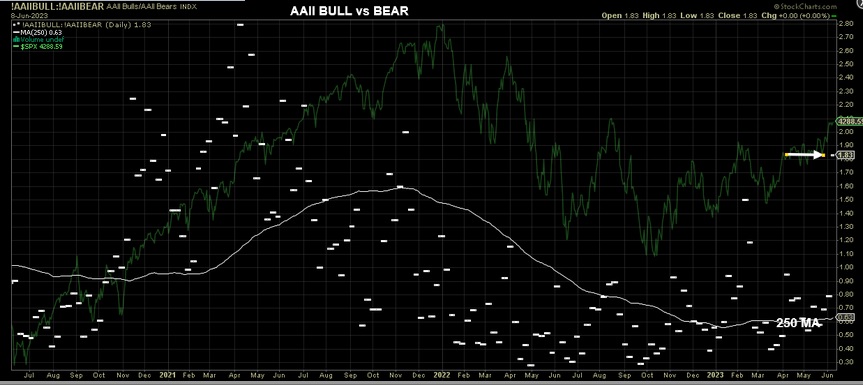

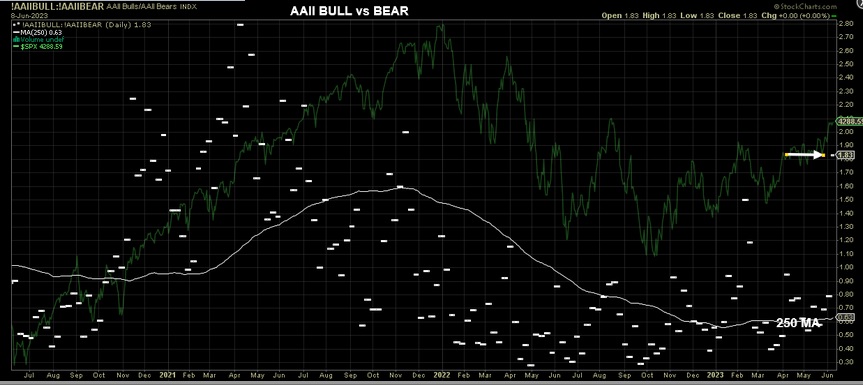

More than one guy snorting now! (If this data is correct at Stockcharts)

It looks very extreme until you look back to 2021 bulls,

Edited by Rogerdodger, 08 June 2023 - 12:20 PM.

Posted 08 June 2023 - 12:12 PM

More than one guy snorting now! (If this data is correct at Stockcharts)

It looks very extreme until you look back to 2021 bulls,

Edited by Rogerdodger, 08 June 2023 - 12:20 PM.

Posted 08 June 2023 - 01:01 PM

they're all bears wearing a hat with horns to look like bulls, but definitely they are bears

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 08 June 2023 - 10:50 PM

And then there is THIS.......

usually decline does not get under way until this starts to reverse in earnest...so could be a few days away from that....

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 08 June 2023 - 10:55 PM

this still very much has the potential of being a giant suck in, before the hammer drops for rest of the year...

and again, likely depends on whether MEGA starts to get hit HARD soon...like next week.

If MEGA just works this off mostly sideways, then indexes can still advance as a whole.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 09 June 2023 - 10:19 AM

Let us count the bullish signals......

New unemployment claims came in higher since Oct 2021

Job openings dropping

Inflation continues

OPEC cut oil production by another million barrels/day

FED is divided on next rate increase

Ukraine war shows no end in sight

Trump indicted

Sounds bullish to me!

Posted 09 June 2023 - 12:29 PM

Let us count the bullish signals......

New unemployment claims came in higher since Oct 2021

Job openings dropping

Inflation continues

OPEC cut oil production by another million barrels/day

FED is divided on next rate increase

Ukraine war shows no end in sight

Trump indicted

Sounds bullish to me!

hi pdx5......you wrote it as a joke, but it is very true. Markets make their tops not on bad, but on good news. So that until we see something good reported by the media, nothing to worry about the rising trend

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 09 June 2023 - 03:48 PM

Andr, my most profitable trades were made with very bad news.

When covid arrived in USA in early 2020, that was not good news and spx dropped 25%.

The financial crisis of 2011 was bad news and markets got hammered. Both occasions I was in bonds, and switched to stocks. So very bad news can be very profitable.

My money spends more time in bonds than stocks.

Currently there is no really bad news, so it is generally bullish. Next very bad news will be bursting of the debt bubble.

Posted 09 June 2023 - 04:16 PM

Andr, my most profitable trades were made with very bad news.

When covid arrived in USA in early 2020, that was not good news and spx dropped 25%.

The financial crisis of 2011 was bad news and markets got hammered. Both occasions I was in bonds, and switched to stocks. So very bad news can be very profitable.

My money spends more time in bonds than stocks.

Currently there is no really bad news, so it is generally bullish. Next very bad news will be bursting of the debt bubble.

wait a moment......very bad news getting out like a thunder in a blue sky are very bearish as for what I have observed, but bad news that the strong hands are aware of, well that is bullish because they know the FED will come to help. I don't want to say I'm right and you are wrong obviously, because we all have our opinions, but that is the scheme I have extracted from my experience. You might disagree, but that's what I have experienced so far.

Edited by andr99, 09 June 2023 - 04:17 PM.

forever and only a V-E-N-E-T-K-E-N - langbard

Posted 10 June 2023 - 09:34 AM

My money spends more time in bonds than stocks.

Reminds me of T Theory.

Laundry seemed to use it personally more as a way to time bonds rather than stocks, as I remember.

During certain periods it worked well for him.

In Terry Laundry’s Best Bond Strategy, the system of moving back and forth between junk bonds (like JNK) and treasury bonds (like TLT) is a conservative method of capital appreciation and I’ve liked it since Terry Laundry introduced me to it.

The idea is that JNK typically moves up during perceived periods of less market risk, whereas Bonds do better in times of investor caution.

.VCIT can also be used also as a corporate bond etf.

Edited by Rogerdodger, 10 June 2023 - 01:18 PM.

Posted 10 June 2023 - 03:34 PM

My money spends more time in bonds than stocks.

Reminds me of T Theory.

Laundry seemed to use it personally more as a way to time bonds rather than stocks, as I remember.

During certain periods it worked well for him.

In Terry Laundry’s Best Bond Strategy, the system of moving back and forth between junk bonds (like JNK) and treasury bonds (like TLT) is a conservative method of capital appreciation and I’ve liked it since Terry Laundry introduced me to it.The idea is that JNK typically moves up during perceived periods of less market risk, whereas Bonds do better in times of investor caution.

bds

.VCIT can also be used also as a corporate bond etf.

What junk can do is during bull markets pay higher than normal yield without losing significant principle.

Since no one knows when the really serious market crash will appear, and when it does appear causing serious deflation of stock values, bonds have the advantage is that drop is much less than stocks. That is exactly what happened in 2020. That is a good time to switch back to stocks.

I realize this is not a maximum trading profit strategy. In my case, what i need is minimize risk of big loss in trading capital value because of me being octogenarian. I simply do not have time to wait long time for stock recoveries. It has succeeded in doing that for me. Ouch, another hefty check (2.5 cruises) to write on June 15th for estimated tax. I measure money by how many cruises can be bought with it. 48 done so far, 52 more to go LOL