Gold Investment Dead?

Adam Hamilton January 19, 2024

Since gold ETFs have proven such a dominant force driving gold prices over the last decade-plus, those quarterly GDT reports also track the world’s biggest physically-backed ETFs. Two American behemoths have always topped that list, the GLD SPDR Gold Shares and IAU iShares Gold Trust ETFs. At the end of Q3, together they commanded over 39% of all the gold held by all the world’s physically-backed ETFs!

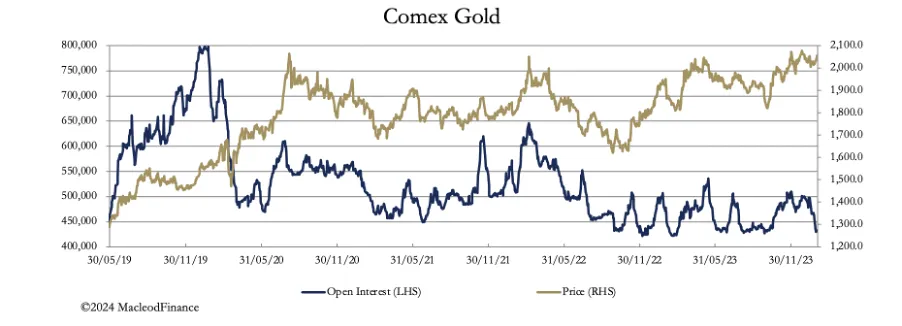

This chart superimposes GLD+IAU holdings in metric tons over gold prices and key technicals. While gold has powered dramatically higher since mid-2022’s anomalous selloff driven by an extreme USDX surge on monster Fed rate hikes, its identifiable investment demand has collapsed! Investors have mostly abandoned gold, not returning after that brutal rout.

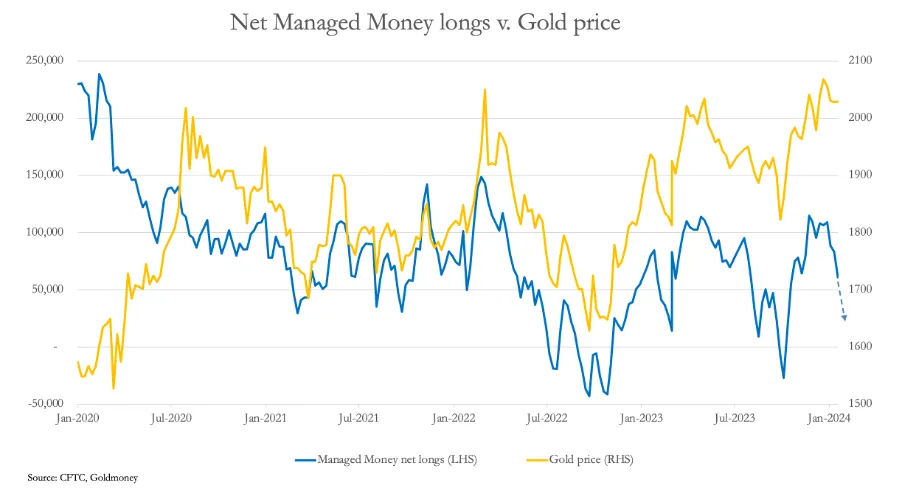

With gold just off nominal record highs yet GLD+IAU holdings threatening new secular lows, it’s sure valid to wonder whether gold investment is dead. Have investors deserted gold forever? Is it now at the mercy of gold-futures speculators alone? It was their massive mean-reversion buying that fueled most of gold’s gains since late September 2022 with investors missing in action. Their selling retarded gold’s advance.

Two big market factors argue investors will soon return to gold, reestablishing normal relationships. The still-high USDX that ravaged gold in mid-2022 is rolling over into what will probably prove a major bear market. The FOMC has all but officially ended its scorching hiking cycle, with markets increasingly looking for rate cuts this year. Just as higher rates were bullish for the dollar, lower ones are bearish for it.

The lower the USDX grinds as Fed rate cuts are anticipated then executed later this year, the more gold-futures buying that will trigger pushing gold higher. And today’s young gold upleg growing will yield many new nominal record highs. The last one was late December’s $2,077, which is merely 3.6% higher than gold’s depressed midweek levels! Streaks of new record highs excite and attract investors like nothing else.

The bottom line is although gold investment looks dead, it almost certainly isn’t. Investors have mostly abandoned gold in recent years, as evident in the holdings of the world’s dominant gold ETFs. Gold’s precipitous mid-2022 plunge as the US dollar skyrocketed on monster Fed rate hikes really damaged gold psychology. So investors mostly sat out gold’s huge mean-reversion bull now achieving new records.

They started returning in mid-2023, but were distracted by stock markets’ euphoric AI bubble. But all that is changing which will increasingly attract back investors to gold. The dollar is rolling over into a likely bear with Fed rate cuts coming, and bubble-valued stock markets are overdue for a major selloff. Gold’s streak of new records will also drive bullish financial-media coverage, generating mounting investor excitement.

Read More