According to my risk summation system, the days in the next week or so with the highest risk of seeing a turn in or acceleration of the current trend in the DJIA are a window extending from the afternoon of Monday October 2nd through Tuesday the 3rd and another window reaching from the afternoon of Friday October 6th through Monday the 9th.

Last week the Monday - Tuesday risk window was just in the middle of the down trend, no turn of any consequences, no real acceleration down, so a dud.

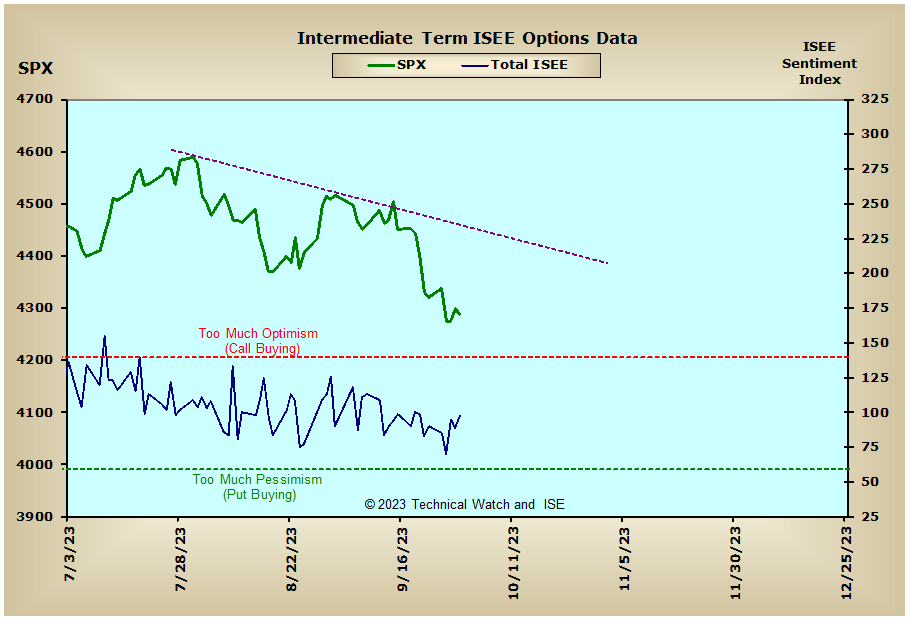

Sentiment has turned downright bearish with the AAII and TSP surveys reaching levels that have tagged rallies in the recent past. The four week average below is not quite at an extreme but is heading there pretty fast. I hesitate to get too sentimental, worrying that if the tide has indeed turned and a bear market is afoot, then it could just be a trap since sentiment will have to reach a serious extreme to form a lasting bottom if the bear is growling. I think that the next few weeks should clarify which fur-lined beast rules the market.

Regards,

Douglas