will there never be a day of reckoning?

"New Fed Bank Backstop Has Scope to Inject as Much as $2 Trillion"https://www.bloomber...on-of-liquidity

Although I do think the fed's mission is to inflate hard and long, they must avoid hyperinflation, i.e., a crack-up boom. How can they prevent that outcome while flooding the country with liquidity? Maybe they will need to temper the wealth effect? Maybe not pause - or only for a short period? If they're going to put all the bank fires out with buckets of money instead of water, then the crisis of the moment is solved and rates can go higher. I'm troubled by noticing that the S&P wedge might also be a H&S, although technically it may not meet the criteria. I'm still thinking we could rally to near ATHs, but then - maybe - the real grizzly could step out of the cave and tear us a new one.