MacleodFinance

Helping others understand money, credit and economics in the context of today's geopolitics.

https://alasdairmacleod.substack.com/

I'm going to report from this and other PM related channels

Posted 15 January 2024 - 10:53 AM

MacleodFinance

Helping others understand money, credit and economics in the context of today's geopolitics.

https://alasdairmacleod.substack.com/

I'm going to report from this and other PM related channels

Posted 16 January 2024 - 12:01 PM

The perils of owning gold through ETFs

This article looks at the cosy relationships permitting securitised bullion to be used for market liquidity purposes

https://alasdairmacl...ng-gold-through

Edited by Carlos77, 16 January 2024 - 12:02 PM.

Posted 16 January 2024 - 04:17 PM

Waiting For Jerome - A Forecast For Precious Metal Prices In 2024

By Craig Hemke

Spot gold prices finished 2023 at all-time highs on the monthly, quarterly, and annual charts. That's a rare trifecta that almost included the weekly and daily charts too. It seems that the entire investment world is watching and waiting for a breakout on the long-term charts, and as 2024 begins, we're awfully close. Here's a weekly chart with the consolidation area between $1650 and $2050.

However, on the monthly chart—and the longer the term, the better—the consolidation range is tighter, and you can plainly see an ongoing breakout. The longer this breakout holds above $2000, the more likely generalist investors will be drawn to gold.

I now expect a recession and Fed pivot by summer 2024, which will prompt a breakout rally to $2300 before an end-of year pullback to $2200-2250.

Perhaps I’m wrong about this and things will get out of hand in 2024 as the reactive Fed is once again late to step in. The stock market begins to crash, banks fail, and the dollar tanks. In an election year, the Fed will do everything it can to keep the politicians happy (think 2008), and they panic with "emergency" rate cuts and assorted new alphabet soup lending programs. If that's the case, then $2500-2700 is possible, but again, I just don't think that sort of thing is likely in 2024. Maybe in 2025, but not this year.

Posted 24 January 2024 - 12:31 PM

"Volatility isn’t in gold or oil, it’s in the dollar!" Feat. Alasdair Macleod - LFTV Ep 156

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Alasdair Macleod, stockbroker and Head of Research for Goldmoney, to exchange views on the US dollar hegemony and its impact on the price of gold. Giving an update on the de-dollarisation process and the geopolitical impact of tensions in the Middle East affecting the global economy, the precious metals experts take us through the debt trap the US has fallen into.

Timestamps:

00:00 Start

03:45 Is gold money and everything else credit?

07:30 Is the US government in a debt trap?

17:00 Why the US has to pivot on interest rates

28:30 Updates on the de-dollarisation process

42:20 Credit is losing its purchasing power, and everything is credit

47:40 Alasdair’s Substack has free and paid versions

50:00 Alasdair’s thoughts on Silver

Posted 25 January 2024 - 05:28 AM

"When The Fed Pivots, We Get Paid": Lawrence Lepard

GOLD AND BITCOIN GOT THE MEMO

As we have chronicled above. the Fed is making its best effort to give us monetary chaos. The interesting thing is that the two sound money alternatives, GOLD AND BITCOIN can see it loud and clear. Basically, the FED began its “we are done raising rates” jawboning at the end of September and since that time frame gold is up 15% and Bitcoin is up 61%. Fairly outsized moves for a 3-month period.

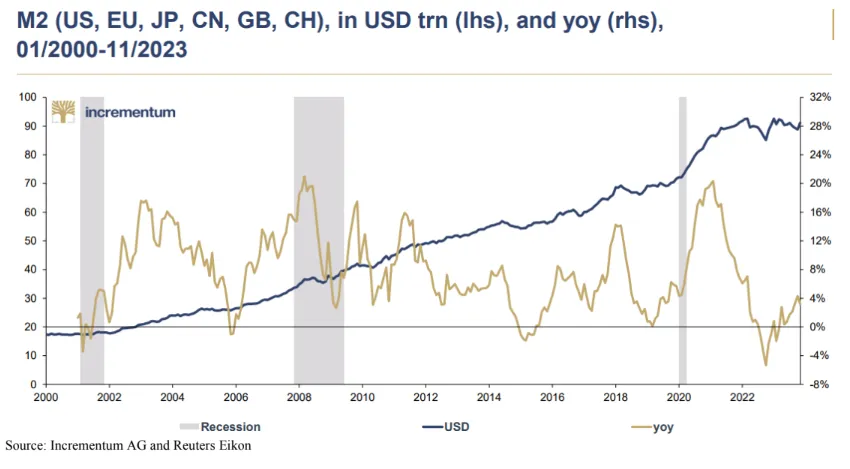

This is not just a US problem of increasing debt and dollar debasement funding that debt. Rather, it’s a global issue. As the chart below shows, global M2 money supply (gold line) is growing again (e.g., Europe/China are stimulating while the US M2 has declined). It is not a coincidence that gold prices correlate with this global M2 money supply and likely is part of what propped up gold making it one of the best performing commodities in 2023.

Posted 26 January 2024 - 10:23 AM

Summary of the dangers facing us in 2024

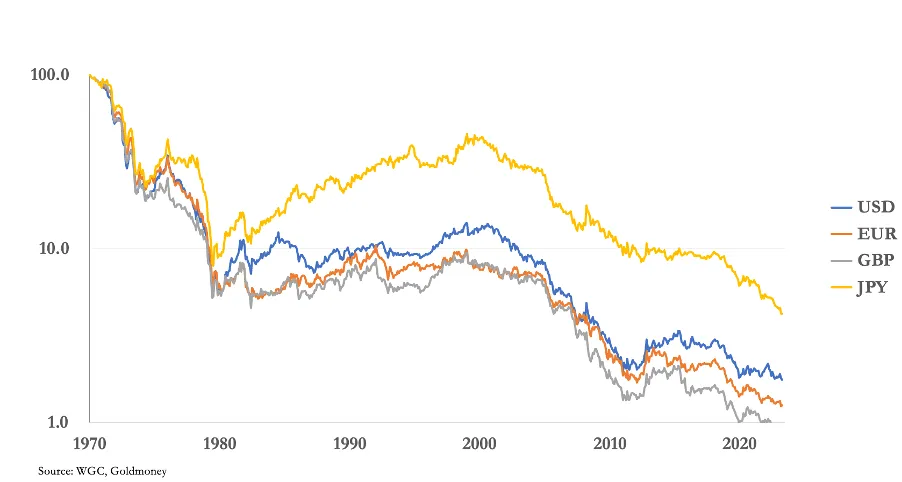

It is credit, including fiat currencies, which is at risk. Gold has broadly maintained its purchasing power over millennia, even though as explained by Gresham’s law it rarely circulates. It’s not generally realised what this means, but the chart below of major currencies valued in gold illustrates the decline of currencies since President Nixon suspended the Bretton Woods Agreement in 1971.

Note the log scale, which records the percentage loss. In US dollars, the loss is 98.3%, and that is on top of the decline from $20.67 to the ounce which was the rate before 1934. Including that devaluation of the dollar, it has lost 99%. In sterling, the post 1971 decline is over 99%. Longer term it has been even worse, bearing in mind that one pound was exchangeable for a sovereign coin, which is currently valued at £390.

The euro comprised of national currencies before 2000 has declined by 98.7%, and the yen 96%. The lack of awareness that the purchasing power of fiat currencies has declined so much encourages investors to believe that their investments and property are the best hedges against inflation, without realising the true extent of currency value destruction.

Before regulatory intervention by governments, as a base case it was generally reckoned that a balanced portfolio should have exposure to gold or related investments of 10%. At current prices, taking average portfolio exposure to just 2% requires the purchase of 23,300 tonnes, or a mixture of mining stocks and bullion to that value.

While it is true to say that the value of gold measured by its purchasing power has been remarkably stable over millennia, it is likely to rise spectacularly in the event of a general credit crisis, because the scale of liquidity to accommodate portfolio adjustment doesn’t exist.

Posted 27 January 2024 - 10:32 AM

Mining Trends Shaping Precious Metal Markets

KEY TAKEAWAYS

This article will explore the economic and political factors influencing the current trends in the precious metals mining industry. This includes examining key variables including mining methods, cost factors, environmental factors and political risk considerations.

Precious Metals Mining and Extraction

Insights for Precious Metal Investors

Posted 28 January 2024 - 09:29 AM

January 26, 2024

Mike Gleason

Although gold and other precious metals are largely being overlooked by U.S. investors at the moment, that’s not the case in other parts of the world. In fact, the gold market is booming in places like China.

The Chinese stock market and currency have both plummeted in value over the past several months. But gold prices have hit record highs in terms of the Chinese yuan.

China is now the world’s biggest retail buyer of gold. And Chinese households are increasingly turning to gold bullion and jewelry for wealth protection. China's jewelry purchases rose 8% last year, according to the China Gold Association.

Meanwhile, demand for gold coins jumped nearly 16% in 2023. Chinese gold-backed exchange-traded products added 10 tons to their holdings. And the People’s Bank of China increased its gold reserves by a whopping 225 tons.

The PBOC has also implemented measures to make it easier for bank account depositors to convert cash into gold. Chinese officials may be viewing gold as a geopolitical tool amid rising tensions with the United States.

Posted 29 January 2024 - 03:24 AM

Precious metals stasis

Market report for week-ending 26 January, 2024

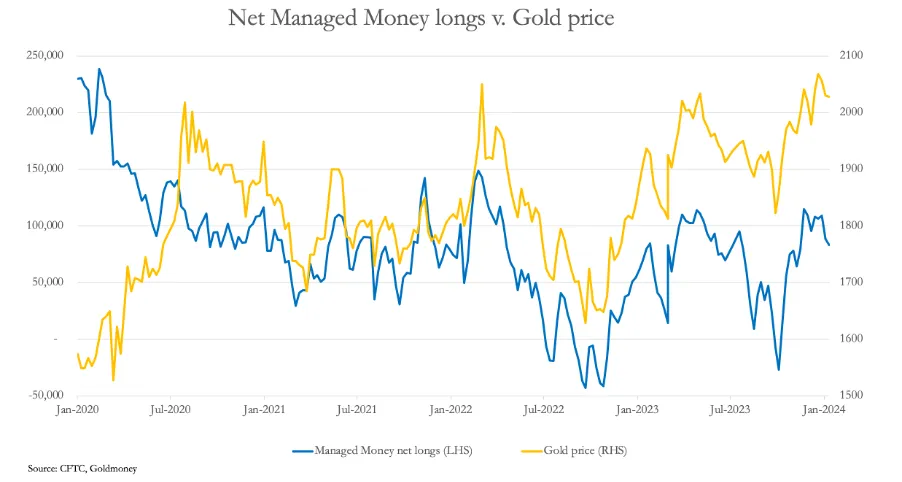

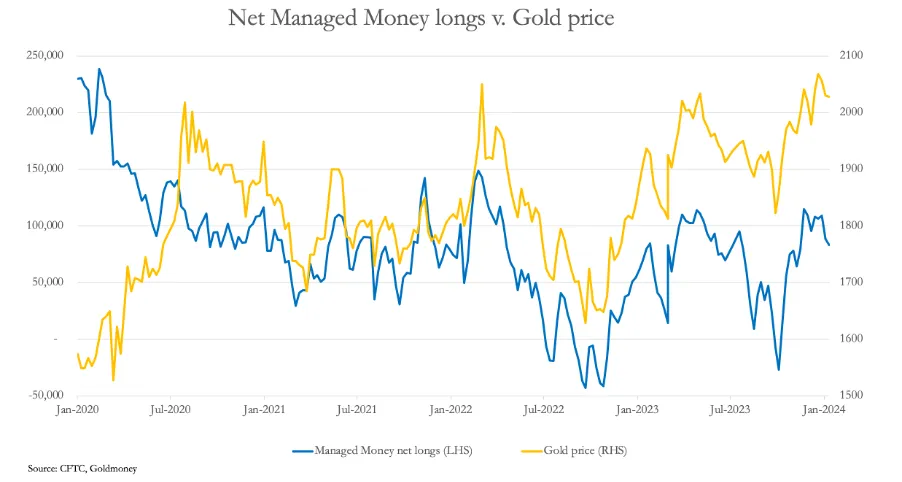

For now, it appears that gold is happy to consolidate above the $2000 level. But a suspicion that this support level is at risk of being broken appears to be the view in paper markets. Indeed, the lack of enthusiasm for the bullish case is reflected in the hedge funds, whose net longs on Comex are only 83,229 contracts (16 January) compared with a long-term neutral position of 110,000. This is shown in my next chart.

The apathy is remarkable. Since January 2020, the gold price has risen 40%, while net longs have more than halved, admittedly from overbought levels. In other words, the gold price has risen without buying by market traders. Yet technical analysts looking at a chart of the gold price would say it paints a positive picture. This is next.

For now, the price is finding support at the 55-day moving average, but even if this doesn’t hold, a deeper reaction should find stronger support at the 12-month MA currently at $1950. Being consistent with a sell-off to fool everyone that the $2000 support becomes insurmountable supply, on sentiment grounds I would not rule it out. But given the economic background it should be a buying opportunity.

Posted 29 January 2024 - 03:25 AM

Precious metals stasis

MacleodFinance

Market report for week-ending 26 January, 2024

For now, it appears that gold is happy to consolidate above the $2000 level. But a suspicion that this support level is at risk of being broken appears to be the view in paper markets.

Indeed, the lack of enthusiasm for the bullish case is reflected in the hedge funds, whose net longs on Comex are only 83,229 contracts (16 January) compared with a long-term neutral position of 110,000.

This is shown in my next chart.

The apathy is remarkable. Since January 2020, the gold price has risen 40%, while net longs have more than halved, admittedly from overbought levels. In other words, the gold price has risen without buying by market traders. Yet technical analysts looking at a chart of the gold price would say it paints a positive picture.

This is next.

For now, the price is finding support at the 55-day moving average, but even if this doesn’t hold, a deeper reaction should find stronger support at the 12-month MA currently at $1950. Being consistent with a sell-off to fool everyone that the $2000 support becomes insurmountable supply, on sentiment grounds I would not rule it out. But given the economic background it should be a buying opportunity.

Edited by Carlos77, 29 January 2024 - 03:27 AM.