if I can find the chart I will post it. I def don't have time to hunt it down now but as I said before, when the Fed cuts rates the market will crash. That is what happens in bear markets. You might be able to find it yourself but you'd have to look up when cuts were made during previous bear markets. Imagine if inflation is running at 6% and the fed cuts rates. Maybe they will take the route of the big lie and say inflation has fallen and cut rates or they will do it because of financial disasters occurring. Will that inspire confidence in anyone?

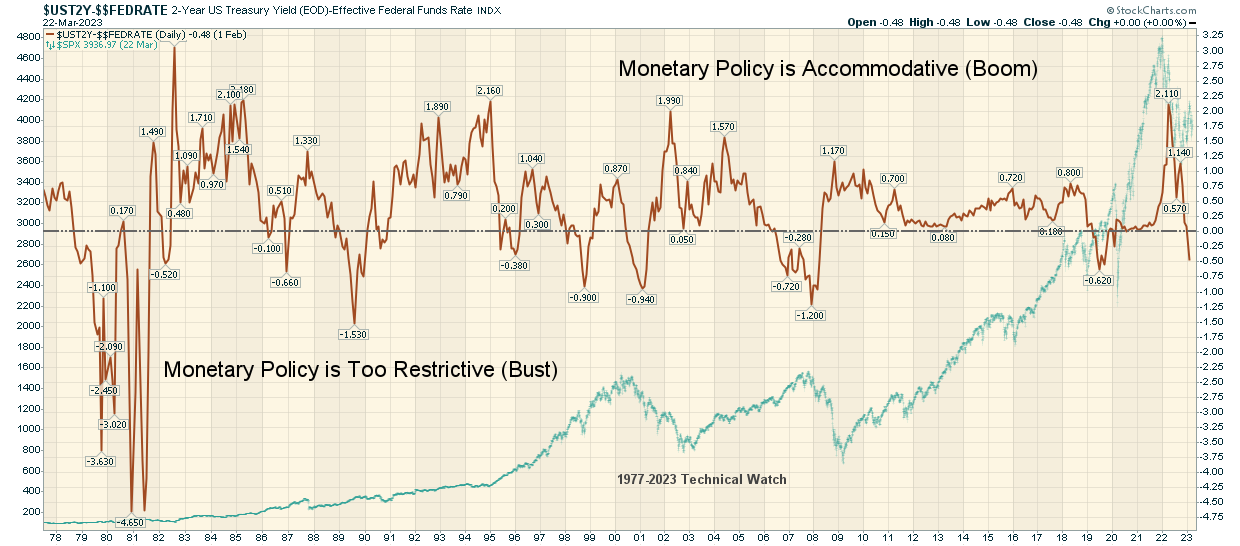

This is one of those "cart before the horse" or "horse before the cart" kind of scenarios, In actuality, and as the chart I posted earlier in this thread shows so eloquently, interest rates move lower when the market has already priced in a contracting economy (like now) and stocks are already declining (like now) and the FED then tries to play catch up to this same dynamic as they realize that they tightened too much (asleep behind the wheel) in their effort to either reduce or eliminate future inflationary tendencies.

Even the Market Watch headline says "the Fed pivot is near...".

As of earlier this morning, the FedWatch tool is showing that bond traders are currently at 65% "no change" and 35% a 1/4% hike for the May meeting. Yesterday it was 50/50. What is interesting, though, is that these same traders are now pricing in a 1/4% cut with the July meeting and gaining favor for another 1/4% decrease in September. Of course, this could all change depending on future fundamental data, but it what it is right now...this tool has been spot on for several years now.

In the fullness of time.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions