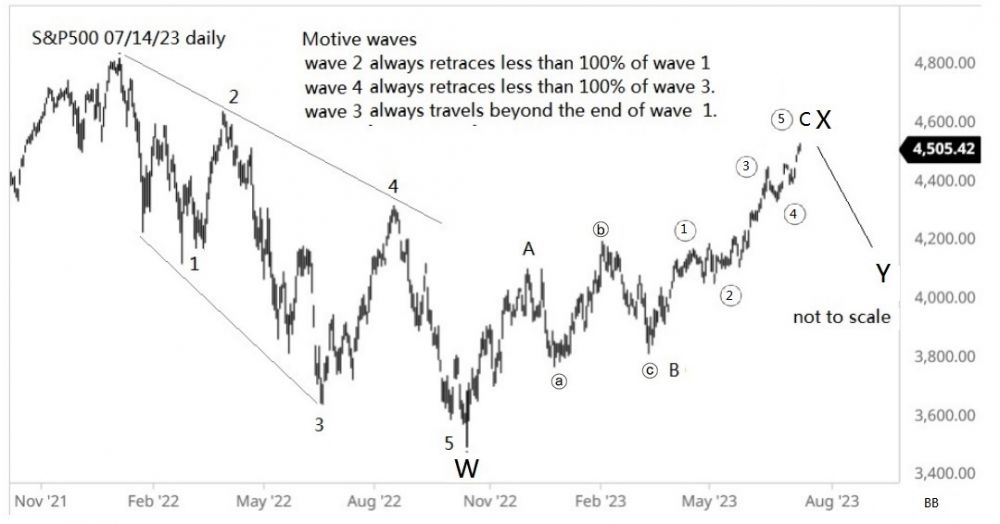

S&P500 ($SPX) short term 1st target zone 4448-4430-4403 (refer to the following chart)

timing - middle August - end of August +/-, [2022 summer peak on 08/16/22 @4325.28, WD Gann 360 degree, anniversary]

Posted 08 August 2023 - 12:15 PM

imho: should $SPX dive below 4344-4328, it confirms 4607.07 as a middle term top.standard 0.236 retracement 4343,81 [4607.07-3491.58], nearby wave ④ reference 4328.08

Posted 16 August 2023 - 05:05 PM

08/18 intraday low 4335.31 @ this writing.

The (initial) pullback usually will (at least) hit wave ④ reference 4328.08, the range is around 4312(4311.69)-4344(4343.81), so far the index movement fits this script. if S&P500 bounces from this zone, it may try to re-capture the 21SMA, from there, a new down leg initiates .......

4343.81 - a standard 0.236 retracement

4311.69 - 0.618 [All time high - October 22 Low],[4607.07-3491.58],

4325.28 - 08/16/22 : WD Gann 360 degree 08/16/23 (+/-)

Autumn Equinox - Friday, September 22, 2023. This is the WD Gann seasonality important date. A possible turn date is -22, -11, 0, +11, +22 (trading day) leads/lags the important date. The Gann seasonality sometimes works, sometimes is irrelevant.

Edited by barbu, 18 August 2023 - 10:36 AM.