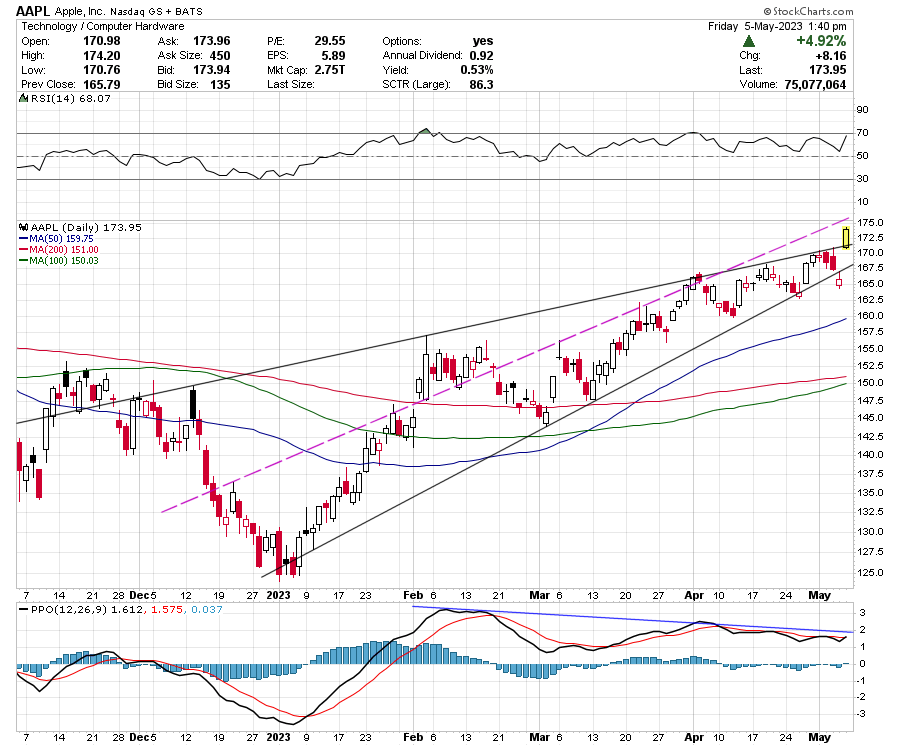

Isn't the idea, you release good earnings and the investors clamour to buy it? See what AAPL gets out of this announcement, then maybe later today oe in a few days, I'll sell some calls. Looks toppy to me. (JMHO)

AAPL earnings were good, but an unprecedented enormous buy back?

#1

Posted 05 May 2023 - 05:57 AM

#2

Posted 05 May 2023 - 06:27 AM

That post is for education purposes. Call selling is an extremly risky action with possible unlimited losses. I have a high risk tollerance and will take my lumps when and if it happens. (JMHO)

#3

Posted 05 May 2023 - 01:22 PM

Toppy? Nahhh...

Posted this daily count for aapl back in march

#4

Posted 05 May 2023 - 01:31 PM

Looks like 177 is about it. I'll take a look Monday.

#5

Posted 17 May 2023 - 06:56 AM

Selling AAPL, calls worked like a charm. Is anybody dumb enough to think the premier FANG stock should have a negative sharp ratio. People don't understand how the risk free rates affect investments, high rates make treasurys quite attractive. The so called "growth" stocks better be able to show some growth. (JMHO) Sharpe Ratio Formula and Definition With Examples (investopedia.com)

#6

Posted 17 May 2023 - 07:01 AM

Bulls are expecting the risk free rate to decline substantially in he second half due to 3 rate cuts, which aren't going to happen. Tech should be in for quite a haircut. (JMHO)