...now it's up to the buyers to see what kind of conviction they have to build on the recent short covering rally of the 2nd and 3rd.

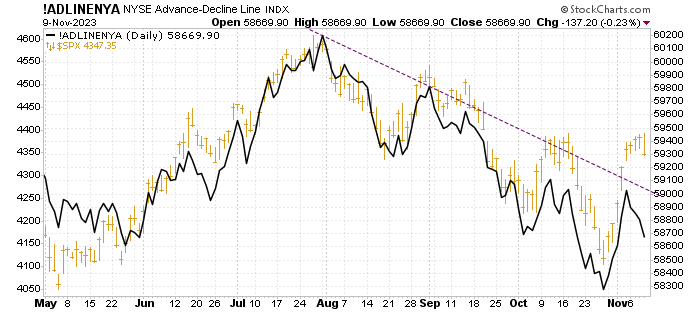

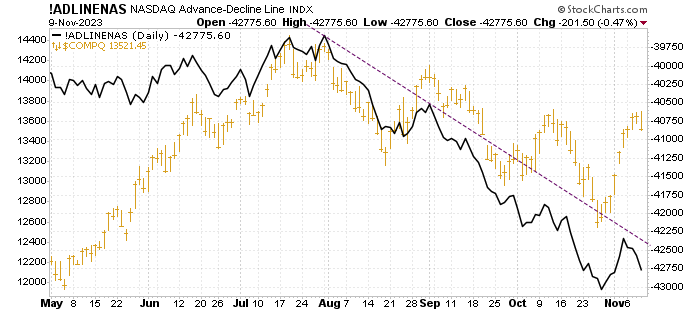

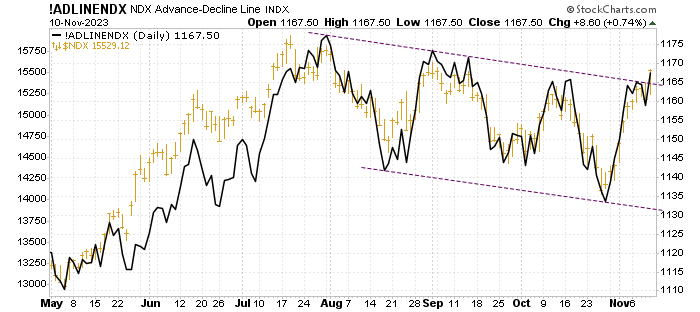

A word of caution for all...we now have the potential of many Sigh Of the Bear pattern structures developing again both externally and internally...the most we've seen since the bear market kick off back in January of 2022. The simple focal point for all is to watch how prices interact with their respective 200 day EMA''s...the longer term "trendline" of bull support and bear resistance. Right now, the NASDAQ, NDX and large caps continue to be buoyant above this same indicator, while the rest of the market is having a tough time getting back above it and staying there. If current liquidity continues to be drained from the system by further interest rate increases, or even if rates stays the same, this lack of underlying fuel needed for price trend development will cause "bid" prices to weaken which forces "asks" (price spreads) to widen in this same direction of the bear market default.

In any event, there currently seems to be enough buoyancy to carry prices through November OPEX, but the bulls better start bellying up to the bar sooner than later or this whole thing is going to fail miserably and we'll likely meet the still open downside price targets that were given from the middle of August.

Fib