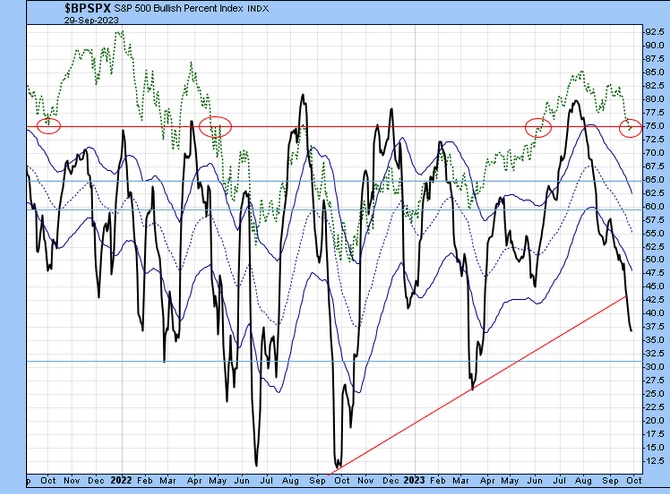

Sept 22nd: I said the bear likely had more to go, but another drop in the SPX would be an interesting buy spot.

SPX dropped another 50 points after that, but it looks like the bear's time is up...for a little while at least.

Seasonality is positive (more so for SPX) Mid-month not so much for other indices.

CNN Sentiment was low Friday at 28, down from 39 a week ago.

Shutdown circus is over for 40+ days anyway.

The good news is:

- New lows declined by more than half from Thursday to Friday.

-

The market is oversold and Seasonality improves after this week

-

During the 3rd year of the Presidential Cycle October has been up 60% time (See charts)

Posted 22 September 2023 - 09:24 AM

CNNs Fear and Greed index is low, but another drop in the SPX would be an interesting buy spot.

TLT or Corp bonds (VCIT?) might become interesting As JUNK is getting "overdone."

.

.

Edited by Rogerdodger, 01 October 2023 - 12:39 AM.