FED is done raising rates

#1

Posted 23 March 2023 - 05:13 AM

#2

Posted 23 March 2023 - 06:53 AM

#3

Posted 23 March 2023 - 08:22 AM

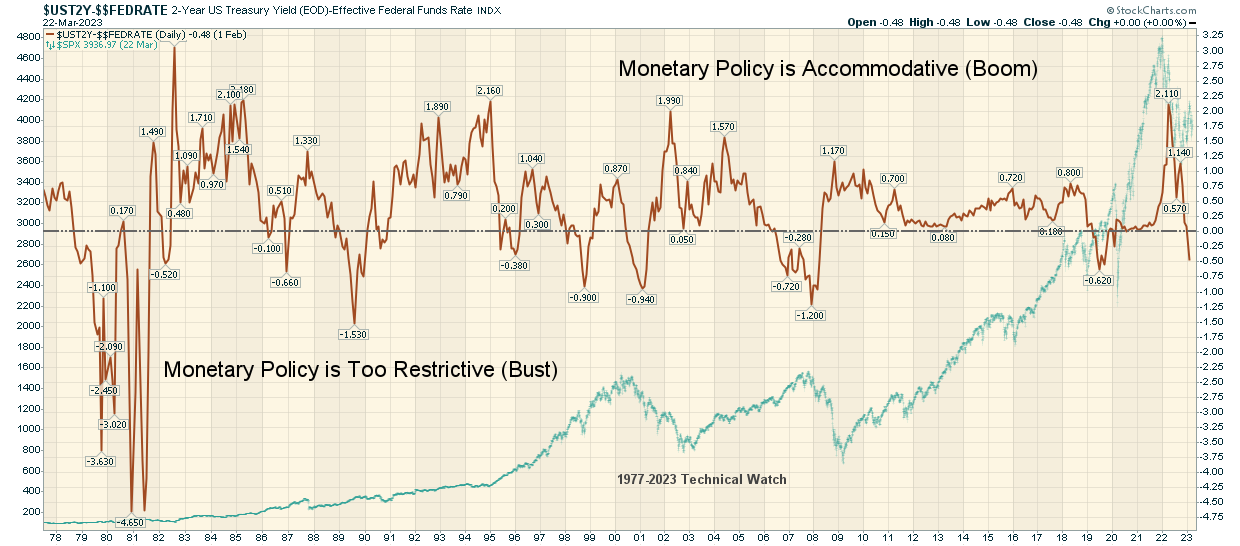

And once the curve inversion fully reverses, Look out below.

And after that epic increase and inversion, the below part could be big.....

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#4

Posted 23 March 2023 - 08:54 AM

From Powell's presser I 'd expect to see more SVB type crisis before talking about the Fed stop hiking ........................

Edited by redfoliage2, 23 March 2023 - 09:00 AM.

#5

Posted 23 March 2023 - 09:36 AM

I'm amazed how many "heard" Powell say they are done raising rates. He didn't say that. He actually said they will wait and see. More crisis in the banking my help them in their goal to lower inflation, in which case they might pause.

#6

Posted 23 March 2023 - 09:45 AM

The Fed sees asset prices still high so the inflation, not enough "pains" yet ............................

Edited by redfoliage2, 23 March 2023 - 09:54 AM.

#7

Posted 23 March 2023 - 09:50 AM

Another 1/4 point raise in 2023 and then pause is what Powell said.

The two year market says otherwise, the bond guys are usually correct.

#8

Posted 23 March 2023 - 09:52 AM

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#9

Posted 23 March 2023 - 10:45 AM

Even the Market Watch headline says "the Fed pivot is near...". Wow, I must be missing something or just stone deaf. He said he envisioned one more hike then they'll take a wait-and-see approach. Of course the Dow Jones publications are for the bull section in the crowd so I guess I shouldn't be surprised. I'm on the sidelines watching the cheerleaders with amazement, and I'm skeptical.

#10

Posted 23 March 2023 - 10:53 AM

if I can find the chart I will post it. I def don't have time to hunt it down now but as I said before, when the Fed cuts rates the market will crash. That is what happens in bear markets. You might be able to find it yourself but you'd have to look up when cuts were made during previous bear markets. Imagine if inflation is running at 6% and the fed cuts rates. Maybe they will take the route of the big lie and say inflation has fallen and cut rates or they will do it because of financial disasters occuring. Will that inspire confidence in anyone?